- United States

- /

- Biotech

- /

- NasdaqCM:IMMX

Immix Biopharma (NASDAQ:IMMX) Is In A Good Position To Deliver On Growth Plans

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Immix Biopharma (NASDAQ:IMMX) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Immix Biopharma

How Long Is Immix Biopharma's Cash Runway?

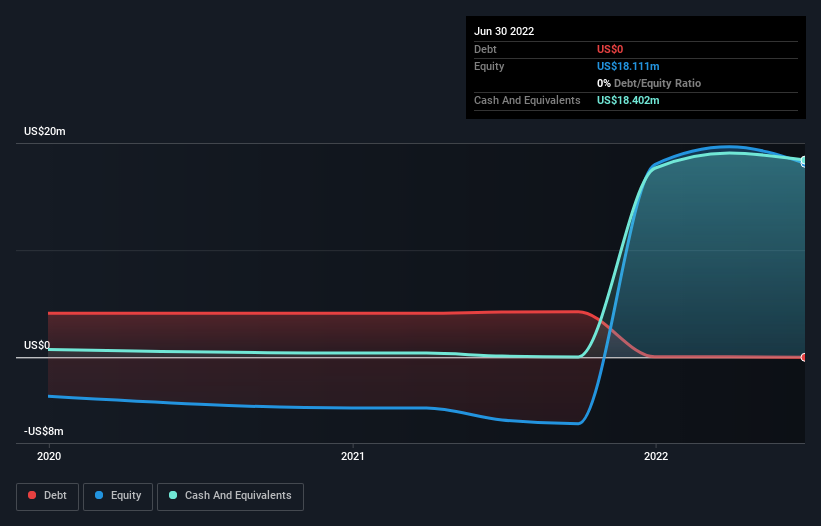

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2022, Immix Biopharma had cash of US$18m and no debt. In the last year, its cash burn was US$3.2m. That means it had a cash runway of about 5.7 years as of June 2022. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Is Immix Biopharma's Cash Burn Changing Over Time?

Because Immix Biopharma isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Its cash burn positively exploded in the last year, up 849%. We certainly hope for shareholders' sake that the money is well spent, because that kind of expenditure increase always makes us nervous. Admittedly, we're a bit cautious of Immix Biopharma due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Immix Biopharma Raise More Cash Easily?

Given its cash burn trajectory, Immix Biopharma shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$24m, Immix Biopharma's US$3.2m in cash burn equates to about 13% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Immix Biopharma's Cash Burn?

On this analysis of Immix Biopharma's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Separately, we looked at different risks affecting the company and spotted 2 warning signs for Immix Biopharma (of which 1 is significant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMMX

Immix Biopharma

A clinical-stage biopharmaceutical company, engages in the development of chimeric antigen receptor cell therapy in light chain Amyloidosis and immune-mediated diseases in the United States and Australia.

Flawless balance sheet moderate.

Market Insights

Community Narratives