- United States

- /

- Biotech

- /

- NasdaqGS:IMCR

Is Rising Institutional Interest and Analyst Coverage Shaping Immunocore’s Trajectory (IMCR)?

Reviewed by Sasha Jovanovic

- Immunocore Holdings plc recently reported the departure of director Robert Perez, effective mid-September, and saw TANG CAPITAL MANAGEMENT LLC increase its stake by acquiring 500,000 additional shares in October 2025.

- This institutional interest was underscored by Wells Fargo initiating coverage of Immunocore with a positive analyst outlook, pointing to heightened confidence in the company's business prospects within the biotechnology space.

- Next, we'll consider how the combination of increased institutional investment and new analyst coverage could influence Immunocore’s future growth expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Immunocore Holdings Investment Narrative Recap

To invest in Immunocore Holdings, you need to have conviction in the company’s ability to translate its innovative immunotherapy pipeline into tangible commercial success beyond KIMMTRAK, especially as current revenue growth is decelerating and clinical progress is vital to diversify future income. The recent director departure and added institutional interest from TANG CAPITAL MANAGEMENT LLC are not expected to shift the company’s immediate reliance on KIMMTRAK or alter the main risk of pipeline setbacks impacting future growth, so the near-term catalysts and hazards remain largely unchanged.

Of the latest company updates, Wells Fargo’s initiation of coverage on Immunocore with an ‘Overweight’ rating signals increased external confidence in the company’s prospects. This adds an encouraging layer to the pipeline catalyst, since positive analyst sentiment might influence broader investor perception as pivotal late-stage trial readouts approach.

But while analyst optimism might catch the eye, investors should also be aware that Immunocore’s high dependence on one commercial therapy means any plateau…

Read the full narrative on Immunocore Holdings (it's free!)

Immunocore Holdings' outlook anticipates $551.3 million in revenue and $88.5 million in earnings by 2028. This scenario assumes 15.7% annual revenue growth and a $108.8 million increase in earnings from current levels of -$20.3 million.

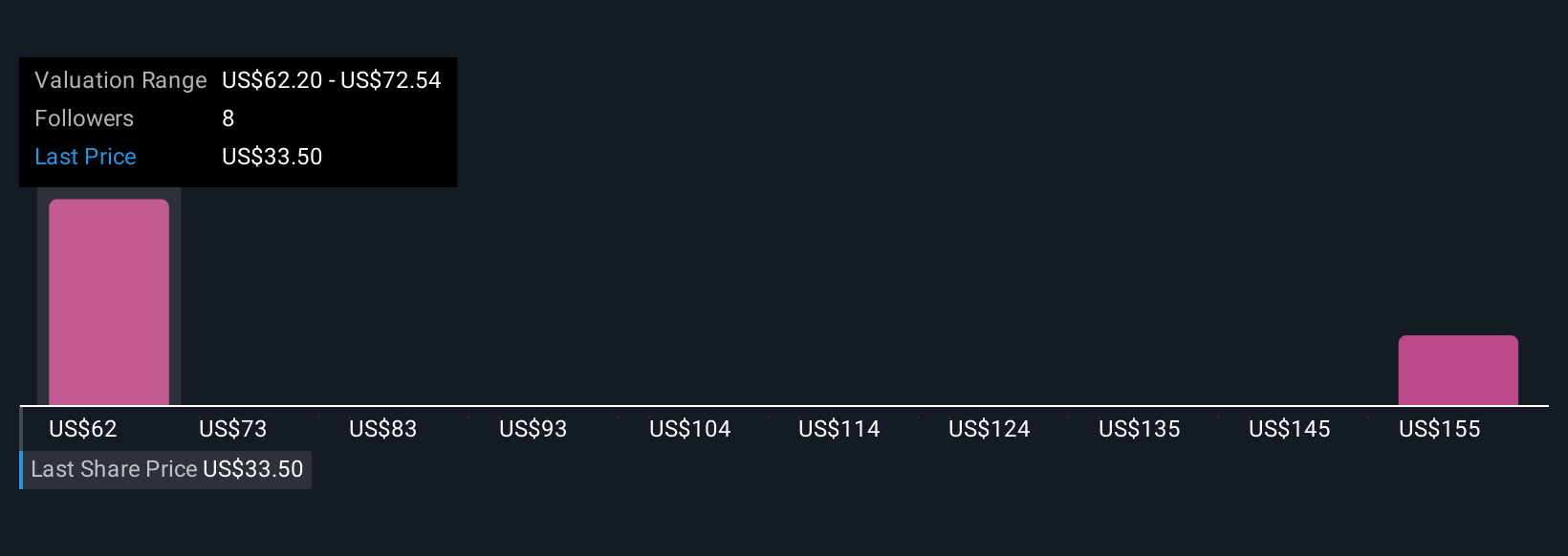

Uncover how Immunocore Holdings' forecasts yield a $62.20 fair value, a 88% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community range from US$62.06 to US$221.63 per share. While opinions are varied, many are watching the risk of clinical trial delays and its effect on future revenue streams.

Explore 3 other fair value estimates on Immunocore Holdings - why the stock might be worth just $62.06!

Build Your Own Immunocore Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immunocore Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Immunocore Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immunocore Holdings' overall financial health at a glance.

No Opportunity In Immunocore Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IMCR

Immunocore Holdings

A commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives