- United States

- /

- Biotech

- /

- NasdaqGS:IMCR

Immunocore Holdings plc's (NASDAQ:IMCR) Business And Shares Still Trailing The Industry

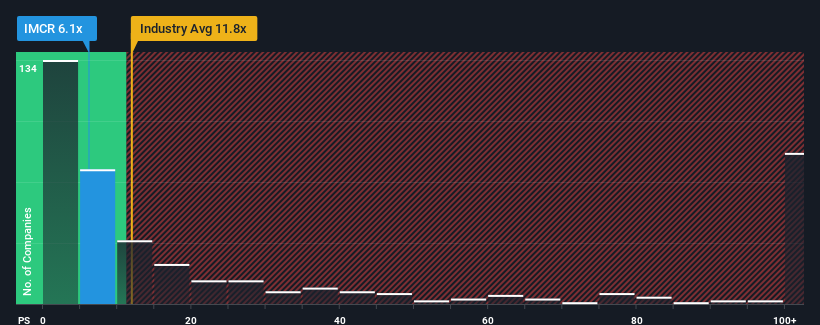

Immunocore Holdings plc's (NASDAQ:IMCR) price-to-sales (or "P/S") ratio of 6.1x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.8x and even P/S above 69x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Immunocore Holdings

How Has Immunocore Holdings Performed Recently?

Recent times haven't been great for Immunocore Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Immunocore Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Immunocore Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 14% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 144% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Immunocore Holdings' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Immunocore Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Immunocore Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Immunocore Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IMCR

Immunocore Holdings

A commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives