- United States

- /

- Biotech

- /

- NasdaqGS:IMCR

Immunocore Holdings (IMCR): Exploring Valuation After Wells Fargo Initiation and Tang Capital's Stake Boost

Reviewed by Simply Wall St

Immunocore Holdings (NasdaqGS:IMCR) has drawn fresh attention after Wells Fargo initiated coverage with a positive view. In addition, TANG CAPITAL MANAGEMENT LLC boosted its stake by acquiring 500,000 more shares last month.

See our latest analysis for Immunocore Holdings.

Momentum around Immunocore Holdings has picked up in recent months, with investor optimism boosted by major shareholders increasing their stakes and ongoing progress in its immunotherapy pipeline. After experiencing a slight dip recently, Immunocore’s year-to-date share price return sits at a solid 8.6%. While its 1-year total shareholder return is 3.9%, the multi-year view reflects the sector's volatility, as long-term holders have seen steeper declines over the last three years. With recent positive news in the mix, the overall trajectory suggests renewed confidence in Immunocore’s growth potential.

If you’re interested in what else is trending in healthcare, consider broadening your search and discover See the full list for free.

With analyst targets nearly doubling the current share price and notable investors increasing their stakes, Immunocore appears attractively valued. However, does this signal a genuine buying opportunity, or is future growth already factored into the price?

Most Popular Narrative: 47.9% Undervalued

Immunocore Holdings closed at $32.38, with the most widely followed narrative asserting a fair value of $62.20. This creates a bullish gap between the stock price and consensus expectations, drawing attention to the financial assumptions behind this perspective.

Momentum in pipeline diversification, progressing late-stage trials in cutaneous melanoma (TEBE-AM, PRISM-MEL) and expanding into infectious and autoimmune diseases, reduces single-product risk and sets the stage for multiple future revenue streams and earnings expansion.

Curious what is fueling this optimistic outlook? This narrative incorporates aggressive future growth, margin expansion, and a significant shift in profitability. The projected trajectory relies on assumptions that may surprise even seasoned market watchers. Want to see the numbers driving such a premium?

Result: Fair Value of $62.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on KIMMTRAK and rising R&D costs could stall Immunocore’s growth story if new pipeline assets fail to deliver as expected.

Find out about the key risks to this Immunocore Holdings narrative.

Another View: Testing the Numbers with Multiples

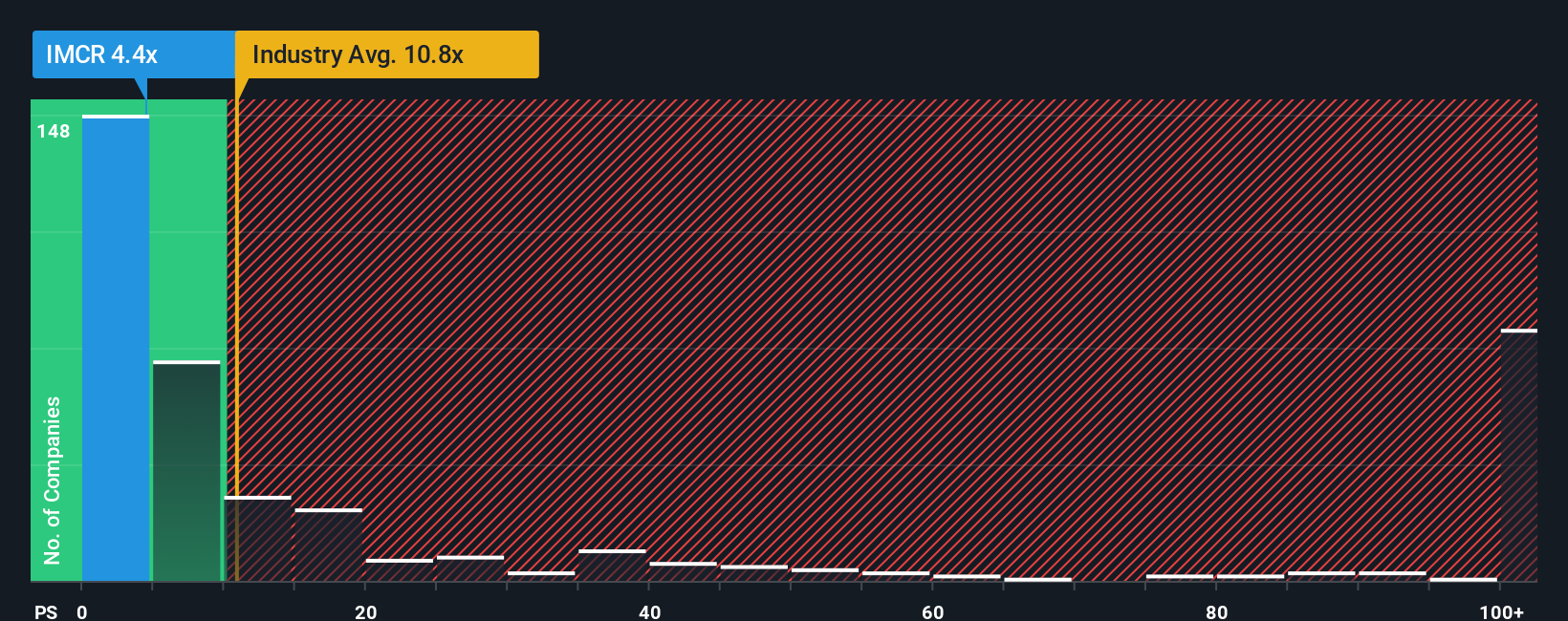

Looking at Immunocore Holdings through the lens of its price-to-sales ratio paints a different picture. IMCR trades at 4.6x sales, higher than peer companies averaging 4x, but well below the broader US Biotechs industry at 11.3x. Compared to its estimated fair ratio of 7x, the current number suggests the market isn’t fully pricing in its potential. This gap introduces both risk and opportunity. Could the market be too cautious, or wisely skeptical about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Immunocore Holdings Narrative

If you have a different take or want to dig into the details yourself, crafting your own view takes just a few minutes. Do it your way

A great starting point for your Immunocore Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don't limit yourself to just one opportunity. Open the door to other high-potential stocks and strategies that could make a real difference to your portfolio.

- Get ahead of the tech curve by tapping into growth with these 27 AI penny stocks, which are redefining innovation and artificial intelligence.

- Catch the next wave of market upsets with these 3592 penny stocks with strong financials, where explosive potential meets rapid change.

- Maximize your passive income by building your watchlist from these 18 dividend stocks with yields > 3% offering strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IMCR

Immunocore Holdings

A commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives