- United States

- /

- Biotech

- /

- NasdaqGS:IMCR

A Fresh Look at Immunocore Holdings (NasdaqGS:IMCR) Valuation After Positive Phase 1 Data for HBV Therapy

Reviewed by Simply Wall St

Immunocore Holdings (NasdaqGS:IMCR) revealed promising Phase 1 results for its IMC-I109V therapy targeting hepatitis B. The treatment was generally well tolerated, with early data indicating reductions in HBsAg, an encouraging signal for future development.

See our latest analysis for Immunocore Holdings.

Following the promising Phase 1 results for IMC-I109V, Immunocore Holdings’ share price has jumped 8.97% over the past month. Enthusiasm around these clinical updates, along with recent conference presentations and steady revenue growth, has helped the stock build momentum, as reflected in a strong 22.6% year-to-date share price return. While the one-year total shareholder return is 17.8%, long-term holders are still down from highs, as the three-year total return remains in negative territory.

If innovative biotech milestones have you exploring the next big opportunity, consider expanding your search with the See the full list for free.

With shares still trading at a significant discount to analyst price targets despite recent gains, the question now is whether Immunocore Holdings presents a compelling buying opportunity or if the market has already factored in future growth expectations.

Most Popular Narrative: 41.2% Undervalued

Immunocore Holdings is currently trading at $36.57, while the most widely followed narrative estimates its fair value at $62.20. This disconnect has sparked a heated debate over whether the recent price rally is just the beginning.

Momentum in pipeline diversification, progressing late-stage trials in cutaneous melanoma (TEBE-AM, PRISM-MEL) and expanding into infectious and autoimmune diseases, reduces single-product risk and sets the stage for multiple future revenue streams and earnings expansion.

Curious what bold expectations drive this high price target? The narrative hinges on breakthrough therapies, market expansion, and a leap in profit margins usually reserved for industry leaders. Exactly what growth and profitability leap are analysts betting on? Get the details behind these provocative projections in the full narrative.

Result: Fair Value of $62.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on KIMMTRAK and increasing R&D spending could slow growth if new pipeline therapies face setbacks.

Find out about the key risks to this Immunocore Holdings narrative.

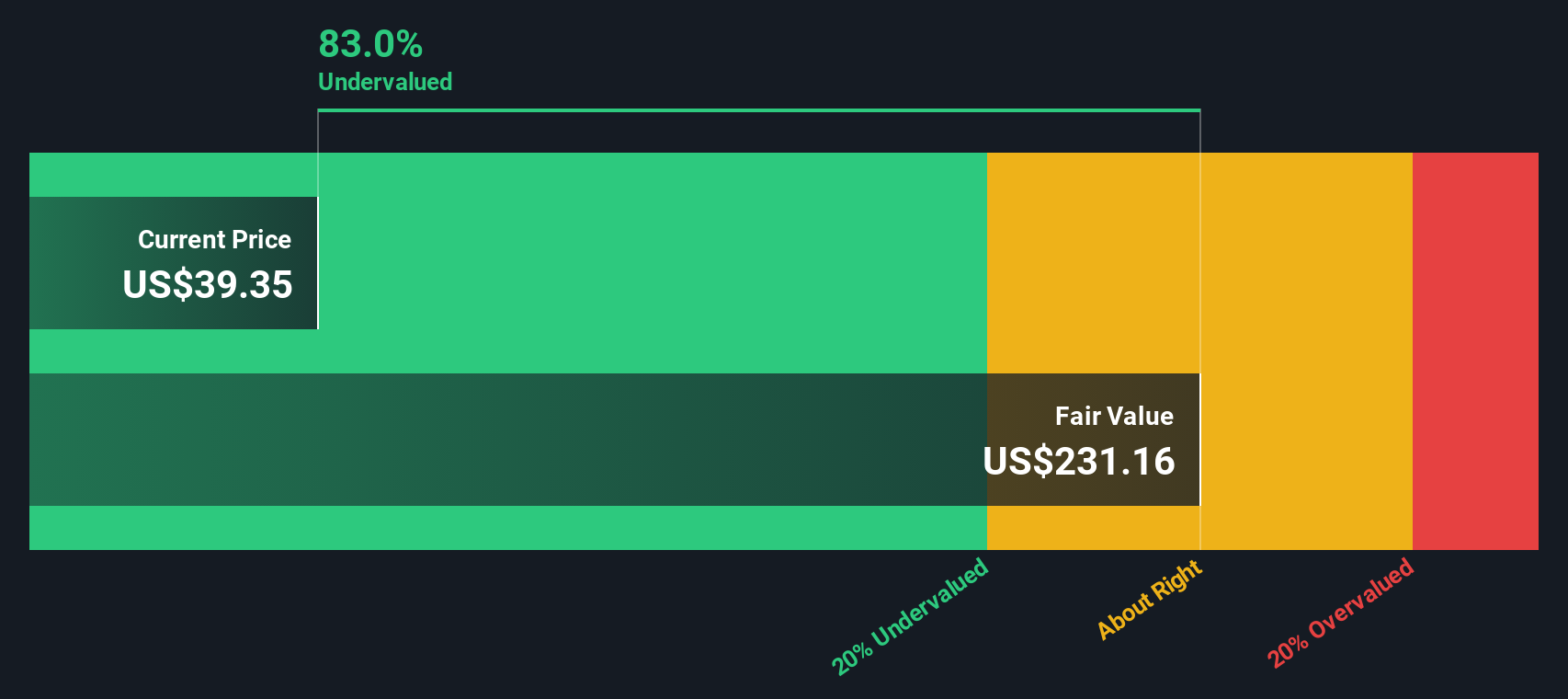

Another View: Discounted Cash Flow Perspective

While the analyst price target paints a bullish picture, our SWS DCF model offers a different perspective, estimating Immunocore Holdings' fair value at a remarkable $230.13. This assessment suggests the shares are trading at a significant discount. However, can the present fundamentals and pipeline support such an optimistic scenario?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Immunocore Holdings Narrative

If you think there's a different story to tell or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Immunocore Holdings.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The right screener can reveal hidden outperformers and transform the way you invest with confidence and clarity.

- Target impressive yields and stable income streams by checking out these 18 dividend stocks with yields > 3% that consistently beat the market with strong payouts.

- Fuel your portfolio with innovation by tapping into these 27 AI penny stocks shaking up industries with real-world artificial intelligence breakthroughs.

- Seize unmatched value by scanning these 894 undervalued stocks based on cash flows that the market has yet to recognize, giving you a potential edge over the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IMCR

Immunocore Holdings

A commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives