- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Will Illumina’s (ILMN) 5-Base Sequencing Advance Its Clinical Genomics Leadership?

Reviewed by Sasha Jovanovic

- At the American Society of Human Genetics Annual Meeting held earlier this month, Illumina announced its new 5-base solution for simultaneous detection of genomic variants and DNA methylation, while client GeneDx presented promising early results from piloting the constellation mapped read technology for challenging regions of the genome.

- GeneDx’s adoption and public validation of Illumina’s constellation technology underscores how Illumina innovations are being integrated into cutting-edge genetic diagnostics for rare diseases across multiple sample types.

- We'll now explore how Illumina's next-generation 5-base sequencing capability strengthens the company's clinical genomics investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Illumina Investment Narrative Recap

To be an Illumina shareholder today, you need confidence in the continued shift of genomics into clinical practice, particularly the growing role of next-generation sequencing in rare disease and oncology testing that now drives most of Illumina’s consumables revenue. The recent launch of Illumina's 5-base solution and encouraging results from GeneDx's pilot are positive for innovation and clinical adoption, but do not fundamentally shift near-term catalysts or the key risk: ongoing uncertainty in research funding and its impact on core instrument demand.

Among recent announcements, Illumina’s new 5-base solution stands out for enabling simultaneous detection of genomic variants and DNA methylation, potentially expanding clinical research capabilities. This innovation further supports the company’s focus on multiomic tools, aligning with a major catalyst: the expansion of clinical sequencing into standard practice and related recurring consumables growth.

However, in contrast, investors should also keep in mind the unresolved challenge of research funding volatility and what it could mean for...

Read the full narrative on Illumina (it's free!)

Illumina's outlook anticipates $4.8 billion in revenue and $873.5 million in earnings by 2028. This is based on expected annual revenue growth of 3.6% and a decrease in earnings of $426.5 million from current earnings of $1.3 billion.

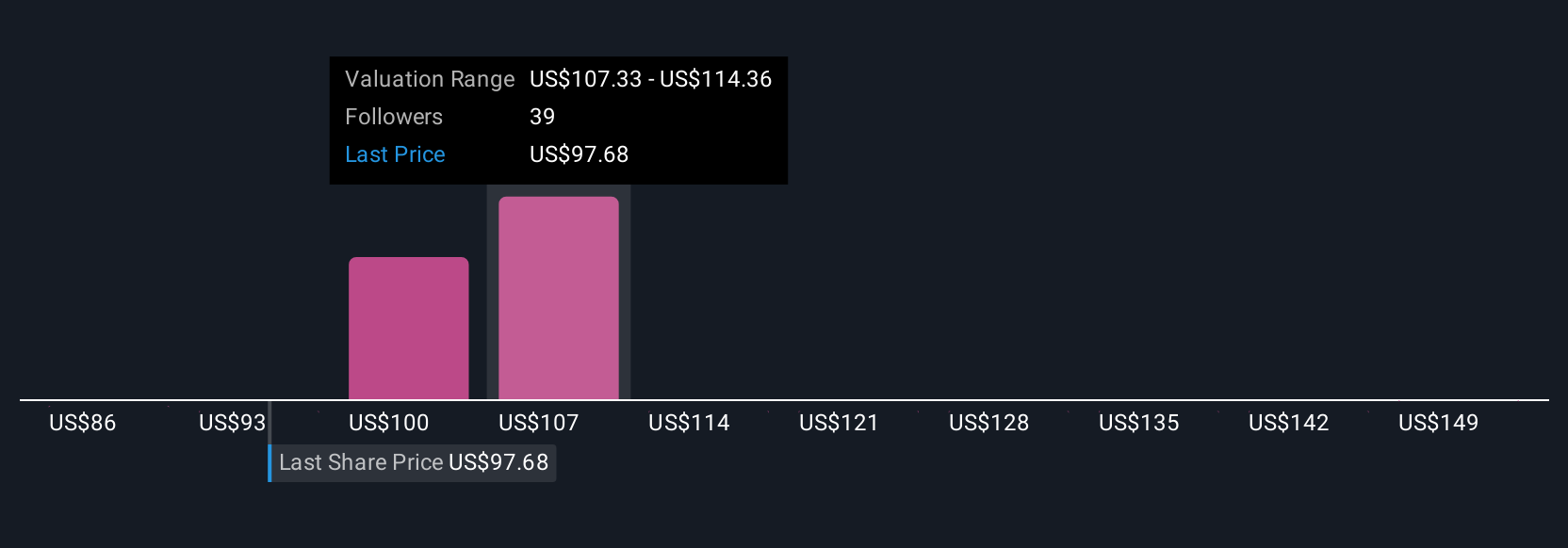

Uncover how Illumina's forecasts yield a $111.95 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Illumina’s fair value between US$86 and US$157 per share, with five different analyses represented. This variety of views comes as persistent uncertainty around research funding could continue to affect both sentiment and earnings momentum; explore these differing perspectives for a broader understanding of potential outcomes.

Explore 5 other fair value estimates on Illumina - why the stock might be worth 14% less than the current price!

Build Your Own Illumina Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illumina research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Illumina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illumina's overall financial health at a glance.

No Opportunity In Illumina?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives