- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

A Look at Illumina (ILMN) Valuation After China Ban Lift and Whole-Genome Breakthrough

Reviewed by Simply Wall St

Illumina (ILMN) is back in the spotlight after the publication of a groundbreaking whole-genome sequencing study in Nature and the Chinese export ban on its products was officially lifted, though requirements remain in place.

See our latest analysis for Illumina.

Alongside these scientific breakthroughs and improved market access, Illumina’s stock has staged a dramatic recovery, posting a 29.75% gain in share price over the past month and climbing 20.54% in the last quarter. While momentum is returning, the one-year total shareholder return remains negative at -10.65%. This reminds investors that the longer-term path has been volatile, even as fresh innovations spark renewed optimism.

If the recent rebound in biotech got you thinking bigger, now is a good time to see what’s next in health innovation by exploring See the full list for free.

With fresh scientific momentum and regulatory progress fueling the stock’s sharp rally, investors now face the central question: is Illumina’s rally just the beginning of a broader re-rating, or is all this future growth already reflected in the share price?

Most Popular Narrative: 6% Overvalued

With Illumina’s fair value estimated at $113.58 and a last close price at $120.67, the prevailing narrative signals that the market is currently assigning a premium above consensus expectations. While optimism has grown, this sets the stage for a closer look at the story behind recent gains.

Ongoing innovation, multiomics expansion, and operational efficiency are enhancing gross margins and creating new growth opportunities. Operational efficiencies, disciplined cost controls, and targeted share repurchases have already resulted in notable operating margin and EPS improvements, and further scaling, along with tax headwinds turning into tailwinds, sets the stage for continued net margin and earnings growth over the next several years.

Want a behind-the-scenes look at what analysts believe will shape Illumina’s future? Discover the quantitative projections, margin pivots, and the bold assumptions driving this valuation. Curious which levers matter most in justifying the higher price? Dive in and see what’s fueling the optimism. The answer might surprise you.

Result: Fair Value of $113.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent export restrictions in China and ongoing research funding uncertainty remain key risks. These factors could derail Illumina’s projected recovery and valuation.

Find out about the key risks to this Illumina narrative.

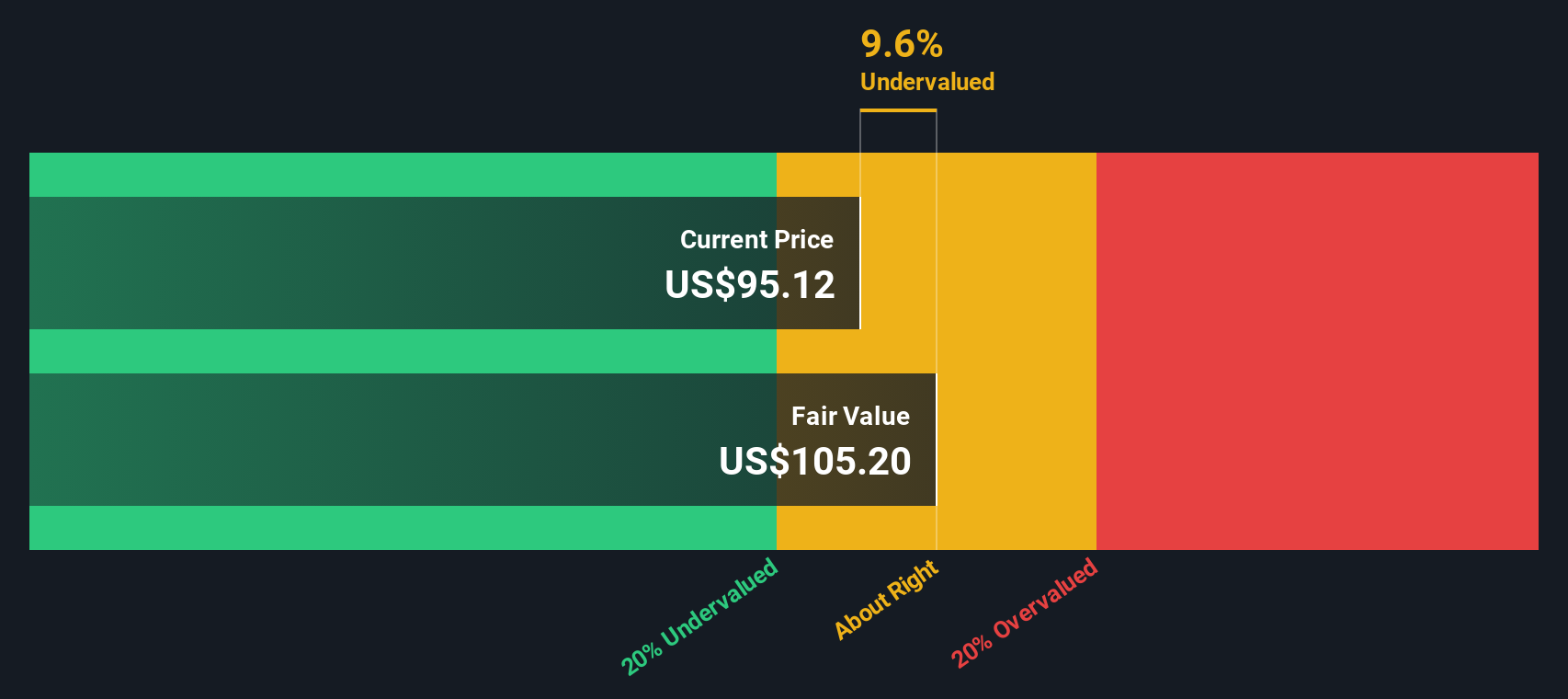

Another View: SWS DCF Model Points to Undervaluation

Taking a different angle, our DCF model values Illumina at $155.71 per share. This suggests the stock is undervalued by over 22% compared to recent prices. Unlike market-based multiples, the DCF approach evaluates future cash flows and long-term growth prospects. Could this indicate overlooked value, or do current challenges justify the discount?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Illumina Narrative

If you see the numbers differently, prefer hands-on analysis, or want to build your own perspective on Illumina, you can craft your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Illumina.

Looking for more smart investment ideas?

Go beyond Illumina and supercharge your portfolio by checking out unique stock opportunities you might be missing. The next compelling story could be just a click away.

- Tap into real-world applications of artificial intelligence when you review these 25 AI penny stocks. These are transforming industries and driving long-term growth.

- Start strengthening your passive income streams by evaluating these 16 dividend stocks with yields > 3%, which feature attractive yields and sustainable payout records.

- Uncover new potential in quantum computing by investigating these 26 quantum computing stocks. These are pushing technological boundaries and opening up frontier markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives