- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

IDEAYA Biosciences (IDYA): Revenue Forecast to Grow 28.3% Annually, Profit Still Elusive

Reviewed by Simply Wall St

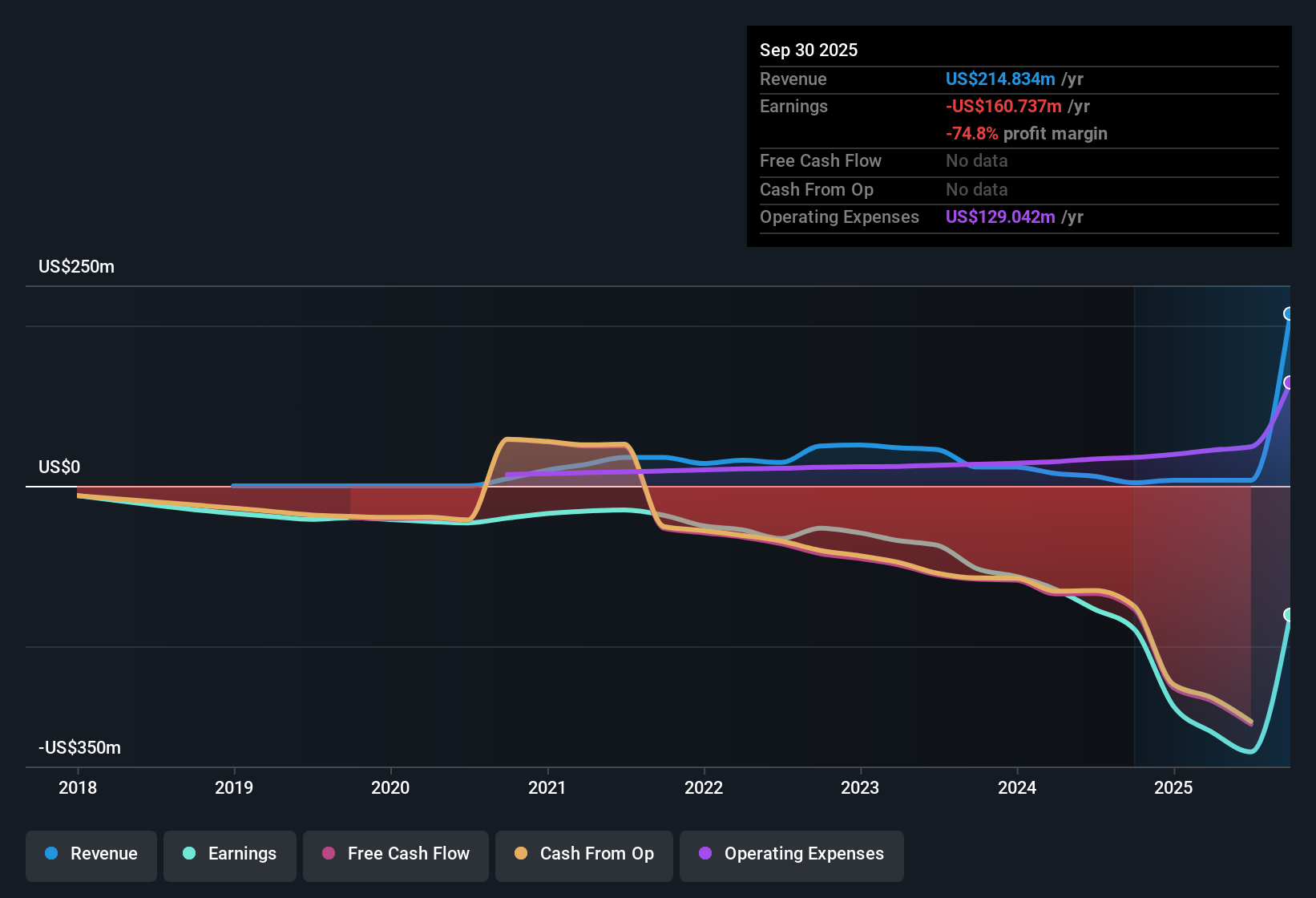

IDEAYA Biosciences (IDYA) reported a 45.2% per year increase in losses over the past five years and is forecasted to remain unprofitable for at least the next three years. However, revenue is projected to grow at 28.3% per year, notably outpacing the US market average of 10.5%. With robust top-line growth but continuing net losses, the results reflect a company in high-growth mode with persistent profitability hurdles for investors to watch.

See our full analysis for IDEAYA Biosciences.Next, we will put the earnings numbers head-to-head with the dominant market narratives, highlighting where the facts confirm the story and where surprises might challenge consensus thinking.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Premium Stands Out

- IDEAYA Biosciences trades at a Price-to-Sales Ratio of 12.4x, higher than the US biotech industry average of 10.8x; however, it remains dramatically lower than the peer group average of 3220.4x.

- Evaluating recent numbers, the premium against the broader industry may support the view that investors are willing to pay up for IDEAYA’s robust 28.3% annual sales growth trajectory.

- While bulls often cite high innovation as justification for paying above-sector multiples, this comparison introduces tension because IDEAYA’s multiple is high for the sector but conservative when compared with peer averages.

- Robust revenue momentum can warrant a premium, but valuation-sensitive investors may worry about whether top-line growth alone is enough for sustained outperformance, given the ongoing lack of profitability.

Losses Accelerate While Profits Remain Elusive

- Annual net losses have increased at 45.2% per year over the past five years, and forecasts show IDEAYA is likely to stay unprofitable for at least the next three years.

- Current figures strongly reinforce the risk focus on persistent losses.

- Critics highlight that the company’s inability to achieve profitability despite strong revenue growth raises questions about operating efficiency and business scalability.

- Recurring net losses mean investors are still waiting for evidence that rapid revenue gains can ultimately flow through to the bottom line, creating ongoing tension for those seeking earnings inflection.

DCF Fair Value and Analyst Targets Out of Reach

- The current share price of $30.48 trades well above the DCF fair value of -$42.46 (noting that actual fair value is uncalculable based on available data) and falls far behind the only allowed analyst price target of $48.12. This divergence makes valuation discussion particularly fraught.

- This pricing gap highlights the central debate among investors.

- Some highlight that, without a clear fair value calculation and with ongoing losses, buying at today’s price is a bet on future milestones, not current fundamentals.

- Others may see the gap to the analyst target as justifying further upside if revenue growth is sustained, but the lack of profitability keeps this thesis speculative rather than grounded in underlying performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on IDEAYA Biosciences's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

IDEAYA’s persistent net losses, stretched valuation, and continued lack of profitability highlight the risks of relying on growth without solid financial footing.

If you want to focus on companies trading at more attractive prices with stronger fundamentals, discover opportunities using these 844 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives