- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

ICON plc (ICLR): Assessing Valuation as CEO Transition Confirms Stability and 2025 Guidance

Reviewed by Simply Wall St

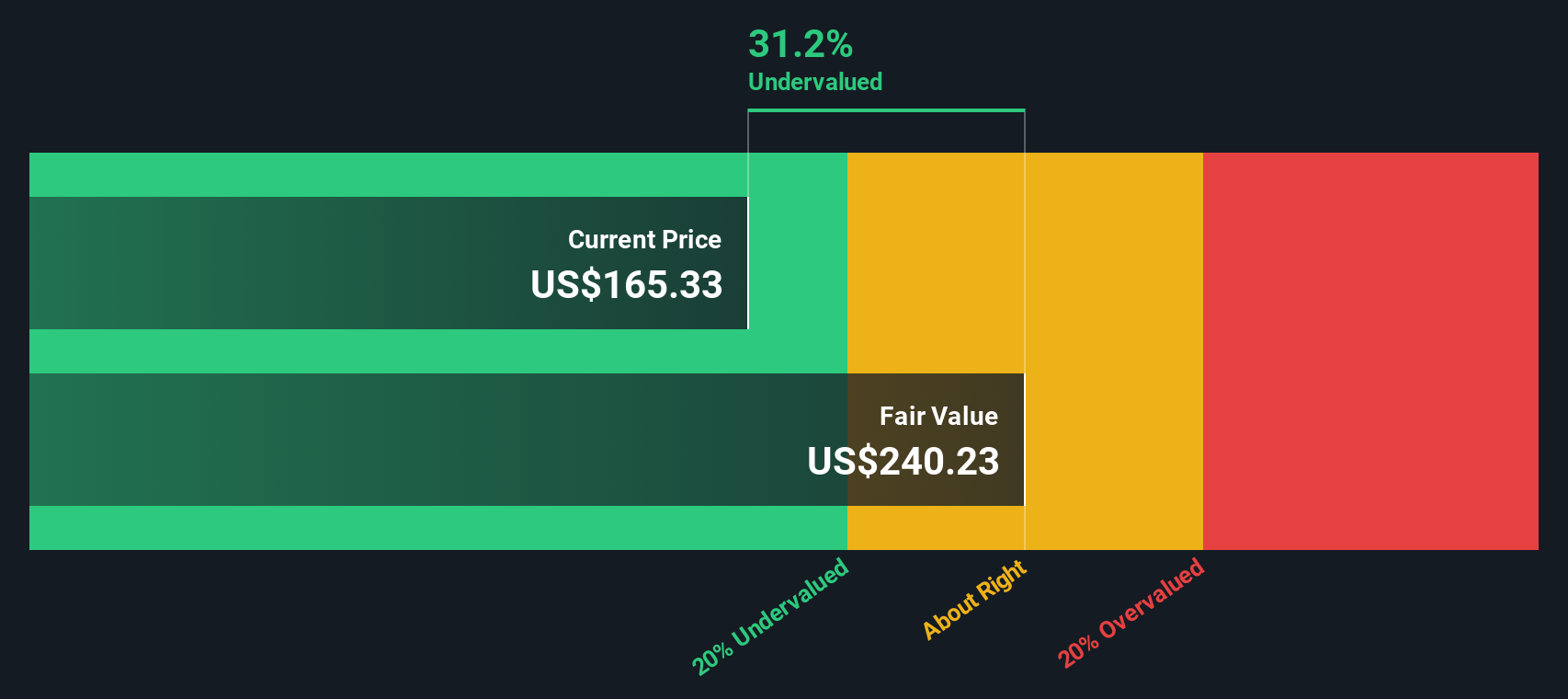

ICON (NasdaqGS:ICLR) just delivered a double dose of updates for shareholders with the appointment of Barry Balfe as CEO, replacing the retiring Dr. Steve Cutler, and a firm message that their 2025 financial guidance is sticking to the script. Leadership transitions can sometimes spook markets or signal shakeups behind the scenes, but ICON took the opportunity to highlight stability and reassure investors there are no surprises on the business front. With Balfe’s CRO experience and Dr. Cutler remaining on the Board to support the handover, the company seems focused on a smooth transition at the top.

Against that backdrop, ICON’s year has tested the nerves of even its most patient holders. The stock has climbed 23% over the past three months, recovering some ground after a difficult stretch that saw it down 16% year-to-date and trailing over the past year. While the leadership news didn’t jolt prices significantly on the day, this run-up since summer hints at growing optimism, or perhaps relief, around ICON’s path forward after a rough earlier patch.

So, with the company reaffirming its outlook as the stock rebounds, does this combination of leadership stability and recent price momentum signal a true buying opportunity, or are investors already betting big on ICON delivering future growth?

Most Popular Narrative: 19% Undervalued

The most widely followed narrative sees ICON as undervalued, suggesting that current prices do not fully reflect its future growth potential and operational improvements.

Operational standardization and streamlining processes are expected to enhance ICON's study cycle times and operational efficiencies. This could potentially improve net margins and profitability. Strategic investments in AI-enabled tools like iSubmit and SmartDraft are set to accelerate trials and enhance data management, which could lead to improved earnings through increased operational efficiency.

Want to uncover what drives this verdict? This narrative is built around strong earnings momentum, margin expansion, and ambitious quantitative assumptions. Curious about which key numbers let ICON claim such an aggressive valuation gap? Explore the underlying forecasts behind this bold outlook and see what could push ICON toward those optimistic price targets.

Result: Fair Value of $220.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent clinical trial cancellations and uncertain biotech funding could present challenges to ICON’s near-term revenue growth and raise doubts about the bullish outlook.

Find out about the key risks to this ICON narrative.Another View: Discounted Cash Flow Perspective

Switching gears from earnings multiples, our DCF model for ICON also points to potential undervaluation, but brings a fresh set of assumptions into play. Could this long-term cash flow view reveal hidden upside, or are expectations too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ICON Narrative

If you see things differently or want to dig into the numbers yourself, there is nothing stopping you from building your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding ICON.

Looking for More Investment Ideas?

Don’t let promising opportunities slip by. Tap into smarter stock picks with our specially curated screeners and trade with the confidence of knowing what others might be missing.

- Power up your portfolio by targeting companies with strong financials. See which penny stocks with strong financials are bucking the odds in today’s market.

- Spot tomorrow’s winners by searching for tech innovators. Unearth AI penny stocks that are transforming industries with advanced artificial intelligence.

- Fuel your hunt for value and find stocks trading below their intrinsic worth with our intuitive screener for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives