- United States

- /

- Pharma

- /

- NasdaqGM:HROW

A Fresh Look at Harrow (HROW) Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Harrow (HROW) shares have captured investor attention lately, supported by strong returns over the past month and past three months. The company’s ongoing performance has sparked discussion about what might be driving its upward momentum in the pharmaceutical sector.

See our latest analysis for Harrow.

Zooming out from the latest run, Harrow’s share price momentum has been building this year. The stock has added more than 26% over the past month and 50% across the last 90 days. Despite the strong recent pace, its one-year total shareholder return is still slightly negative, highlighting just how much the stock has turned a corner lately as sentiment improves.

If you’re curious to find more healthcare opportunities with tailwinds, check out the full potential lineup via our See the full list for free..

With shares up sharply in recent months but still trading below analyst targets, the key question is whether Harrow’s current price offers a compelling entry point or if the surge already reflects future growth expectations.

Most Popular Narrative: 23% Undervalued

Harrow's most widely followed narrative points to a fair value that sits well above the current closing price, suggesting opportunity for those who believe in the company's growth story and ambitious future metrics.

The rapidly growing demand for Harrow's portfolio of specialty ophthalmic drugs, particularly VEVYE, IHEEZO, and TRIESENCE, is positioned to accelerate further as aging populations and increased prevalence of chronic ocular diseases expand the baseline patient pool. This supports sustainable long-term revenue growth. Strategic expansion into new indications and broader patient segments (for example, TRIESENCE's expected launch into the large ocular inflammation market and BYQLOVI's entry into the post-operative care segment), coupled with rising healthcare access and coverage in the U.S., should increase prescription volumes and elevate top-line performance.

Want to know which extraordinary growth assumptions are fueling this optimistic valuation? The narrative hints at explosive expansion, margin leaps, and industry-defying financial targets. Find out what projections are bold enough to anchor such a premium.

Result: Fair Value of $61.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few flagship products and rapid, potentially unsustainable recent growth could undermine Harrow’s long-term earnings and revenue outlook.

Find out about the key risks to this Harrow narrative.

Another View: Multiples Comparison Highlights Caution

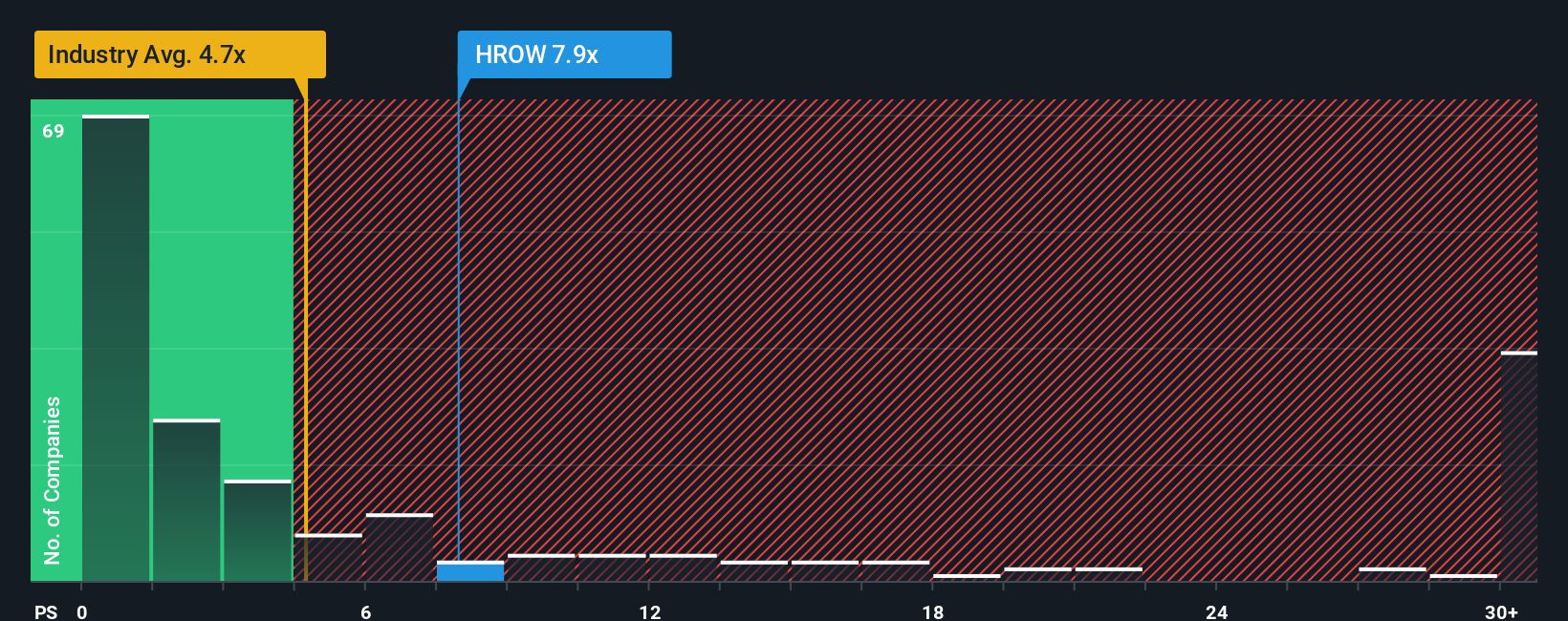

While the fair value model suggests major upside, Harrow’s current price-to-sales ratio of 7.8x stands well above both the US Pharmaceuticals industry average of 4.4x and its peer average of 2.8x. Even compared to its own fair ratio of 7.8x, there is little current margin of safety. That means investors could face valuation risk if sales growth falters. This premium may indicate exceptional potential, or it may simply reflect heightened risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harrow Narrative

If you want to dig into the data and shape your own view on Harrow, it's quick and easy to build your unique thesis. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Harrow.

Looking for More Investment Ideas?

Great opportunities rarely wait for long. Make the most of your market momentum by uncovering investment ideas you might not have considered yet with our powerful tool.

- Tap into untapped potential by spotting these 902 undervalued stocks based on cash flows that are trading below their intrinsic worth before the market catches on.

- Boost your portfolio’s income with these 19 dividend stocks with yields > 3% offering attractive yields higher than 3% and solid fundamentals to support consistent payouts.

- Ride the innovation wave as you browse these 24 AI penny stocks, featuring companies poised to benefit from breakthroughs in artificial intelligence and cutting-edge automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives