- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences Holdings, Inc.'s (NASDAQ:HRMY) Shares Not Telling The Full Story

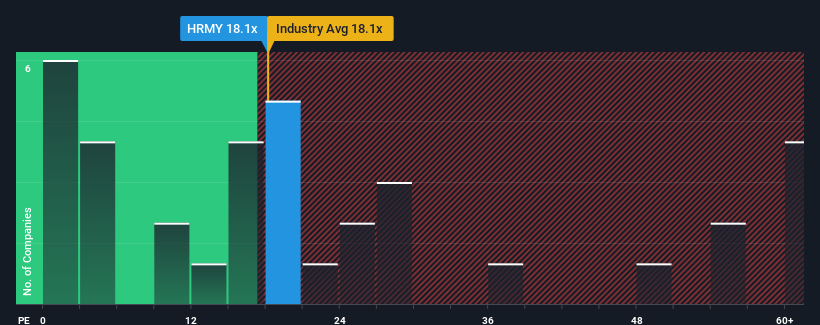

It's not a stretch to say that Harmony Biosciences Holdings, Inc.'s (NASDAQ:HRMY) price-to-earnings (or "P/E") ratio of 18.1x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Harmony Biosciences Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Harmony Biosciences Holdings

How Is Harmony Biosciences Holdings' Growth Trending?

The only time you'd be comfortable seeing a P/E like Harmony Biosciences Holdings' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 953% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 39% each year over the next three years. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

In light of this, it's curious that Harmony Biosciences Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Harmony Biosciences Holdings' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Harmony Biosciences Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 1 warning sign for Harmony Biosciences Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Harmony Biosciences Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives