- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences Holdings (HRMY) Reports Impressive Earnings Growth

Reviewed by Simply Wall St

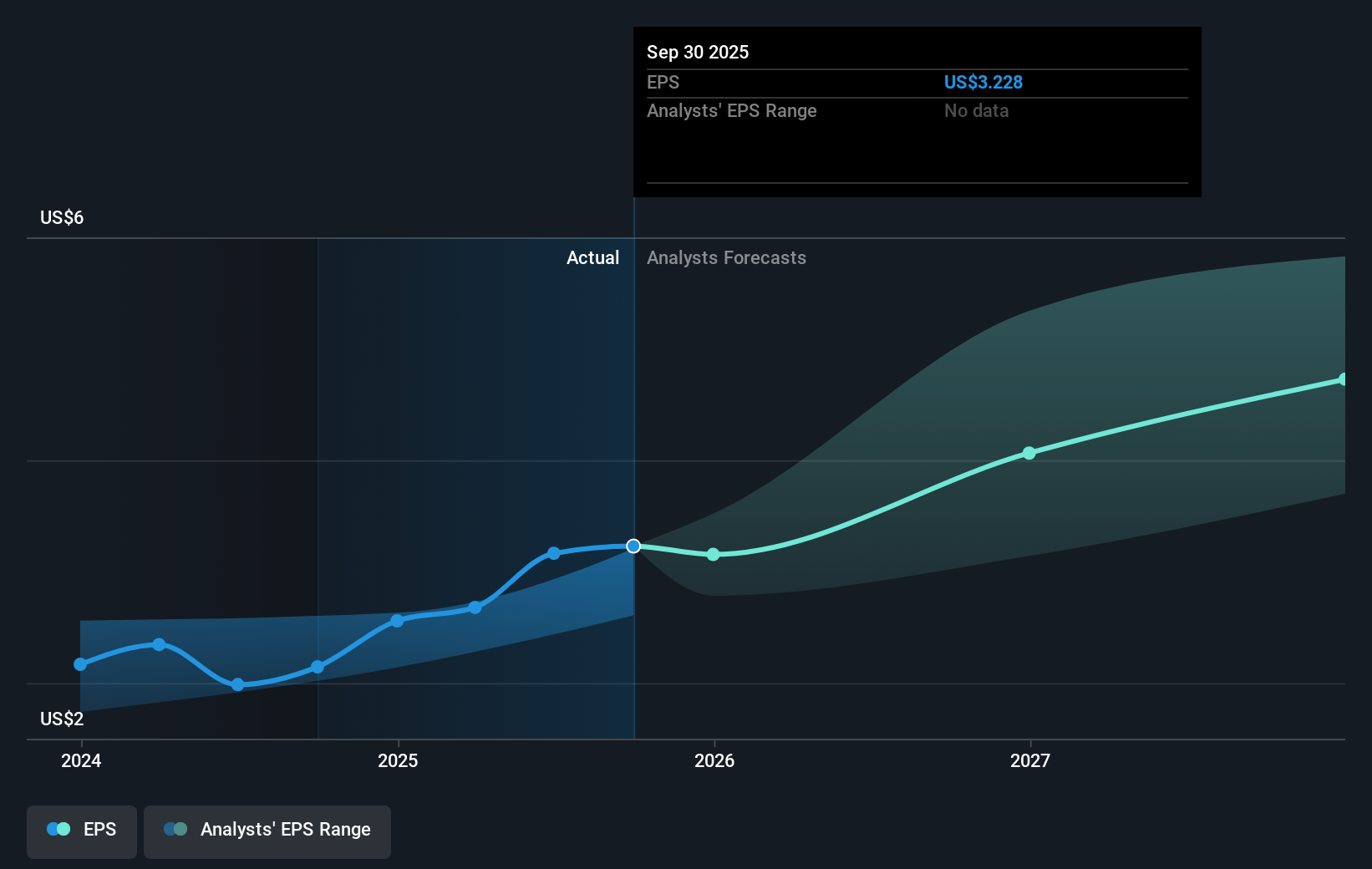

Harmony Biosciences Holdings (HRMY) recently reaffirmed its revenue guidance for the year and reported impressive growth in earnings for both the second quarter and the first half of 2025. Despite these positive updates, which might have typically supported a stronger upward trend, the company's share price remained flat over the last quarter, moving by only 0.36%. The rather subdued share price movement occurred against a backdrop of broader market gains, where major indexes reached record highs, buoyed by stable inflation data and expectations of interest rate cuts. Harmony's maintained levels may underscore the weight of broader market optimism during this period.

Despite Harmony Biosciences Holdings' recent reaffirmation of its revenue guidance and notable earnings growth, the company's total return over the past five years shows an 8.96% decline. This long-term performance offers context to the recent flat share price movement against broader market gains. While the short-term news highlights revenue and earnings strength, the overall share underperformance suggests that investors might still be cautious due to the company's high reliance on a single product and the current competitive landscape in the pharmaceutical industry.

Over the past year, Harmony's share return matched the US Pharmaceuticals industry, reflecting a challenging period compared to the broader US market's growth rates. The company's focus on expanding its addressable markets in sleep and rare diseases, supplemented by a diversified product pipeline, is intended to support sustained revenue growth. However, potential regulatory and competitive pressures pose risks to future earnings forecasts. With a current share price of US$33.21 and a consensus price target at US$50.45, there's a significant gap indicating investor caution or skepticism about the achievement of analysts' optimistic projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026