- United States

- /

- Biotech

- /

- NasdaqCM:HOOK

The Market Doesn't Like What It Sees From HOOKIPA Pharma Inc.'s (NASDAQ:HOOK) Revenues Yet As Shares Tumble 29%

To the annoyance of some shareholders, HOOKIPA Pharma Inc. (NASDAQ:HOOK) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

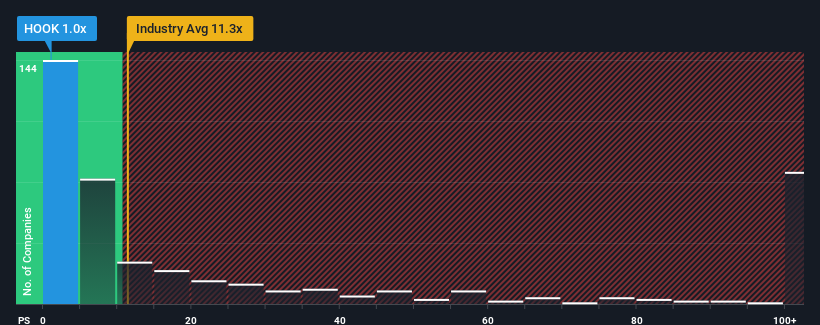

After such a large drop in price, HOOKIPA Pharma may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.3x and even P/S higher than 59x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for HOOKIPA Pharma

What Does HOOKIPA Pharma's P/S Mean For Shareholders?

HOOKIPA Pharma certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HOOKIPA Pharma.Is There Any Revenue Growth Forecasted For HOOKIPA Pharma?

In order to justify its P/S ratio, HOOKIPA Pharma would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 228%. The latest three year period has also seen an excellent 162% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 11% per annum during the coming three years according to the four analysts following the company. With the industry predicted to deliver 139% growth per year, that's a disappointing outcome.

With this information, we are not surprised that HOOKIPA Pharma is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On HOOKIPA Pharma's P/S

Having almost fallen off a cliff, HOOKIPA Pharma's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that HOOKIPA Pharma's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for HOOKIPA Pharma that you should be aware of.

If these risks are making you reconsider your opinion on HOOKIPA Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HOOKIPA Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HOOK

HOOKIPA Pharma

A clinical stage biopharmaceutical company, develops immunetherapeutics targeting infectious diseases based on its proprietary arenavirus platform.

Moderate with adequate balance sheet.

Market Insights

Community Narratives