- United States

- /

- Life Sciences

- /

- NasdaqCM:HBIO

Harvard Bioscience (NASDAQ:HBIO shareholders incur further losses as stock declines 11% this week, taking three-year losses to 65%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Harvard Bioscience, Inc. (NASDAQ:HBIO) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 65% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 35% lower in that time. And the share price decline continued over the last week, dropping some 11%.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Harvard Bioscience

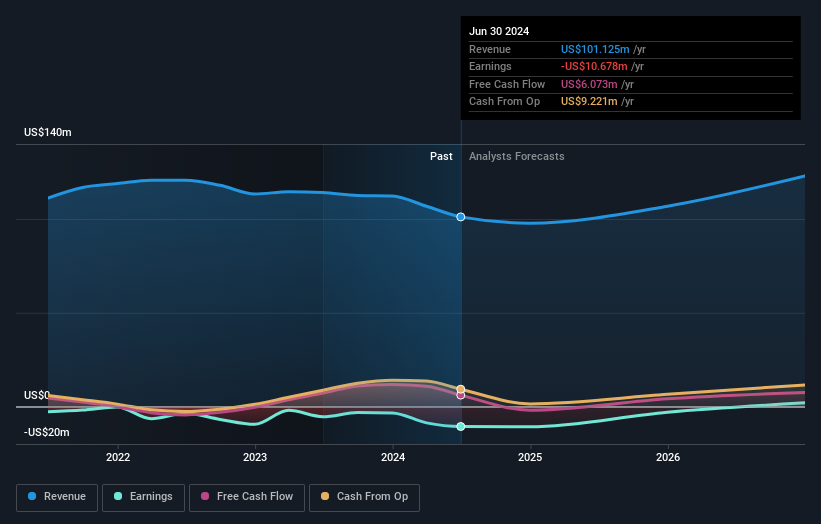

Because Harvard Bioscience made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Harvard Bioscience's revenue dropped 3.4% per year. That is not a good result. The share price decline of 18% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Harvard Bioscience stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 25% in the last year, Harvard Bioscience shareholders lost 35%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 0.9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Harvard Bioscience you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Harvard Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HBIO

Harvard Bioscience

Develops, manufactures, and sells technologies, products, and services for life science applications in the United States, Germany, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives