- United States

- /

- Biotech

- /

- NasdaqCM:HARP

Improved Revenues Required Before Harpoon Therapeutics, Inc. (NASDAQ:HARP) Stock's 97% Jump Looks Justified

Despite an already strong run, Harpoon Therapeutics, Inc. (NASDAQ:HARP) shares have been powering on, with a gain of 97% in the last thirty days. The annual gain comes to 117% following the latest surge, making investors sit up and take notice.

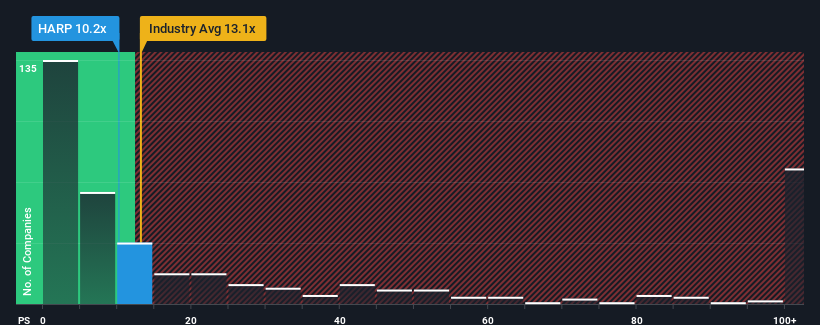

In spite of the firm bounce in price, Harpoon Therapeutics may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 10.2x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.1x and even P/S higher than 55x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Harpoon Therapeutics

How Has Harpoon Therapeutics Performed Recently?

With revenue growth that's inferior to most other companies of late, Harpoon Therapeutics has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Harpoon Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Harpoon Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Pleasingly, revenue has also lifted 206% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 2.9% per year as estimated by the nine analysts watching the company. That's not great when the rest of the industry is expected to grow by 236% per year.

With this in consideration, we find it intriguing that Harpoon Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Harpoon Therapeutics' P/S

The latest share price surge wasn't enough to lift Harpoon Therapeutics' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Harpoon Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Harpoon Therapeutics (2 shouldn't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Harpoon Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harpoon Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HARP

Harpoon Therapeutics

Harpoon Therapeutics, Inc., a clinical-stage immunotherapy company, engages in the development of a novel class of T cell engagers that harness the power of the body’s immune system to treat patients suffering from cancer and other diseases in the United States.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives