- United States

- /

- Biotech

- /

- NasdaqGS:GTHX

G1 Therapeutics, Inc. (NASDAQ:GTHX) Stock Catapults 61% Though Its Price And Business Still Lag The Industry

Despite an already strong run, G1 Therapeutics, Inc. (NASDAQ:GTHX) shares have been powering on, with a gain of 61% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

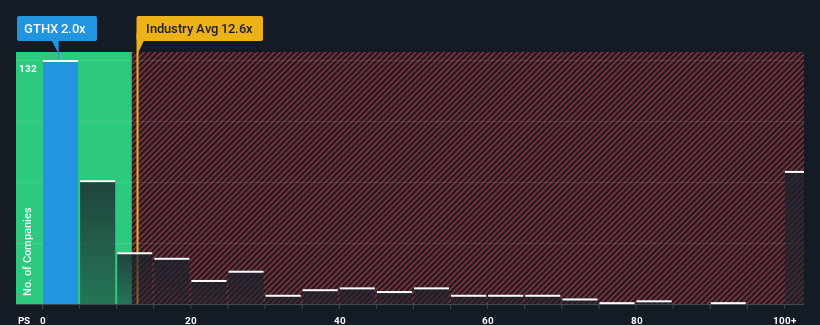

Even after such a large jump in price, G1 Therapeutics may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.6x and even P/S higher than 53x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for G1 Therapeutics

How G1 Therapeutics Has Been Performing

G1 Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on G1 Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

G1 Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. The strong recent performance means it was also able to grow revenue by 171% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 27% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 240% per annum, which is noticeably more attractive.

With this information, we can see why G1 Therapeutics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in G1 Therapeutics have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of G1 Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 2 warning signs for G1 Therapeutics (1 shouldn't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTHX

G1 Therapeutics

A commercial-stage biopharmaceutical company, engages in the discovery, development, and commercialization of small molecule therapeutics for the treatment of patients with cancer in the United States.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives