- United States

- /

- Biotech

- /

- NasdaqGS:GRAL

A Look at GRAIL (GRAL) Valuation Following Analyst Upgrades and Strong Quarterly Results

Reviewed by Simply Wall St

GRAIL (GRAL) has attracted fresh market attention after its recent quarterly report showed revenue growth and narrowing losses. Investors are watching closely as GRAIL advances its multi-cancer early detection technologies.

See our latest analysis for GRAIL.

GRAIL’s momentum is hard to miss, with its latest 1-day share price return of 7.99% and an impressive year-to-date price return of 390.90%. The total shareholder return for the past 12 months is even stronger at 437.06%, as investors are rewarding the company not just for its surge in revenue and narrower losses, but also for a series of recent capital raises and ongoing innovation in early cancer detection. Overall, GRAIL’s stock has delivered significant gains, suggesting market optimism for both its short- and long-term future.

If you’re looking for other promising healthcare innovators, don’t miss the discovery opportunity in our curated list of leaders in See the full list for free.

The question now is whether these gains mean GRAIL’s stock still offers upside for new investors, or if the market has already factored in the company’s aggressive expansion and future growth potential.

Most Popular Narrative: 2.3% Undervalued

At $87.97, GRAIL’s shares are now trading just below the most widely followed narrative's fair value estimate of $90. This slim margin spotlights bullish sentiment, even after the latest rally. The market is signaling confidence in GRAIL’s trajectory, but what is driving this optimism?

Ongoing positive clinical trial results, including substantially higher cancer detection and positive predictive value with consistent specificity for Galleri in population-scale studies, are setting the stage for robust FDA approval and broad payer reimbursement. This could unlock significant new revenue streams and accelerate top-line growth.

Want to know why analysts are betting on explosive growth? The narrative hinges on crucial milestones, ambitious revenue targets, and a profit profile rarely seen in biotech. The secret drivers behind this price target might surprise you. Curious what’s powering the numbers? Find out what’s fueling this momentum inside the full narrative.

Result: Fair Value of $90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant hurdles remain because profitability depends on pivotal clinical trial results and obtaining broad regulatory and payer approval for Galleri’s adoption.

Find out about the key risks to this GRAIL narrative.

Another View: Market Ratios Send a Caution Signal

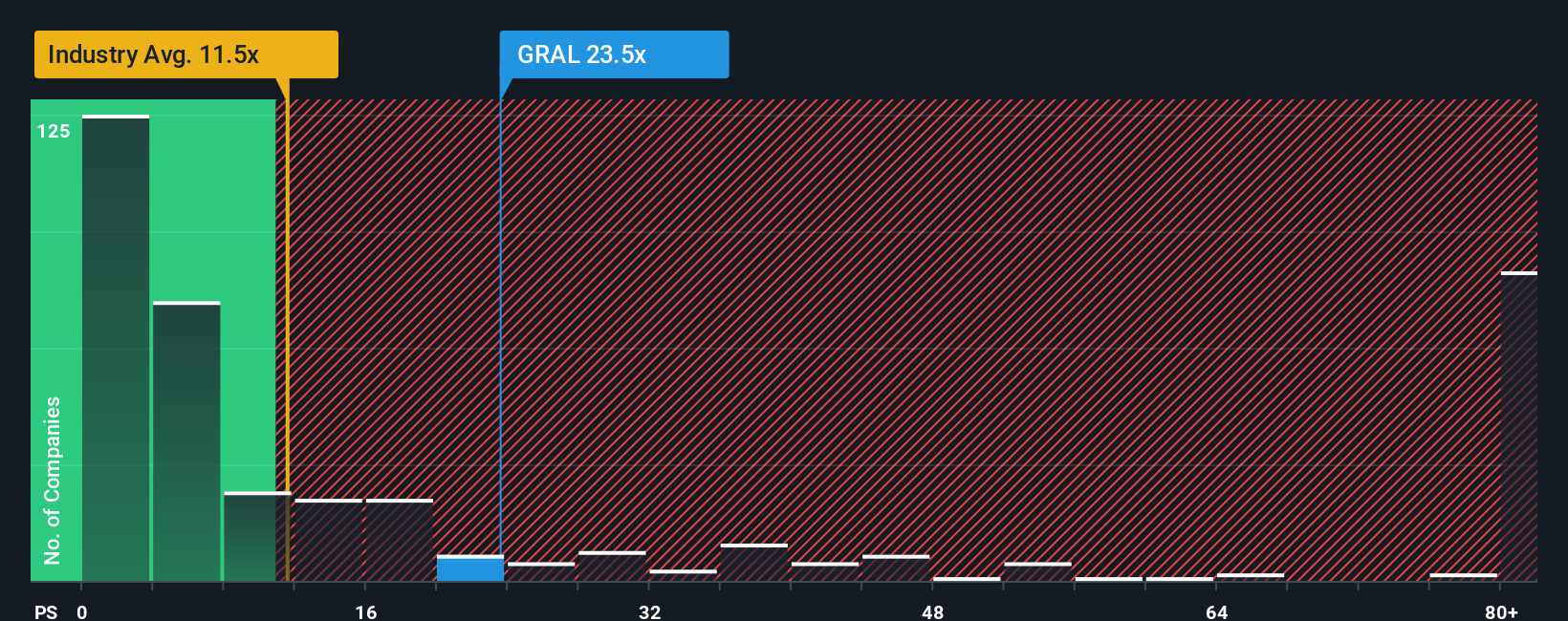

Looking beyond narratives, GRAIL's price-to-sales ratio stands at 24.2x, which is much higher than the US Biotechs industry average of 11.6x and the peer average of just 7.2x. In contrast to a fair ratio estimate of 1.7x, this premium suggests investors are pricing in significant future gains that may not be guaranteed. When a stock trades this far above market norms, does it signal real promise or introduce extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GRAIL Narrative

If you have your own perspective or want to dig into the numbers directly, you can craft your own take in just a few minutes, Do it your way

A great starting point for your GRAIL research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for More Eye-Opening Investment Opportunities?

Don’t let a crowded market pass you by. Take charge of your investing journey with curated stock ideas tailored to today’s most exciting trends and sectors.

- Grow your portfolio by targeting under-the-radar companies identified in these 908 undervalued stocks based on cash flows that may be trading below their true worth.

- Access market-shaping trends by checking out these 26 AI penny stocks, featuring forward-thinking firms accelerating artificial intelligence innovation.

- Boost your returns and secure steady income streams from these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAL

GRAIL

A commercial-stage healthcare company, provides multi-cancer early detection testing and services in the United States and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives