- United States

- /

- Pharma

- /

- NasdaqGM:GPCR

Structure Therapeutics (GPCR): Valuation Perspective as New Clinical Pipeline Advances Take Shape

Reviewed by Kshitija Bhandaru

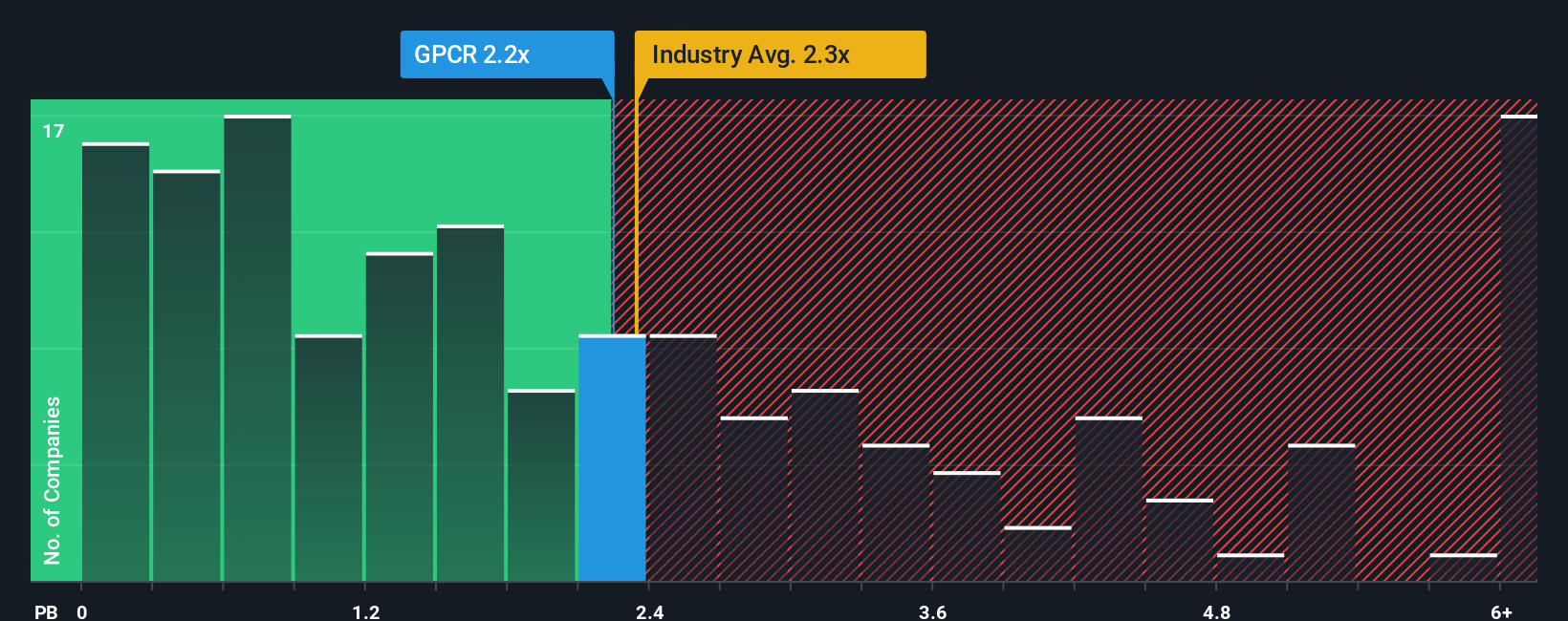

Price-to-Book of 1.8x: Is it justified?

Based on its price-to-book ratio, GPCR appears undervalued relative to both industry peers and the broader US Pharmaceuticals sector. With a ratio of 1.8x, investors are paying less for the company’s net assets compared to what is typical in this market segment.

The price-to-book ratio measures a company's market value against its book value, providing insight into how the market values the underlying assets. For biotech firms that are yet to reach profitability, this metric helps benchmark valuation compared to less speculative companies or those with consistent asset-based returns.

This result suggests the market is underpricing GPCR’s asset base, possibly due to the lack of revenue and ongoing losses, while at the same time overlooking its significant projected revenue growth and product pipeline potential.

Result: Fair Value of $43.22 (UNDERVALUED)

See our latest analysis for Structure Therapeutics.However, setbacks in upcoming trial results or a continued lack of revenue could quickly reverse recent gains and dampen sentiment around GPCR.

Find out about the key risks to this Structure Therapeutics narrative.Another View: Multiples Tell a Different Story

While fair value estimates point to GPCR being undervalued, looking at the price-to-book ratio compared to the industry also paints the company as good value. However, can a single ratio capture the bigger picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Structure Therapeutics Narrative

If you see things differently or prefer to dive deeper on your own, you can easily build your own view in just minutes. Do it your way

A great starting point for your Structure Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just limit yourself to one stock when the market is packed with fresh opportunities. If you want to stay ahead, check out these handpicked ideas now. Opportunity waits for no one.

- Uncover value you might be missing by scanning a lineup of companies priced attractively for growth. See which stocks are considered undervalued stocks based on cash flows right now.

- Catch the latest breakthroughs in healthcare technology by searching for leaders in medical AI solutions and data-driven innovation with our healthcare AI stocks.

- Start your search for tomorrow’s fast-movers among overlooked companies with solid financials. Tap into potential with our exclusive group of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GPCR

Structure Therapeutics

A clinical stage global biopharmaceutical company, develops and delivers novel oral small molecule therapeutics to treat various chronic diseases with unmet medical needs in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives