- United States

- /

- Pharma

- /

- NasdaqGM:GPCR

Structure Therapeutics (GPCR) Falls Deeper into Losses and Seeks $250M—Is Its Funding Model Sustainable?

Reviewed by Simply Wall St

- Structure Therapeutics Inc. recently reported a second-quarter net loss of US$61.66 million, widening from US$26.03 million a year ago, and for the six-month period, the net loss also increased to US$108.49 million from US$52.07 million in the previous year.

- Following these results, the company filed for a US$250 million follow-on equity offering and a shelf registration allowing future issuance of various securities including American Depositary Shares, preferred shares, debt securities, warrants, and units.

- We’ll explore how the combination of increased losses and plans for substantial new capital raising could reshape Structure Therapeutics’ investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Structure Therapeutics' Investment Narrative?

For anyone eyeing Structure Therapeutics stock, the key story is belief in future breakthroughs in weight management and obesity-related therapeutics, paired with confidence in the company's ability to sustain heavy investment during this unprofitable stage. The recent, sharply widened net losses and immediate US$250 million equity offering make the investment case even more focused on questions of capital: Will the new cash be enough to get clinical programs over the finish line, especially with no revenue yet, or does it highlight deeper funding needs if expenses keep rising? Near-term catalysts, such as Phase 2b data for GSBR-1290 or Phase 1 progress on ACCG-2671, remain intact but now look far more sensitive to trial outcomes and cash runway. The new offering could introduce short-term volatility, potentially shifting attention from clinical excitement to dilution concerns and liquidity risks. On the risk front, rapidly increasing losses and ongoing dilution now feel less like background issues and more like central questions for would-be shareholders.

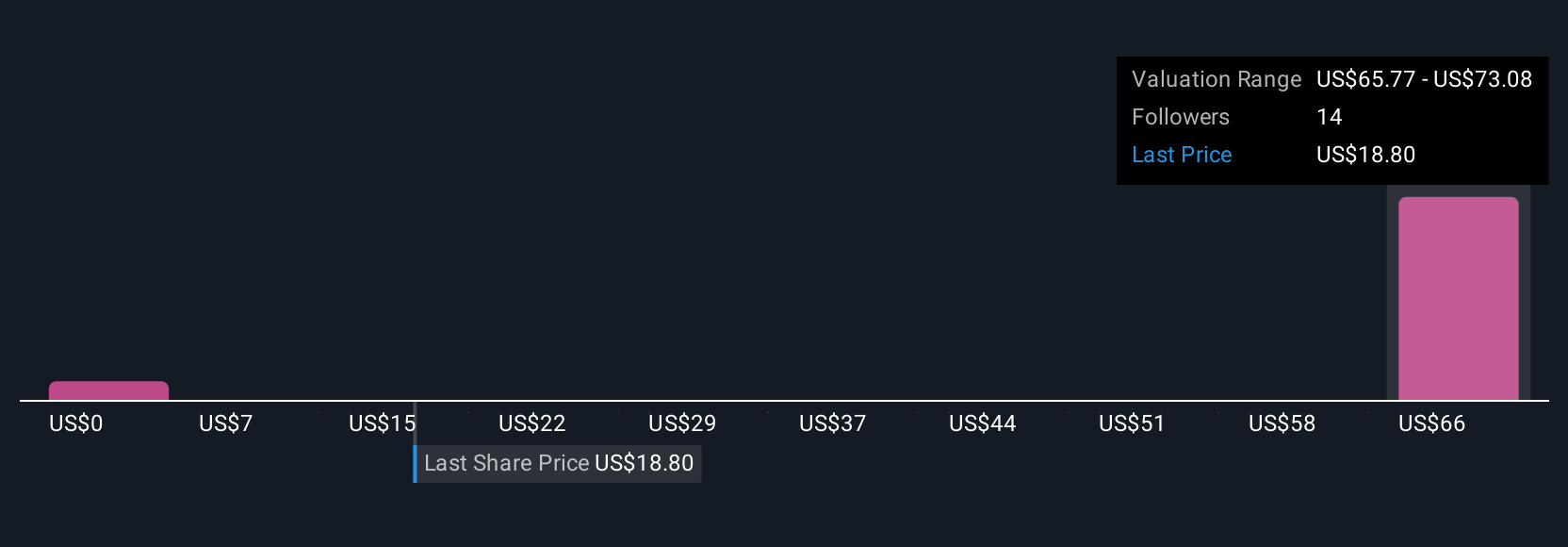

But, with increasing dilution on the table, new funding risks can't be ignored for long. Our comprehensive valuation report raises the possibility that Structure Therapeutics is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 3 other fair value estimates on Structure Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Structure Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Structure Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Structure Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Structure Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GPCR

Structure Therapeutics

A clinical stage global biopharmaceutical company, develops and delivers novel oral small molecule therapeutics to treat various chronic diseases with unmet medical needs in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives