- United States

- /

- Biotech

- /

- NasdaqCM:GLYC

Here's Why It's Unlikely That GlycoMimetics, Inc.'s (NASDAQ:GLYC) CEO Will See A Pay Rise This Year

Shareholders will probably not be too impressed with the underwhelming results at GlycoMimetics, Inc. (NASDAQ:GLYC) recently. At the upcoming AGM on 18 May 2021, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for GlycoMimetics

How Does Total Compensation For Rachel King Compare With Other Companies In The Industry?

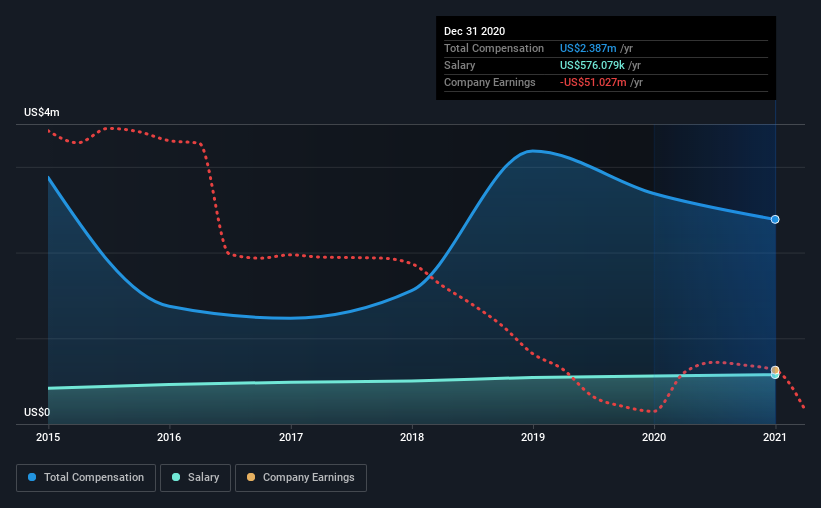

At the time of writing, our data shows that GlycoMimetics, Inc. has a market capitalization of US$115m, and reported total annual CEO compensation of US$2.4m for the year to December 2020. That's a notable decrease of 11% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$576k.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$1.1m. Hence, we can conclude that Rachel King is remunerated higher than the industry median. Furthermore, Rachel King directly owns US$1.2m worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$576k | US$559k | 24% |

| Other | US$1.8m | US$2.1m | 76% |

| Total Compensation | US$2.4m | US$2.7m | 100% |

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. GlycoMimetics is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at GlycoMimetics, Inc.'s Growth Numbers

Earnings per share at GlycoMimetics, Inc. are much the same as they were three years ago, albeit slightly lower. Its revenue is down 75% over the previous year.

A lack of EPS improvement is not good to see. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has GlycoMimetics, Inc. Been A Good Investment?

Few GlycoMimetics, Inc. shareholders would feel satisfied with the return of -88% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 4 warning signs for GlycoMimetics that investors should think about before committing capital to this stock.

Important note: GlycoMimetics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading GlycoMimetics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:GLYC

GlycoMimetics

Engages in the discovery and development of therapies for cancers and inflammatory diseases in the United States.

Moderate with adequate balance sheet.

Market Insights

Community Narratives