- United States

- /

- Biotech

- /

- NasdaqGS:GILD

The Bull Case For Gilead Sciences (GILD) Could Change Following EMA Backing For Lenacapavir PrEP

Reviewed by Simply Wall St

- In July 2025, Gilead Sciences received a positive opinion from the European Medicines Agency's CHMP for its injectable HIV-1 capsid inhibitor, lenacapavir, as a new pre-exposure prophylaxis (PrEP) option for adults and adolescents at increased HIV-1 risk across EU states and select European countries.

- This recommendation marks an important regulatory milestone, increasing the likelihood that lenacapavir could become a novel, long-acting preventative therapy amid growing interest in differentiated HIV prevention solutions.

- We’ll now examine how this regulatory advancement for lenacapavir could impact Gilead’s long-term product portfolio and investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Gilead Sciences Investment Narrative Recap

To be a Gilead shareholder today, you need to believe the HIV franchise can adapt to policy shifts and competitive threats while tapping new pockets of growth through pioneering products like lenacapavir. The July 2025 positive CHMP opinion for lenacapavir as a long-acting PrEP in Europe is a meaningful regulatory step, but its immediate impact on Gilead’s biggest near-term risk, pricing and reimbursement dynamics in the HIV segment, remains limited until final approval and market uptake play out.

One recent announcement with direct relevance is the June 2025 FDA approval of lenacapavir (Yeztugo) as the first twice-yearly PrEP option in the US. This adds regulatory momentum to Gilead's HIV innovation strategy, reinforcing the company's position in preventative therapies. How well these drugs are adopted in key markets will influence short-term catalysts around new product launches and revenue visibility.

By contrast, what investors should watch for is whether Gilead faces greater-than-expected pressure on HIV pricing in the US, as...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences' outlook anticipates $31.7 billion in revenue and $9.8 billion in earnings by 2028. This is based on analysts forecasting 3.3% annual revenue growth and a $3.8 billion increase in earnings from the current $6.0 billion.

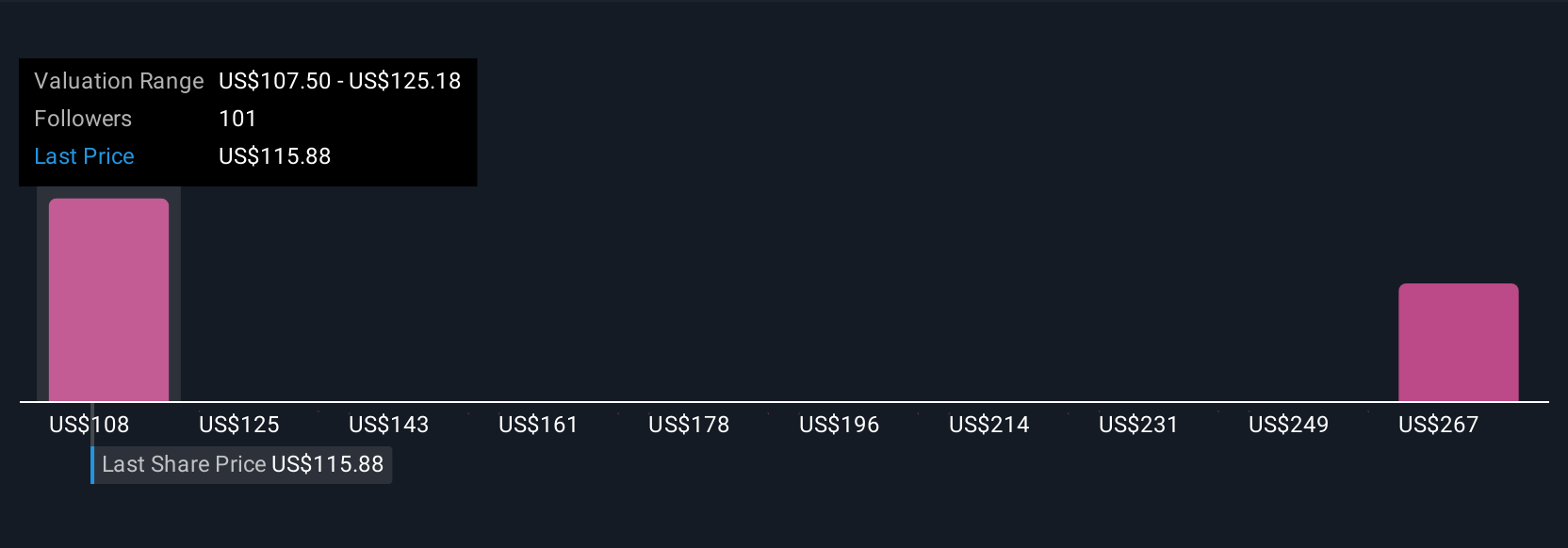

Uncover how Gilead Sciences' forecasts yield a $118.16 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some analysts were far more optimistic before this news, highlighting how lenacapavir and Trodelvy could drive annual revenue to over US$33.8 billion and earnings to US$10.8 billion by 2028. If you are considering different outcomes, it's important to recognize that expectations for Gilead's future can vary greatly, especially as new developments unfold.

Explore 9 other fair value estimates on Gilead Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives