- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Is Extended Biktarvy Exclusivity and New HIV Data Shifting Gilead's (GILD) Investment Outlook?

Reviewed by Sasha Jovanovic

- In October 2025, Gilead Sciences presented significant advances at the European AIDS Conference and ESMO Congress, unveiling new HIV treatment data, progress in long-acting therapies, and promising results for its oncology pipeline, including Trodelvy in metastatic triple-negative breast cancer.

- An important highlight was the settlement that extends exclusivity for Gilead’s key HIV drug Biktarvy until April 2036, reinforcing the company's leadership and supporting the commercial longevity of its core franchise.

- We’ll now examine how the extended Biktarvy exclusivity and new long-acting therapy data influence Gilead Sciences’ investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Gilead Sciences Investment Narrative Recap

To be a Gilead Sciences shareholder, you have to believe the company will continue to lead in HIV treatment while meaningfully diversifying into other therapeutic areas. The recent extension of Biktarvy’s exclusivity until 2036 stabilizes Gilead’s core franchise and delays generic competition, a strong short-term catalyst, though it doesn’t eliminate the company’s longer-term reliance on its HIV portfolio amid ongoing policy and pricing risks. So far, this news supports, rather than materially changes, the current risk/reward profile for the business.

Among the announcements, the five-year real-world data for Biktarvy presented at the European AIDS Conference is especially relevant. It reinforces investor confidence in Biktarvy’s long-term clinical value and supports the argument that Gilead’s HIV franchise benefits from high patient persistence, a strong safety record, and a high barrier to resistance, important pillars for sustaining revenue until new therapies reach scale.

By contrast, there are important details about shifting regulatory dynamics and pricing pressure that investors should be aware of...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences is projected to reach $32.3 billion in revenue and $10.0 billion in earnings by 2028. This outlook assumes a 3.8% annual revenue growth rate and a $3.7 billion increase in earnings from the current $6.3 billion.

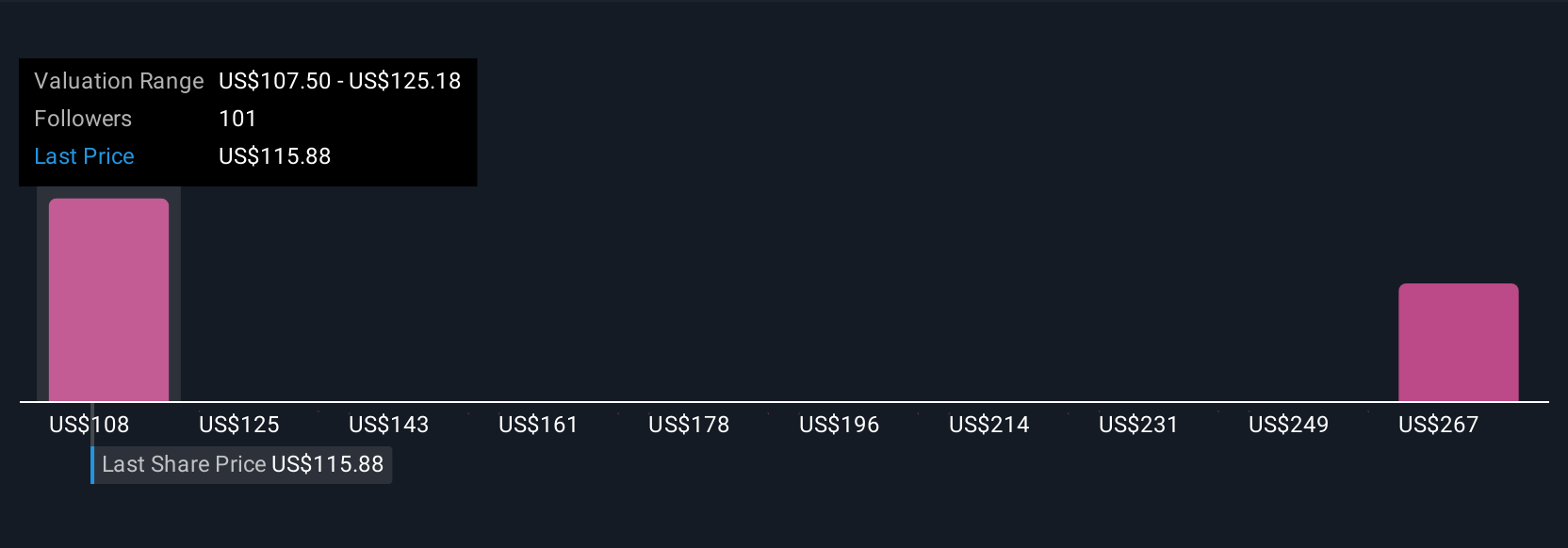

Uncover how Gilead Sciences' forecasts yield a $126.31 fair value, a 3% upside to its current price.

Exploring Other Perspectives

While many analysts see Biktarvy’s extended market control as a growth anchor, the most optimistic call for revenue hitting US$33,900,000,000 by 2028, with much heavier weight on new launches. These higher forecasts show how opinions on Gilead’s future can differ, so before settling on your view, consider that bullish targets may still need to adjust for recent developments in both HIV and oncology.

Explore 10 other fair value estimates on Gilead Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives