- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

What Fortrea Holdings (FTRE)'s Debt Tender, Legal Scrutiny Mean for Investor Confidence

Reviewed by Sasha Jovanovic

- Earlier this month, Fortrea Holdings Inc. commenced a debt tender offer to repurchase up to US$75.74 million of its 7.500% Senior Secured Notes due 2030, following the divestiture of certain business units as required by bond covenants.

- This move comes amid heightened regulatory and legal scrutiny, including a new investigation into the company’s executive leadership after missed financial guidance and ongoing litigation.

- We'll examine how the increased legal investigation risk could impact confidence in Fortrea’s investment narrative and future outlook.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fortrea Holdings Investment Narrative Recap

Fortrea Holdings appeals to investors confident in the long-term growth of outsourced clinical services, driven by robust drug development trends and ongoing cost optimization. The recent debt tender offer, largely mechanical and tied to divestiture-related bond covenants, does not materially affect the company’s main near-term catalyst, margin expansion from ongoing cost savings, or mitigate the biggest risk of legal and regulatory uncertainty stemming from governance investigations.

Among recent announcements, the ongoing securities class action lawsuit and new executive investigation are most relevant given their potential to dampen investor sentiment and increase operational distraction. These legal developments could exacerbate existing concerns regarding revenue concentration risk and persistent unprofitability, making them important considerations when evaluating catalysts surrounding leadership changes and margin recovery plans.

In contrast, investors should be aware of how heightened legal scrutiny, especially following missed guidance and continued litigation, could...

Read the full narrative on Fortrea Holdings (it's free!)

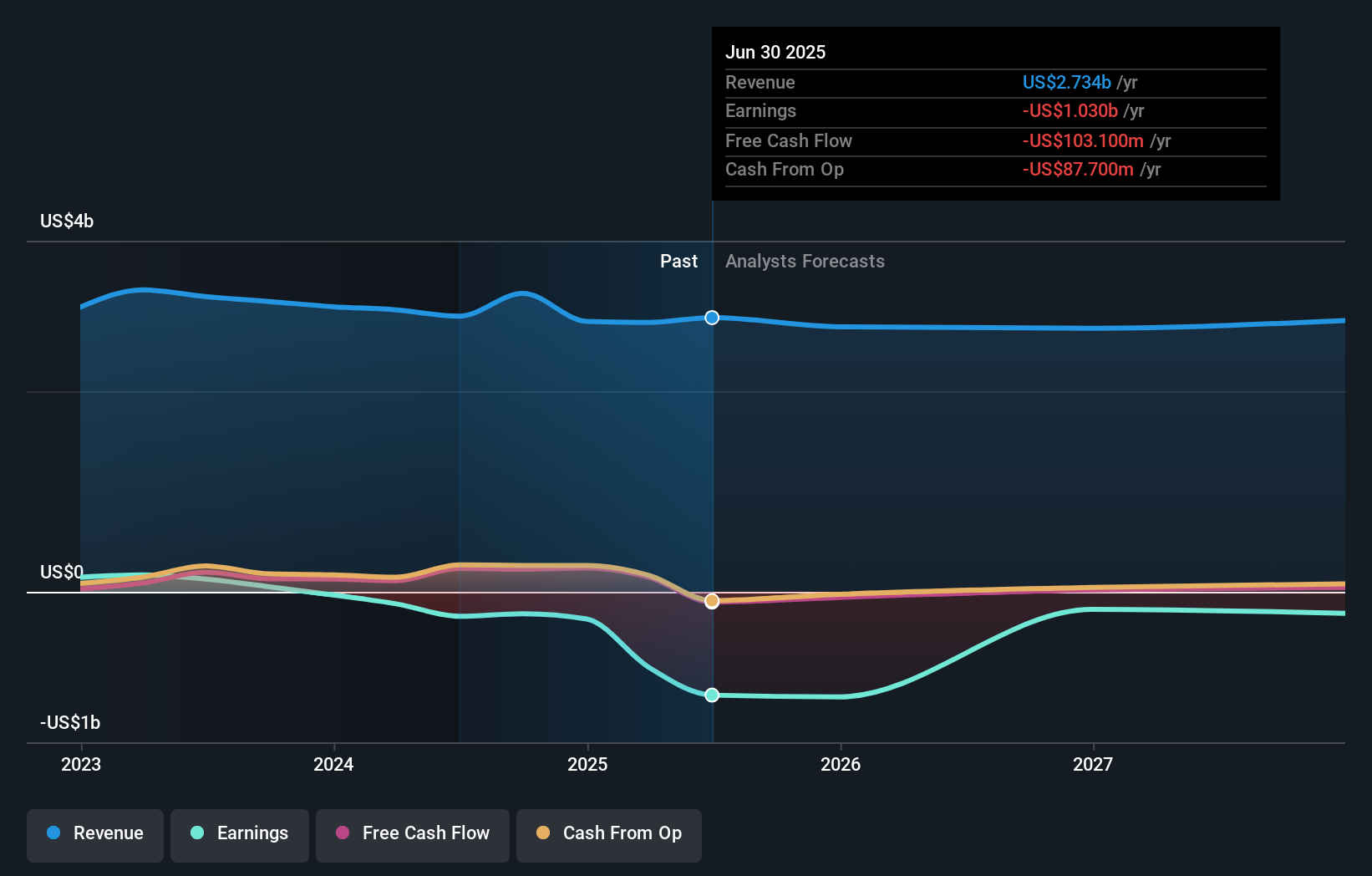

Fortrea Holdings' narrative projects $2.7 billion revenue and $388.5 million earnings by 2028. This requires a 0.1% annual revenue decline and an earnings increase of about $1.4 billion from current earnings of -$1.0 billion.

Uncover how Fortrea Holdings' forecasts yield a $9.44 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate fair values for Fortrea ranging from US$9.44 to US$21.24 per share. With legal risks rising, your interpretation of the company’s governance outlook could be crucial in deciding which view best aligns with your own expectations.

Explore 2 other fair value estimates on Fortrea Holdings - why the stock might be worth 11% less than the current price!

Build Your Own Fortrea Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Fortrea Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortrea Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives