- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Fortrea Holdings (FTRE): Exploring Valuation Following Recent Share Price Changes

Reviewed by Simply Wall St

Fortrea Holdings (FTRE) shares have moved in a mixed range recently, with the stock gaining 2% over the past month but still down more than 44% for the year. Investors are watching closely as the company's fundamentals demonstrate both ongoing challenges and areas of improvement.

See our latest analysis for Fortrea Holdings.

The recent 7.43% one-month share price return suggests some positive momentum is building for Fortrea, even though its year-to-date share price return remains sharply negative. Despite this, the past quarter’s rally hints that sentiment around the stock may be shifting as investors reassess risk and potential upside.

If you'd like to expand your watchlist beyond just biopharma, now is a smart time to discover fast growing stocks with high insider ownership

But is Fortrea truly trading below its intrinsic value after such a steep decline, or is the recent rebound simply a reflection of the market already pricing in its growth prospects? Is there a real buying opportunity here, or are expectations already reflected in the price?

Most Popular Narrative: 9% Overvalued

Fortrea’s most followed narrative places fair value at $9.53, just below the recent close of $10.41, tilting the stock into slightly overvalued territory. This latest estimate centers on operational cost savings and improved profitability, yet it also signals caution as the company works through market headwinds.

Post-spin, the company has executed significant cost optimization initiatives (achieving over $50 million in net savings year-to-date and targeting $90 to $100 million for the year), with further SG&A savings and margin improvements anticipated in 2026 as more of these initiatives annualize, supporting both EBITDA and net income growth.

Want to unlock what’s behind this small premium? A bold forecast for margin growth and operational efficiencies underpins the narrative’s valuation math. See how future profitability ambitions shape this story and what these numbers mean for long-term investors. The real surprises are in the assumptions driving that fair value.

Result: Fair Value of $9.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer concentration and rising competitive pressures could quickly undermine the narrative. This may keep revenue growth and margin expansion at risk.

Find out about the key risks to this Fortrea Holdings narrative.

Another View: DCF Valuation Paints a Different Picture

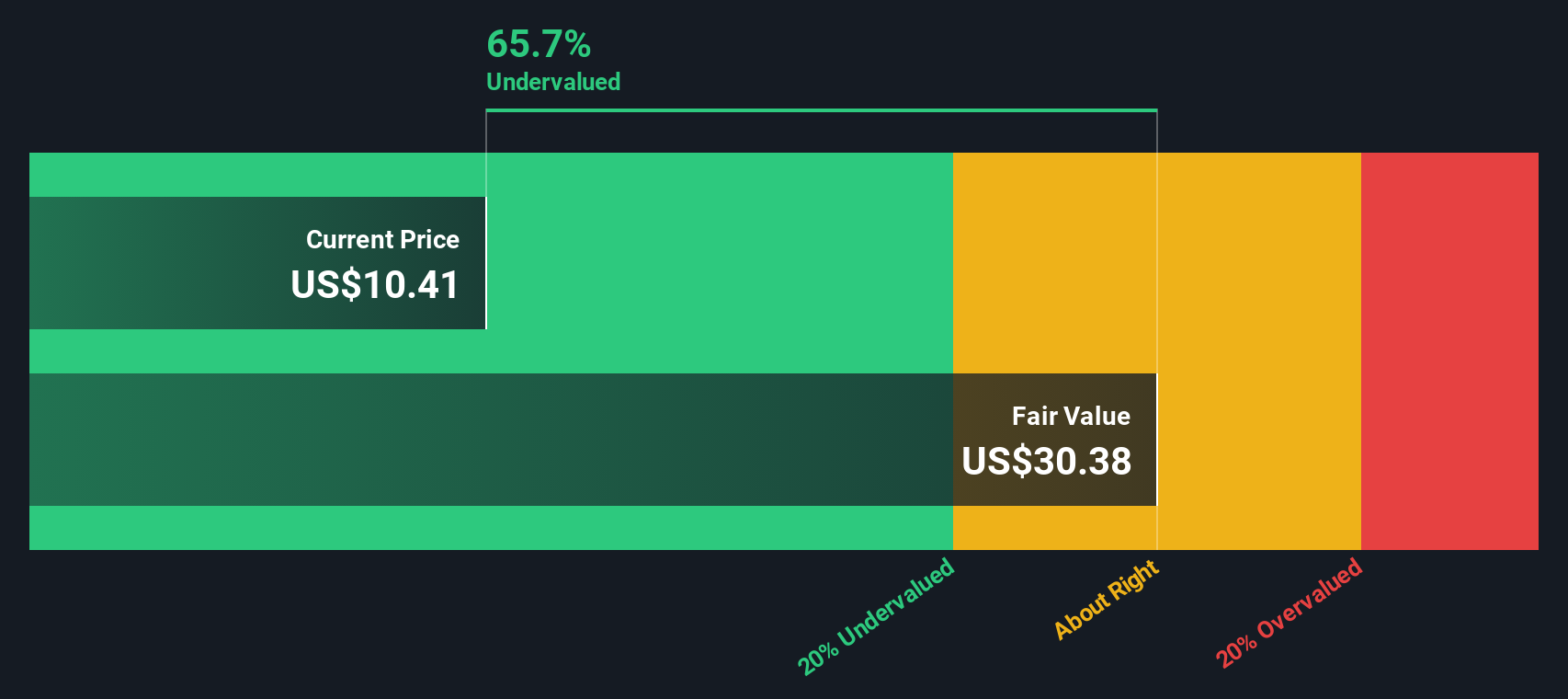

While multiples suggest Fortrea may be overvalued, the SWS DCF model tells a different story. According to our DCF analysis, Fortrea is trading at a steep 65.7% discount to its estimated fair value. Could this gap reflect hidden upside for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortrea Holdings Narrative

If you want to test your own assumptions or build a different case for Fortrea, you can easily craft your narrative from scratch in just a few minutes. Do it your way

A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are constantly on the lookout for tomorrow’s winning stocks. Don’t let opportunity pass you by. Use these expert-curated ideas to spot your next move:

- Track steady income potential by checking out these 16 dividend stocks with yields > 3% that currently offer attractive yields above 3% for portfolio stability.

- Pounce on fast-changing trends by reviewing these 25 AI penny stocks capitalizing on advances in artificial intelligence and data-driven innovation.

- Unlock hidden bargains and see which companies stand out as undervalued based on the latest cash flow models through these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives