The Five Prime Therapeutics (NASDAQ:FPRX) Share Price Is Down 84% So Some Shareholders Are Rather Upset

This month, we saw the Five Prime Therapeutics, Inc. (NASDAQ:FPRX) up an impressive 34%. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 84% in that time. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Five Prime Therapeutics

Given that Five Prime Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Five Prime Therapeutics's revenue dropped 26% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 46%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

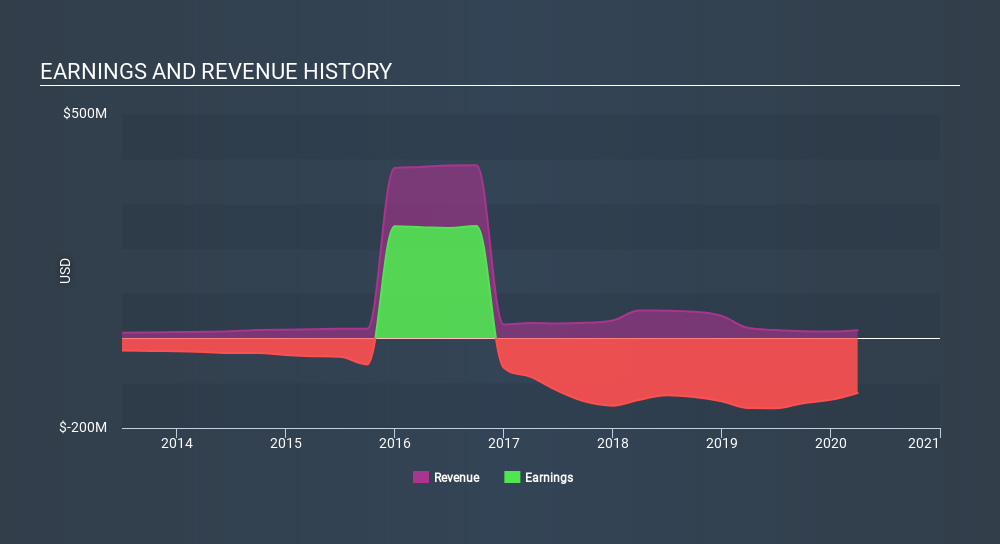

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Five Prime Therapeutics's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Five Prime Therapeutics had a tough year, with a total loss of 23%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 27% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Five Prime Therapeutics , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Market Insights

Community Narratives