- United States

- /

- Biotech

- /

- NasdaqGM:FOLD

Amicus Therapeutics Valuation in Focus After Strategic Partnership and Regulatory Updates

Reviewed by Bailey Pemberton

- Wondering if Amicus Therapeutics' stock is a bargain waiting to be discovered? You are not alone, as many investors are paying attention to its value signals right now.

- The stock has climbed 4.8% over the past week and jumped 12.6% in the last month, suggesting that growth potential or shifting risk perceptions may be influencing its performance.

- Part of the renewed interest follows strategic partnership news and regulatory updates, both of which have brought additional attention to the company. These developments are being closely watched because they could shape expectations around Amicus' pipeline and market position.

- By our checks, Amicus scores 5 out of 6 on our valuation score, which compares favorably with many peers. Next, we will compare the valuation approaches used by analysts, and later in the article, we will highlight an even more insightful way to assess value.

Find out why Amicus Therapeutics's 0.4% return over the last year is lagging behind its peers.

Approach 1: Amicus Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to the present day. This approach is designed to calculate what those future dollars are worth today, helping investors judge if the current share price is attractive compared to the company’s underlying value.

For Amicus Therapeutics, the latest reported Free Cash Flow is $6.16 Million. Analysts project strong growth in the company’s cash flows, with estimates reaching $563.66 Million by 2029. While analyst projections cover only the next five years, subsequent years are extrapolated using industry and company-specific growth assumptions.

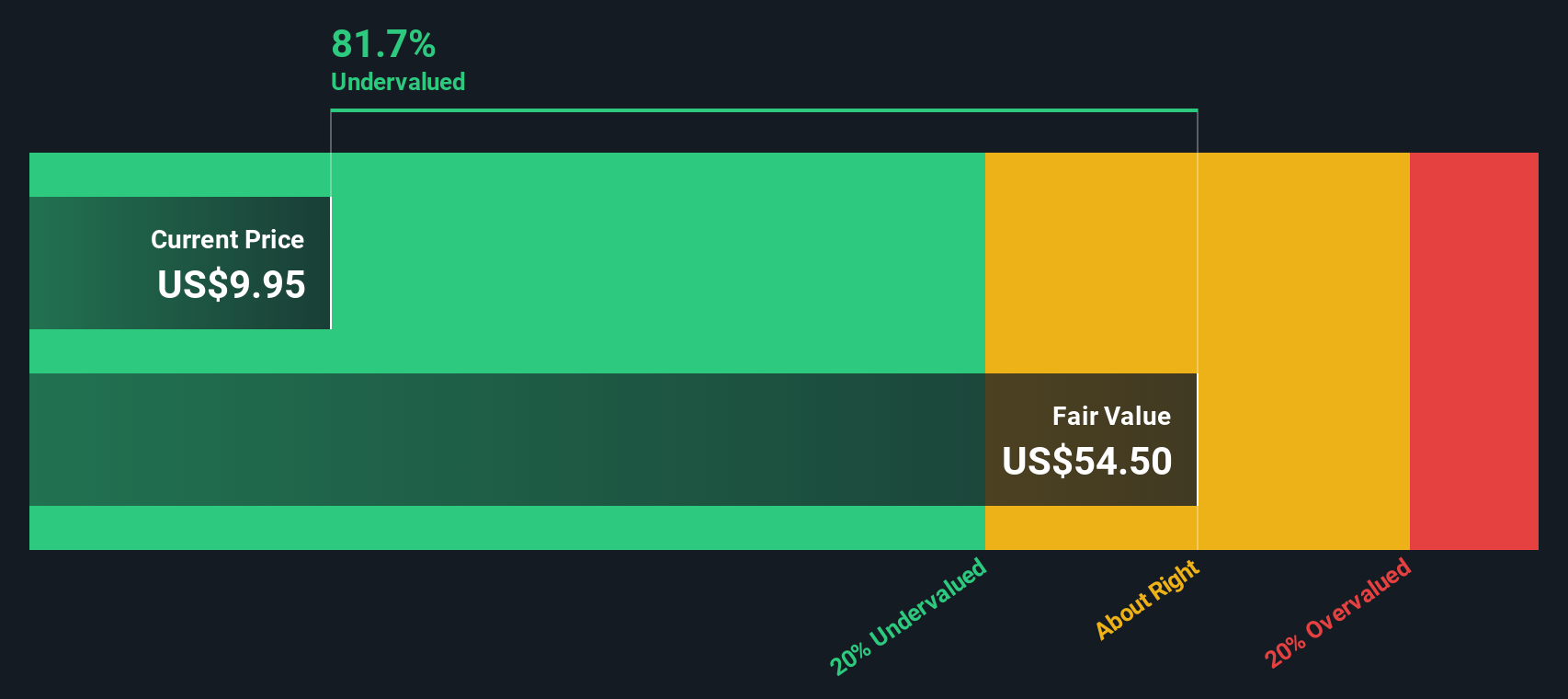

The DCF model values Amicus shares at an intrinsic value of $54.42, suggesting the stock is trading at an 81.6% discount compared to this estimate. This significant gap indicates that, based on cash flow potential, Amicus Therapeutics appears substantially undervalued at current market levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amicus Therapeutics is undervalued by 81.6%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Amicus Therapeutics Price vs Sales

The Price-to-Sales (P/S) ratio is often favored for valuing biotech companies like Amicus Therapeutics because such companies may not yet be consistently profitable, making earnings-based metrics less meaningful. The P/S ratio allows investors to assess how much the market is willing to pay for each dollar of sales, which can still be informative regardless of bottom-line profits.

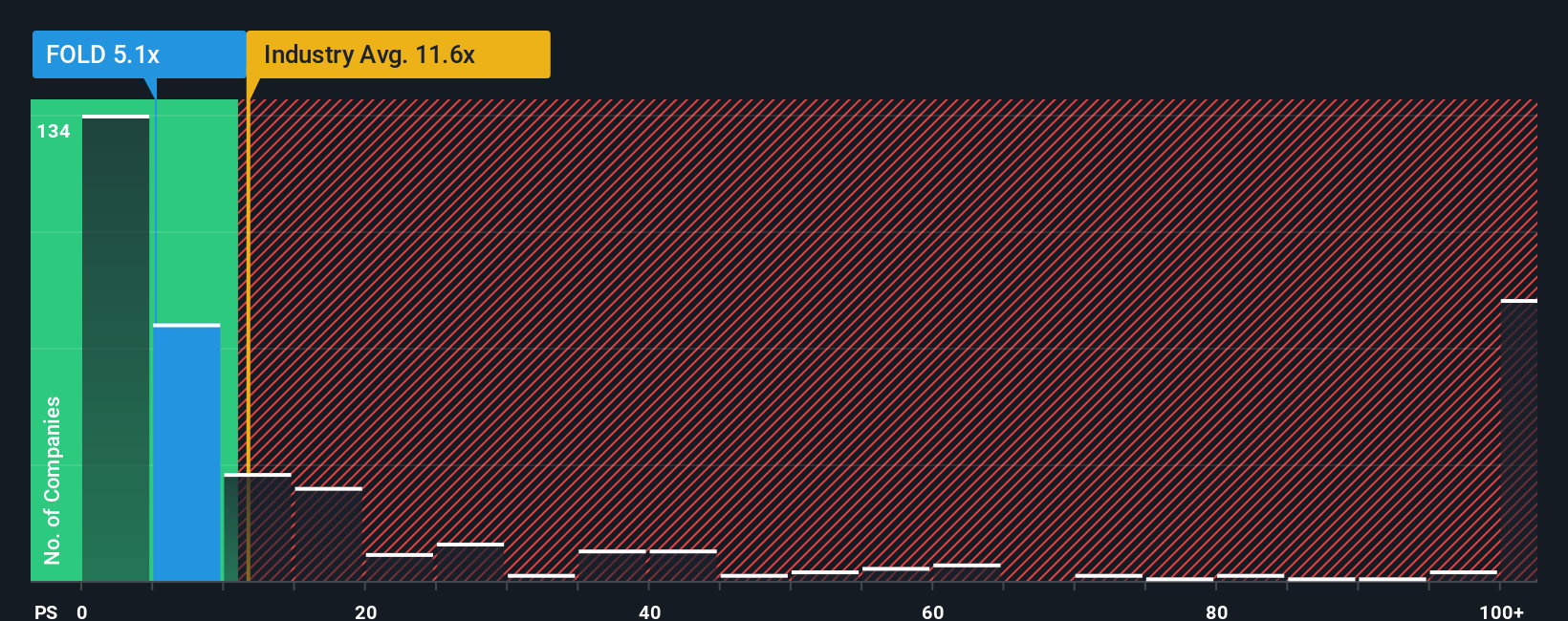

Typically, a higher P/S ratio is justified for companies with strong growth prospects and lower risk. Lower-growth or higher-risk firms will have lower ratios. For Amicus, the current P/S ratio is 5.16x, which sits below the biotechnology industry average of 13.11x and below the peer average of 8.10x. At first glance, this suggests the stock may be undervalued relative to other players in the sector.

Rather than rely solely on peer and industry comparisons, Simply Wall St’s proprietary “Fair Ratio” provides a tailored benchmark. This Fair Ratio reflects not just industry averages, but also factors in Amicus' earnings growth outlook, profit margins, risk profile, and market cap, making it a more holistic valuation measure. For Amicus, the Fair Ratio is 7.61x, which is above the company’s actual P/S ratio. This differential indicates the market is pricing its future sales potential conservatively.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amicus Therapeutics Narrative

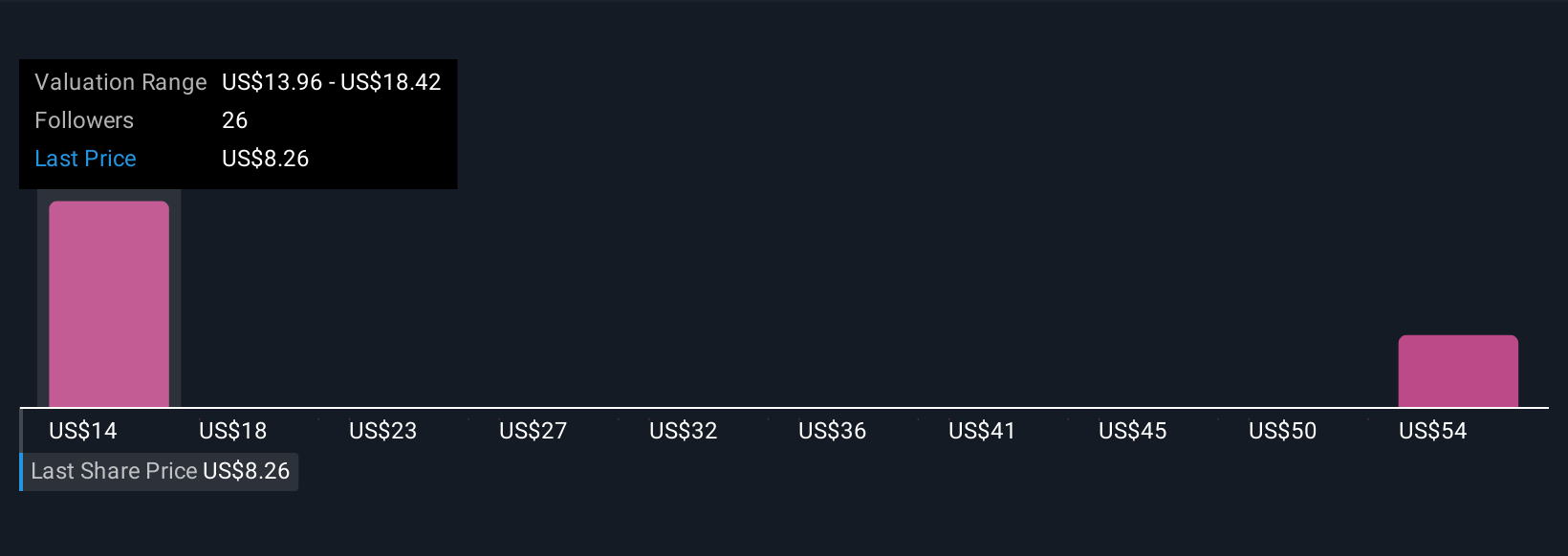

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, backed up by your assumptions for its future revenue, earnings, margins, and ultimately, its fair value estimate. Narratives connect what you believe about Amicus Therapeutics’ business prospects to the numbers, creating a transparent link between your outlook, the company's future performance, and what the stock is really worth.

Available on Simply Wall St’s Community page, Narratives are easy to use and are popular among millions of investors who want a more dynamic, up-to-date tool for decision making. By comparing your calculated Fair Value against today's price, Narratives help you decide whether to buy or sell. Since Narratives update automatically with new news, earnings, or regulatory changes, you always have a fresh, actionable view.

For example, some investors are bullish on Amicus Therapeutics, modeling aggressive revenue growth and expecting fair values near $22 per share, while others are more cautious due to legal and market risks, with estimates as low as $9 per share. This shows how your own Narrative can guide smarter, more personalized investing decisions.

Do you think there's more to the story for Amicus Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FOLD

Amicus Therapeutics

A biotechnology company, focuses on discovering, developing, and delivering novel medicines for rare diseases in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.