- United States

- /

- Biotech

- /

- NasdaqGM:FOLD

Amicus Therapeutics (NASDAQ:FOLD) shareholders have endured a 26% loss from investing in the stock a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Amicus Therapeutics, Inc. (NASDAQ:FOLD) share price slid 26% over twelve months. That contrasts poorly with the market return of 27%. On the bright side, the stock is actually up 2.1% in the last three years. Furthermore, it's down 16% in about a quarter. That's not much fun for holders.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Amicus Therapeutics

Amicus Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Amicus Therapeutics grew its revenue by 33% over the last year. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 26%. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

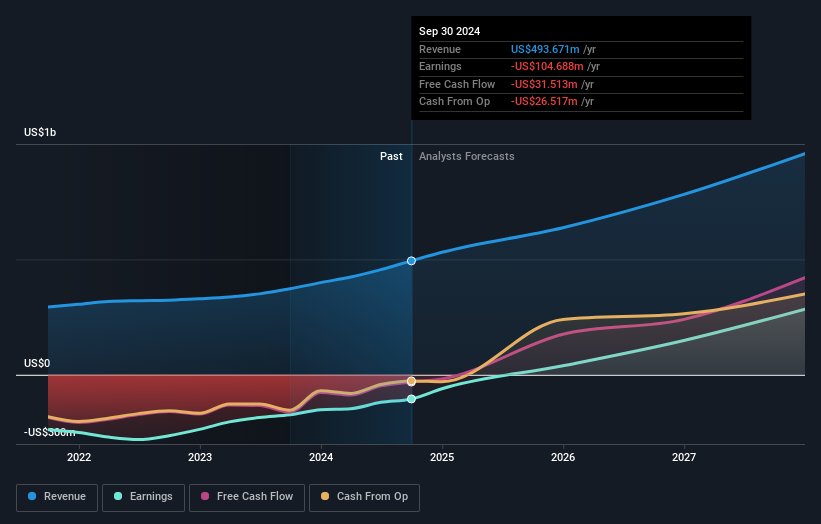

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Amicus Therapeutics is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Amicus Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

Amicus Therapeutics shareholders are down 26% for the year, but the market itself is up 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Amicus Therapeutics better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FOLD

Amicus Therapeutics

A biotechnology company, focuses on discovering, developing, and delivering novel medicines for rare diseases in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives