- United States

- /

- Life Sciences

- /

- NasdaqGS:LAB

Did Changing Sentiment Drive Fluidigm's Share Price Down A Painful 77%?

It is doubtless a positive to see that the Fluidigm Corporation (NASDAQ:FLDM) share price has gained some 35% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 77% lower after that period. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

Check out our latest analysis for Fluidigm

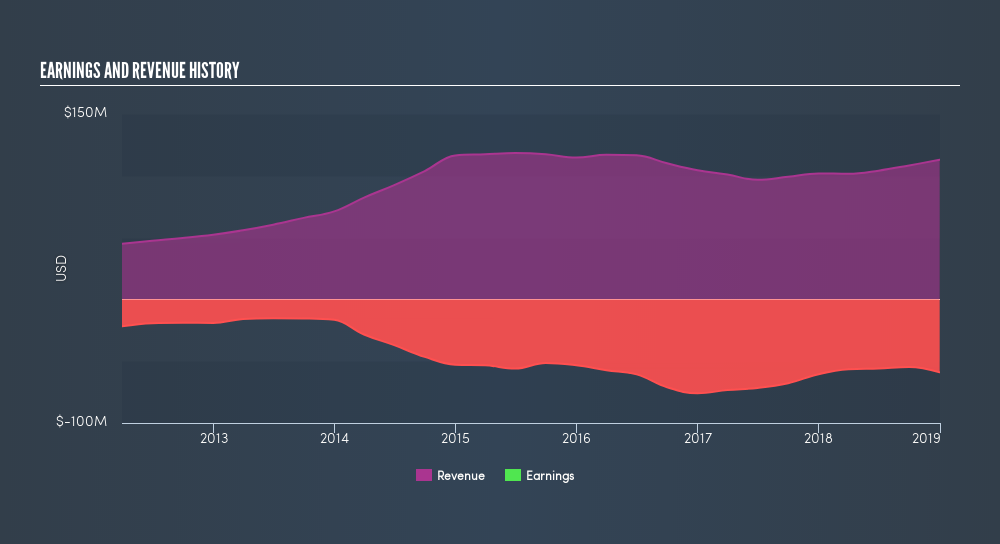

Fluidigm isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Fluidigm grew its revenue at 1.9% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 25%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Fluidigm shareholders have received a total shareholder return of 76% over one year. Notably the five-year annualised TSR loss of 25% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:LAB

Standard BioTools

Develops, manufactures, and sells a range of instrumentation, consumables, and services to scientists and biomedical researchers to develop therapeutics in the Americas, Europe, the Middle East, Africa, and the Asia pacific.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives