- United States

- /

- Biotech

- /

- NasdaqCM:FENC

Lacklustre Performance Is Driving Fennec Pharmaceuticals Inc.'s (NASDAQ:FENC) 27% Price Drop

The Fennec Pharmaceuticals Inc. (NASDAQ:FENC) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

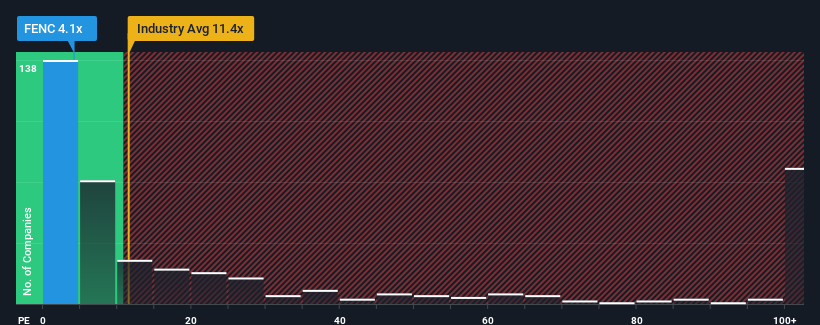

Although its price has dipped substantially, Fennec Pharmaceuticals' price-to-sales (or "P/S") ratio of 4.1x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.4x and even P/S above 67x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Fennec Pharmaceuticals

What Does Fennec Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Fennec Pharmaceuticals has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Fennec Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is Fennec Pharmaceuticals' Revenue Growth Trending?

Fennec Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 31% per year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 208% per annum growth forecast for the broader industry.

In light of this, it's understandable that Fennec Pharmaceuticals' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Fennec Pharmaceuticals' P/S

Shares in Fennec Pharmaceuticals have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Fennec Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Fennec Pharmaceuticals you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FENC

Fennec Pharmaceuticals

Operates as a commercial stage biopharmaceutical company in the United States.

Undervalued with high growth potential.

Market Insights

Community Narratives