- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

Optimistic Investors Push EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) Shares Up 84% But Growth Is Lacking

Those holding EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) shares would be relieved that the share price has rebounded 84% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 65% share price drop in the last twelve months.

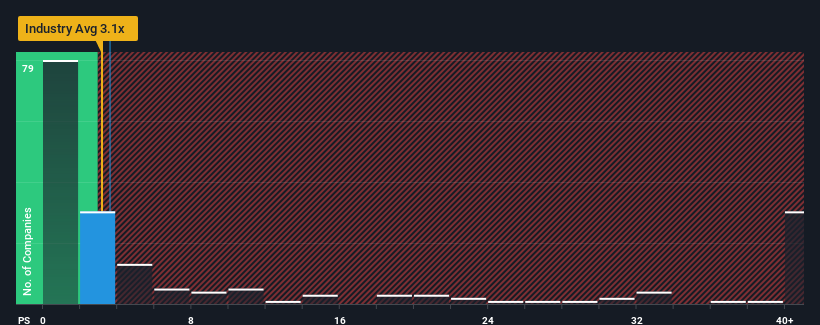

Although its price has surged higher, you could still be forgiven for feeling indifferent about EyePoint Pharmaceuticals' P/S ratio of 3.6x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in the United States is also close to 3.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for EyePoint Pharmaceuticals

What Does EyePoint Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for EyePoint Pharmaceuticals as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EyePoint Pharmaceuticals.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, EyePoint Pharmaceuticals would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 103% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 0.7% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 31% per annum, which paints a poor picture.

In light of this, it's somewhat alarming that EyePoint Pharmaceuticals' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

EyePoint Pharmaceuticals' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that EyePoint Pharmaceuticals currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It is also worth noting that we have found 2 warning signs for EyePoint Pharmaceuticals that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives