- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

EyePoint Pharmaceuticals (EYPT): A Fresh Valuation Look Following Key DURAVYU Phase 3 Safety Review Completion

Reviewed by Simply Wall St

The independent Data Safety Monitoring Committee has completed its second scheduled review of EyePoint Pharmaceuticals (EYPT)'s pivotal Phase 3 study of DURAVYU for wet age-related macular degeneration. This marks a meaningful step forward in the clinical program and reinforces ongoing safety monitoring and development.

See our latest analysis for EyePoint Pharmaceuticals.

EyePoint Pharmaceuticals has seen substantial momentum build throughout 2024, with a 22% share price return in the past month alone and an impressive 84% year-to-date gain. This positive trend follows progress in the pivotal DURAVYU trial and strengthens a multi-year run, as the stock’s three-year total shareholder return now tops 360%. This reflects both investor confidence in its pipeline and shifting expectations for breakthrough retinal therapies.

If novel treatment milestones like this inspire you, it’s a smart time to explore other innovators—discover See the full list for free.

Yet with the stock already surging more than 80% year-to-date and trading well above analyst price targets, investors must ask: is there more upside left for EyePoint Pharmaceuticals, or is all future growth already reflected?

Most Popular Narrative: 57% Undervalued

With EyePoint Pharmaceuticals closing at $14.79 and the most followed narrative estimating fair value at $34.42, expectations diverge strongly from the current price. This hints at a potential re-rating if forecasts are realized.

Expansion into diabetic macular edema (DME), underpinned by positive Phase II results and a growing diabetic population worldwide, introduces significant pipeline diversification and potential for long-term revenue streams. Investment in state-of-the-art, scalable cGMP manufacturing capacity and disciplined cash management (cash runway into 2027) reduces operational risk, lowering the likelihood of further dilution and preserving future earnings and net margins as commercial sales ramp up.

Want to know what’s fueling the hype behind this bold price target? The secret sauce involves blockbuster revenue growth assumptions and significant margin shifts. Click to unpack the assumptions and find out what’s driving that high fair value projection.

Result: Fair Value of $34.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in regulatory approval or heavier than expected competition could quickly dampen future revenue growth and challenge today's bullish projections.

Find out about the key risks to this EyePoint Pharmaceuticals narrative.

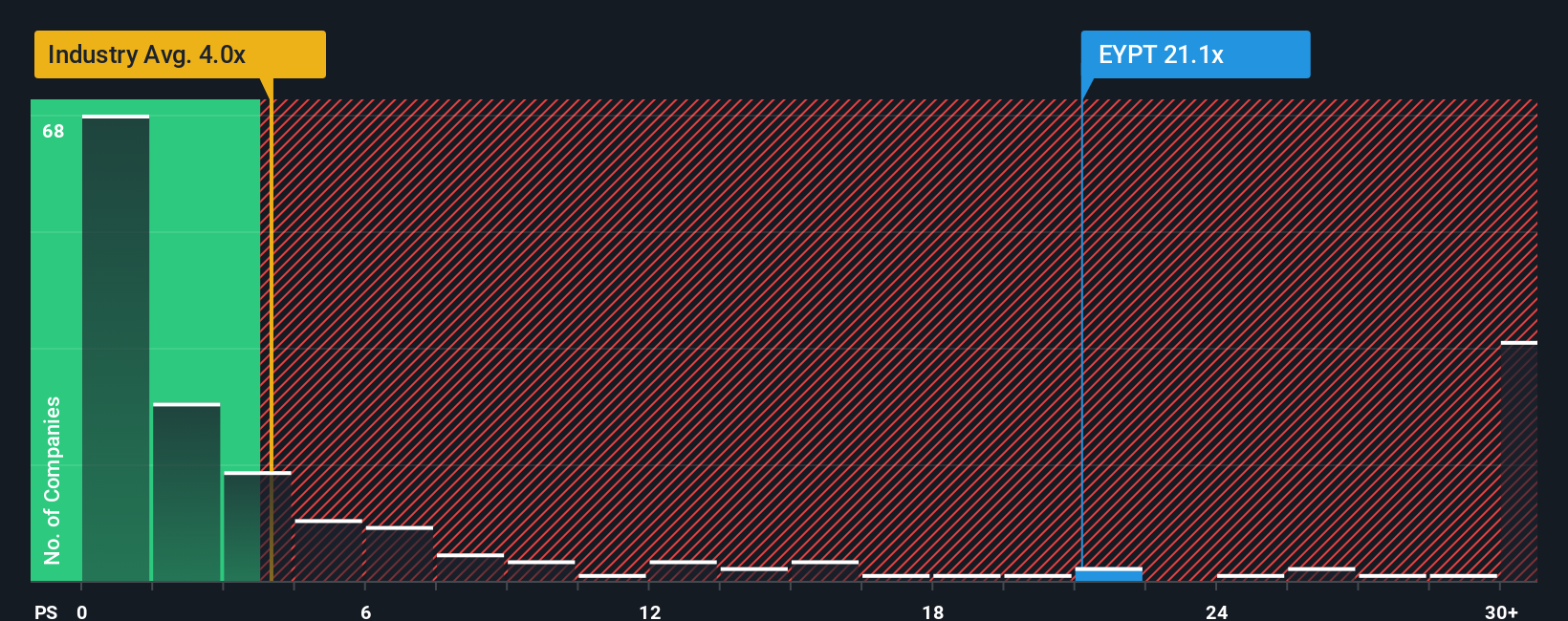

Another View: Market Multiples Tell a Different Story

Looking at the price-to-sales ratio, EyePoint Pharmaceuticals trades at 28.9 times sales, much higher than the US Pharmaceuticals industry average of 4.2x and the peer average of 14.9x. Compared to the estimated fair ratio, this suggests the market may be factoring in more optimism and more risk than most competitors. Should investors worry about this premium, or is it a sign of confidence in breakthrough potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EyePoint Pharmaceuticals Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to shape your own perspective. Do it your way

A great starting point for your EyePoint Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting on the sidelines and uncover new opportunities to build your portfolio with stocks that stand out for their innovation, resilience, or income potential. Make the most of your next move and get ahead of market trends before others catch on.

- Capture growth in the booming AI sector by reviewing these 25 AI penny stocks poised for breakthrough performance.

- Secure steady yields and potential compounding returns by exploring these 15 dividend stocks with yields > 3% with payouts above market averages.

- Unlock value opportunities with these 932 undervalued stocks based on cash flows trading below intrinsic worth but showing strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

Engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.