- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Exelixis (EXEL): Is There More Value Left After Recent Growth?

Reviewed by Simply Wall St

Shares of Exelixis (EXEL) have caught investor attention recently, especially as pharmaceutical and biotech names move amid shifting sentiment. With Exelixis showing steady revenue growth and a positive track record over the past year, many are watching for its next catalyst.

See our latest analysis for Exelixis.

Exelixis shares have pulled back in the past month, with a 1-month share price return of -5.46 percent. The stock is still up 11.67 percent year-to-date and has delivered a robust 9 percent total shareholder return over the last year. Momentum remains solid in the bigger picture, highlighted by a 129 percent total return over three years, as investors factor in consistent growth and potential catalysts ahead.

If you’re searching for more opportunities in the healthcare and biotech arena, check out See the full list for free..

The question now is whether Exelixis shares are trading below their true worth, or if recent gains already account for all the company’s growth prospects. Is there real value left for buyers, or has the market priced it all in?

Most Popular Narrative: 14% Undervalued

With Exelixis shares last closing at $37.90 and the narrative’s fair value sitting at $44.06, investors face a valuation gap that is fueling plenty of debate. Here is the key driver behind that gap, straight from the most widely tracked analyst narrative.

The recent introduction and rapid uptake of CABOMETYX in neuroendocrine tumors, combined with its continued strength and market leadership in renal cell carcinoma, signals an expanding patient base in tumor types with high unmet need. This is poised to drive strong durable revenue growth as aging populations and rising cancer incidence increase long-term demand for oncology therapeutics.

Want the inside scoop on what underpins this bullish view? The narrative is built on ambitious growth expectations, aggressive margin expansion, and a sharp reset in future profit multiples. See the full picture to uncover the specific scenario analysts are betting on.

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent overreliance on Cabometyx, coupled with mounting competition in key cancer markets, could quickly shift the outlook for Exelixis and its future growth.

Find out about the key risks to this Exelixis narrative.

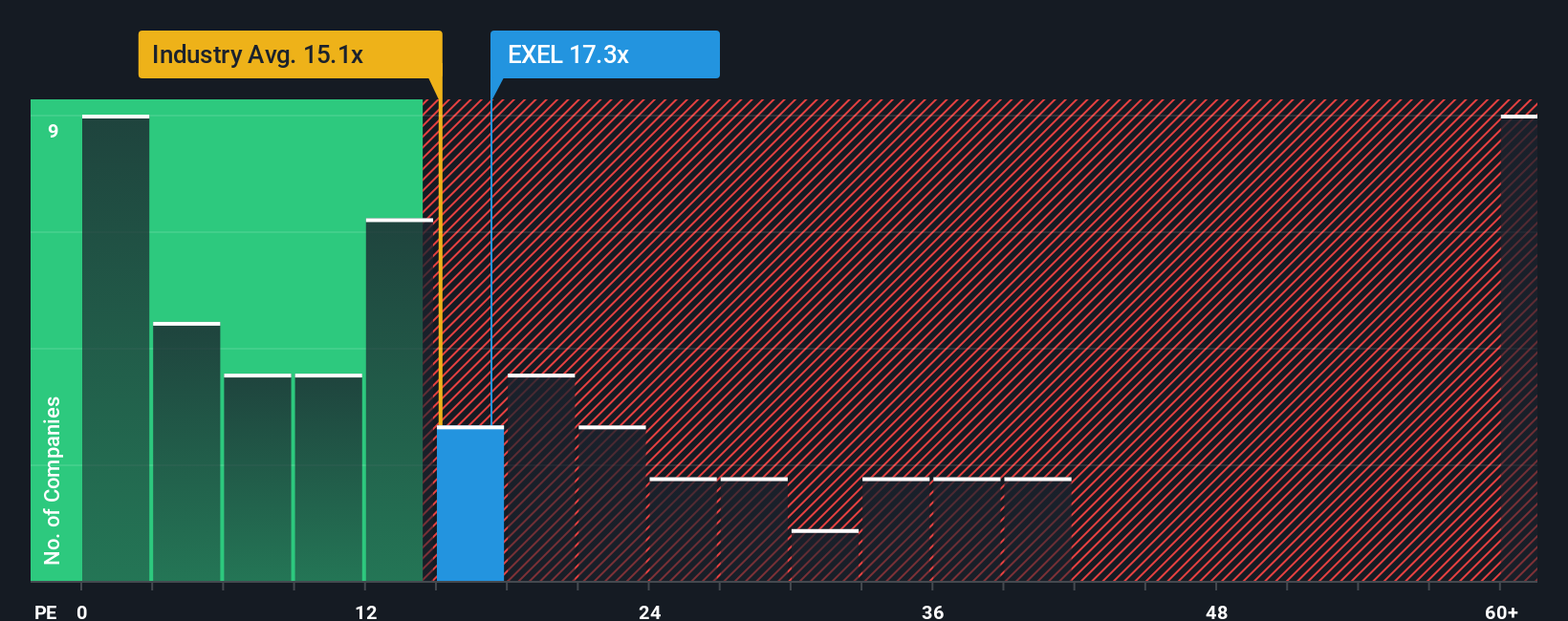

Another View: Comparing to Market Multiples

While the narrative points to solid growth, our current market-based valuation tells a different story. Exelixis trades at a price-to-earnings ratio of 16.9x, which matches exactly with the US Biotechs industry’s average, but stands well below its peer set average at 20.8x and the fair ratio of 25x. This suggests there may still be some room for optimism. Yet, with market multiples this close to average, can investors really count on a clear-cut bargain, or does it hint that expectations are already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exelixis Narrative

If you’re seeing the story differently or prefer to dig into the numbers on your own terms, crafting a personalized Exelixis narrative takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exelixis.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one stock. With powerful screening tools, you can uncover promising companies that others may be overlooking and get ahead of the next market move.

- Uncover opportunities for steady passive income by starting with these 20 dividend stocks with yields > 3%, offering high yields and solid financial foundations.

- Tap into tomorrow’s breakthroughs by scanning these 26 AI penny stocks, harnessing artificial intelligence to disrupt traditional industries and deliver exponential growth.

- Capitalize on inefficiencies in the market with these 840 undervalued stocks based on cash flows, which present potential bargains based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.