- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Exelixis (EXEL): Evaluating Valuation After Recent Strong Share Price Gains

Reviewed by Kshitija Bhandaru

Exelixis (EXEL) stock has seen some attention from investors recently, gaining more than 11% over the past month and up 22% year to date. The company’s performance has sparked some discussion around its valuation and recent growth metrics.

See our latest analysis for Exelixis.

Momentum around Exelixis has picked up as investors react to its steady growth. The stock’s year-to-date share price return of 22% is complemented by an impressive 1-year total shareholder return of nearly 58%. This recent upswing suggests improving sentiment and indicates that the market is warming to the company’s long-term prospects as fundamentals strengthen.

If Exelixis’s move has you watching for other fast movers, now is a great time to broaden your search with fast growing stocks with high insider ownership.

But with shares rising so quickly, investors now face a pivotal question: Is Exelixis still trading at a bargain, or has the market already baked in expectations for continued robust growth?

Most Popular Narrative: 6.1% Undervalued

Exelixis closed at $41.35, while the consensus fair value sits higher at $44.06. This difference is driving discussion about what’s fueling the upside potential in analysts’ models.

The recent introduction and rapid uptake of CABOMETYX in neuroendocrine tumors, combined with its continued strength and market leadership in renal cell carcinoma, signals an expanding patient base in tumor types with high unmet need. This is poised to drive strong durable revenue growth as aging populations and rising cancer incidence increase long-term demand for oncology therapeutics.

Want to know the quantitative engine behind the narrative’s premium? Bold assumptions about growth, profit margins, and share reduction are at play. See which forecasts push Exelixis into rarefied territory, then decide if you buy the thesis.

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Exelixis’s heavy reliance on one key drug and mounting competition, which could threaten forecasts if challenges materialize.

Find out about the key risks to this Exelixis narrative.

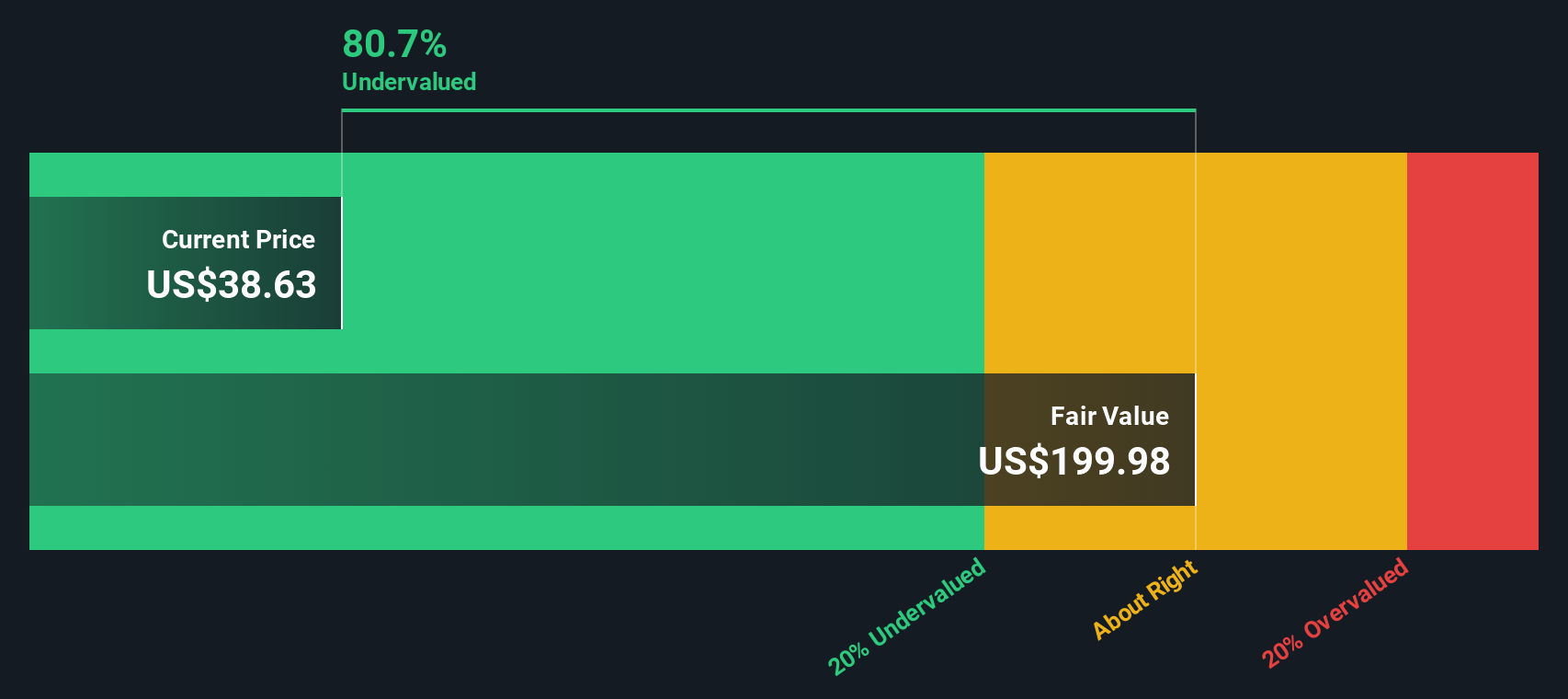

Another View: SWS DCF Model Offers a Different Take

While multiples suggest Exelixis is valued closely to its peers, our DCF model presents a very different picture. The SWS DCF analysis estimates Exelixis's fair value at $199.96, which is far above its current trading price. This sharp gap introduces the possibility that the market is missing something significant. Which approach do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Exelixis Narrative

If you see things differently or want to dig into the numbers yourself, there's nothing stopping you from building a custom narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exelixis.

Looking for more investment ideas?

If you’re serious about seizing your next opportunity, don’t wait. Some of the most promising stocks are flying under the radar and are just waiting to be uncovered.

- Uncover rare growth potential by targeting these 3563 penny stocks with strong financials that show strong fundamentals and resilience where it matters most.

- Unlock consistent income streams by checking out these 19 dividend stocks with yields > 3% that currently yield over 3% and reward shareholders handsomely.

- Position yourself at the forefront of innovation by following these 24 AI penny stocks that are making significant progress in artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives