- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Is There Now an Opportunity in Exact Sciences After Its 18% Price Surge?

Reviewed by Bailey Pemberton

Thinking of what to do with Exact Sciences stock? You are not alone. Many investors are weighing their options after some notable swings in both the price and the risk perceptions around this innovative diagnostics company. Over the past month, shares have climbed an impressive 18.2%, setting a fresh tone of optimism that follows a more sluggish 1-year return of -9.1%. Looking further back, the company has delivered an 81.9% return over three years, underscoring that there is potential for volatility, but also for significant gains. Yet, if we zoom all the way out to a five-year perspective, the story is more sobering, with shares down nearly 50% from their longer-term peak.

Some of this recent momentum appears linked to increased investor confidence following the company’s advancements in non-invasive cancer screening and regulatory developments that have broadened its addressable market. There has also been buzz about partnerships that could unlock even more value from Exact’s technology. These signals suggest that the market may be rethinking how it values the business’s pipeline and commercial reach. With a valuation score of 5 out of 6 (where a higher score means more checks for undervaluation), the numbers suggest Exact Sciences is offering considerable value by several traditional benchmarks. But are these methods telling the whole story? Next, we will walk through the main approaches to assessing the company’s valuation and at the end, reveal a perspective that could give you the clearest insight yet.

Why Exact Sciences is lagging behind its peers

Approach 1: Exact Sciences Discounted Cash Flow (DCF) Analysis

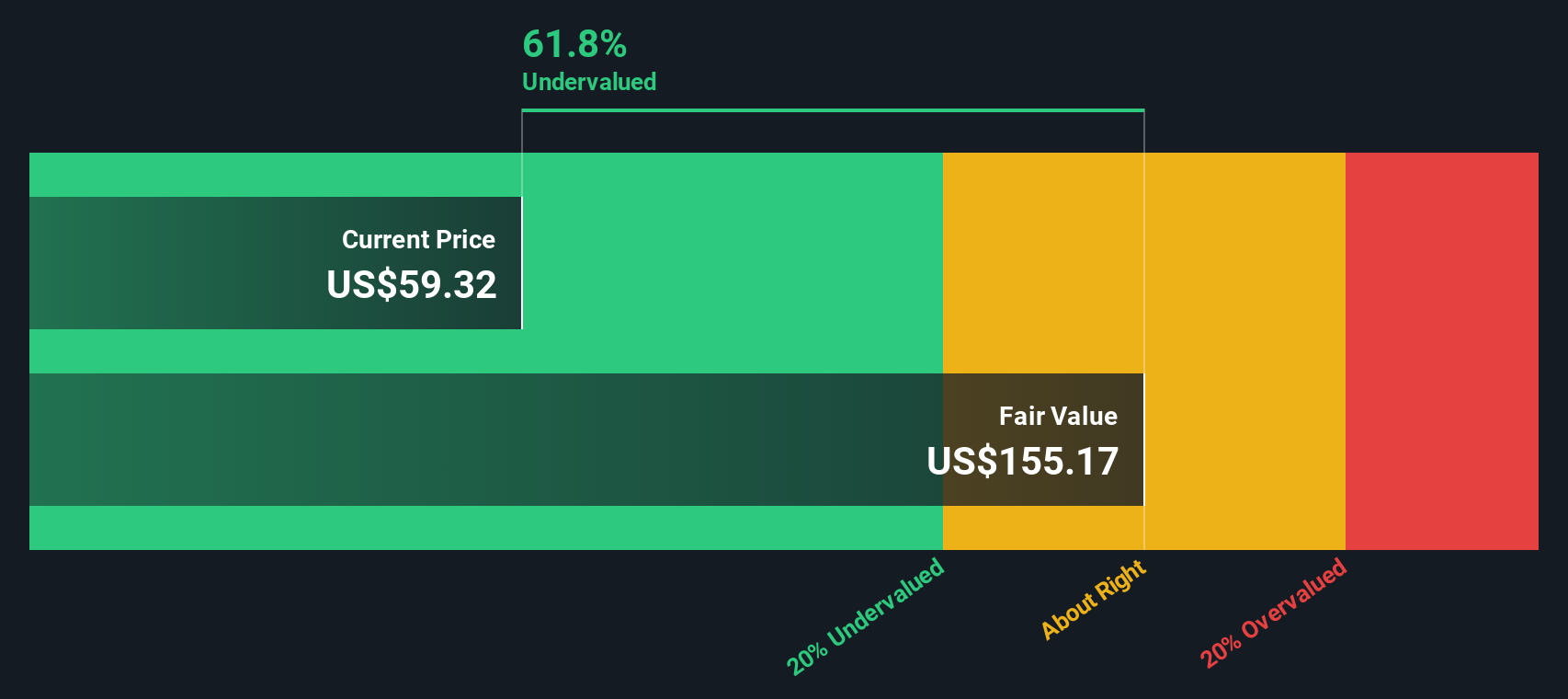

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s dollars. This approach helps determine whether a stock is currently trading higher or lower than its intrinsic value based on those projections, rather than recent market sentiment.

For Exact Sciences, the model starts with its latest Free Cash Flow (FCF) of $136.7 million. From there, analysts estimate continued strong growth, with projections reaching roughly $1.78 billion in annual Free Cash Flow a decade from now. While analysts only extend their estimates for five years, Simply Wall St extrapolates trends for the rest of the decade to build a fuller picture.

With all future cash flows discounted using a two-stage Free Cash Flow to Equity model, the estimated fair value for Exact Sciences comes out to $153.07 per share. This suggests the stock is trading at a 58.6% discount to its intrinsic value, meaning it appears significantly undervalued by this yardstick.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exact Sciences is undervalued by 58.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

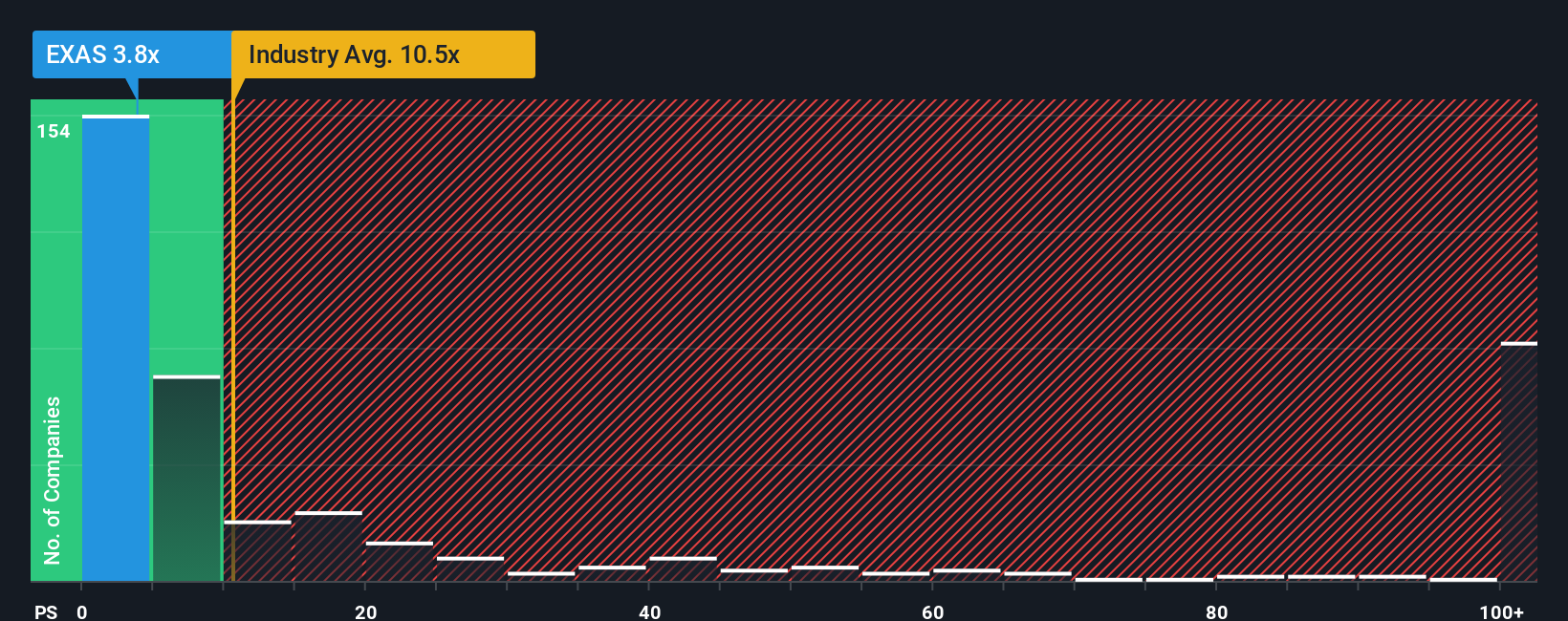

Approach 2: Exact Sciences Price vs Sales

For growth-stage companies like Exact Sciences, the Price-to-Sales (P/S) ratio is often the go-to valuation metric, especially when consistent profitability is still on the horizon. The P/S multiple is particularly relevant when evaluating biotech firms because it focuses on revenue generation instead of earnings, which can be negative during intensive investment cycles.

Determining what constitutes a “fair” P/S ratio is not just about the company’s own numbers. Growth expectations and risk play a big role. Investors typically award higher multiples to businesses with faster growth or unique advantages, and lower ones to those facing more risk or uncertain outlooks.

Currently, Exact Sciences trades at a P/S ratio of 4.08x. This is well below both the biotech industry average of 11.35x and the peer average of 6.60x, suggesting a considerable discount. However, rather than relying solely on these broad benchmarks, Simply Wall St’s proprietary “Fair Ratio” (6.12x for Exact Sciences) sets a more precise expectation. This Fair Ratio is tailored to the company’s unique growth profile, industry trends, profit margins, market cap, and risk factors, giving it a sharper edge over generic averages.

Comparing the actual P/S ratio (4.08x) to the Fair Ratio (6.12x) suggests Exact Sciences may be undervalued by the market at current prices.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exact Sciences Narrative

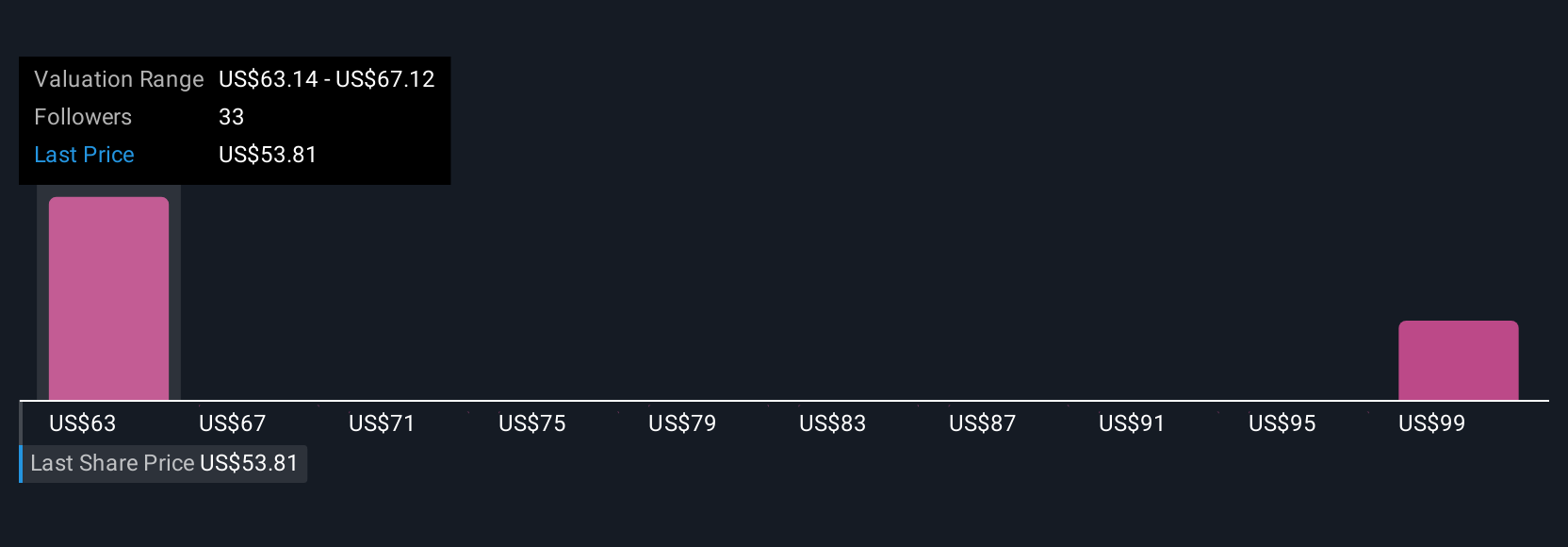

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, actionable story that connects your view of a company’s future, including what you believe about revenue growth, profits, and risks, to an explicit financial forecast and a fair value estimate for the stock.

Narratives go beyond static numbers by letting you define what matters most and why, then instantly translating your perspective into a clear, up-to-date valuation. On Simply Wall St’s Community page, millions of investors access and share Narratives, making them a practical and accessible decision tool for both new and experienced users.

By comparing a Narrative’s Fair Value estimate to the current share price, you can easily spot whether the stock appears under- or over-valued by your chosen view and decide whether it is time to buy, hold, or sell. Narratives are dynamically updated whenever relevant news, results, or analyst changes are released, ensuring your investment thesis stays current and actionable.

For example, around Exact Sciences, some investors’ Narratives are built on strong revenue growth and new product launches, leading to targets above $80 per share. Others are more cautious, citing execution risks and market competition, resulting in fair values closer to $50 per share. Narratives capture that diversity and help you decide where you stand in seconds.

Do you think there's more to the story for Exact Sciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives