- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Is Exact Sciences Still an Opportunity After Recent Coverage Expansion and a 34.8% Rally?

Reviewed by Bailey Pemberton

- Ever wondered if Exact Sciences is actually a bargain, or if the recent hype means you could be buying at the peak? Let’s unravel what today’s price really means for investors looking for value.

- The stock has caught some attention lately, climbing 15.2% in the past month and 20.1% year-to-date, with an impressive 34.8% gain over the last year. However, it is still down 39.2% from five years ago.

- Industry buzz has recently ramped up after Exact Sciences made headlines with strategic collaborations and expanded coverage for its flagship cancer screening products. This news has helped drive optimism around future growth and has contributed to shifting market sentiment.

- With all this in mind, it’s worth noting that Exact Sciences scores a 6 out of 6 on our valuation checks, ticking every box for being undervalued. Let’s take a closer look at these valuation approaches, and keep reading for an even more insightful way to gauge value.

Approach 1: Exact Sciences Discounted Cash Flow (DCF) Analysis

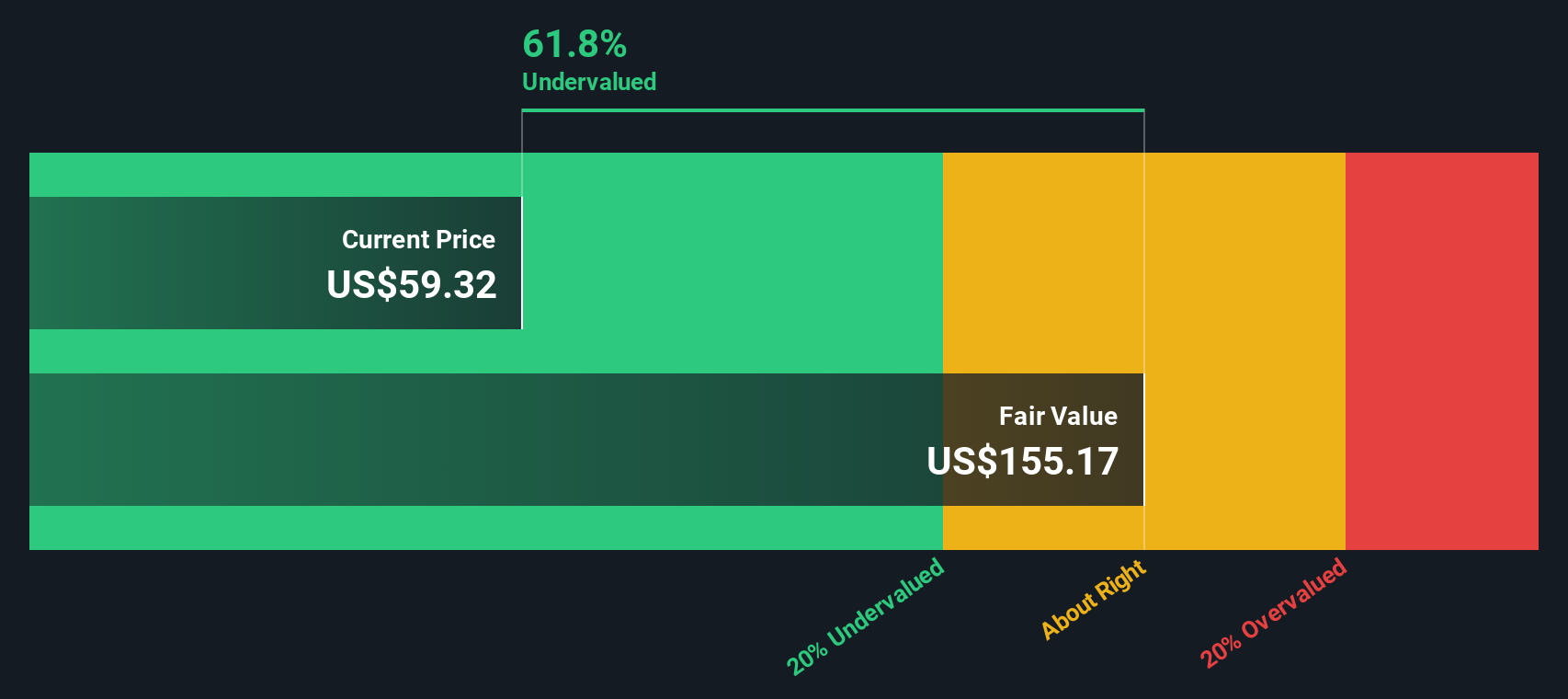

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them to reflect their value in today’s dollars. This approach is especially useful for growth companies like Exact Sciences, where future cash generation is a critical driver of intrinsic value.

For Exact Sciences, the most recent reported Free Cash Flow is $222 million. Projections anticipate solid growth, with free cash flow estimated to reach $1.3 billion by 2035 according to Simply Wall St’s extended estimates. While analysts typically provide five-year forecasts, years beyond this are extrapolated for a complete picture of long-term potential.

All cash flows are considered in US dollars. By discounting these projected cash flows back to the present, the model calculates a fair value of $116.56 per share. This suggests Exact Sciences is currently trading at a 41.3% discount to its intrinsic value, indicating a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exact Sciences is undervalued by 41.3%. Track this in your watchlist or portfolio, or discover 881 more undervalued stocks based on cash flows.

Approach 2: Exact Sciences Price vs Sales

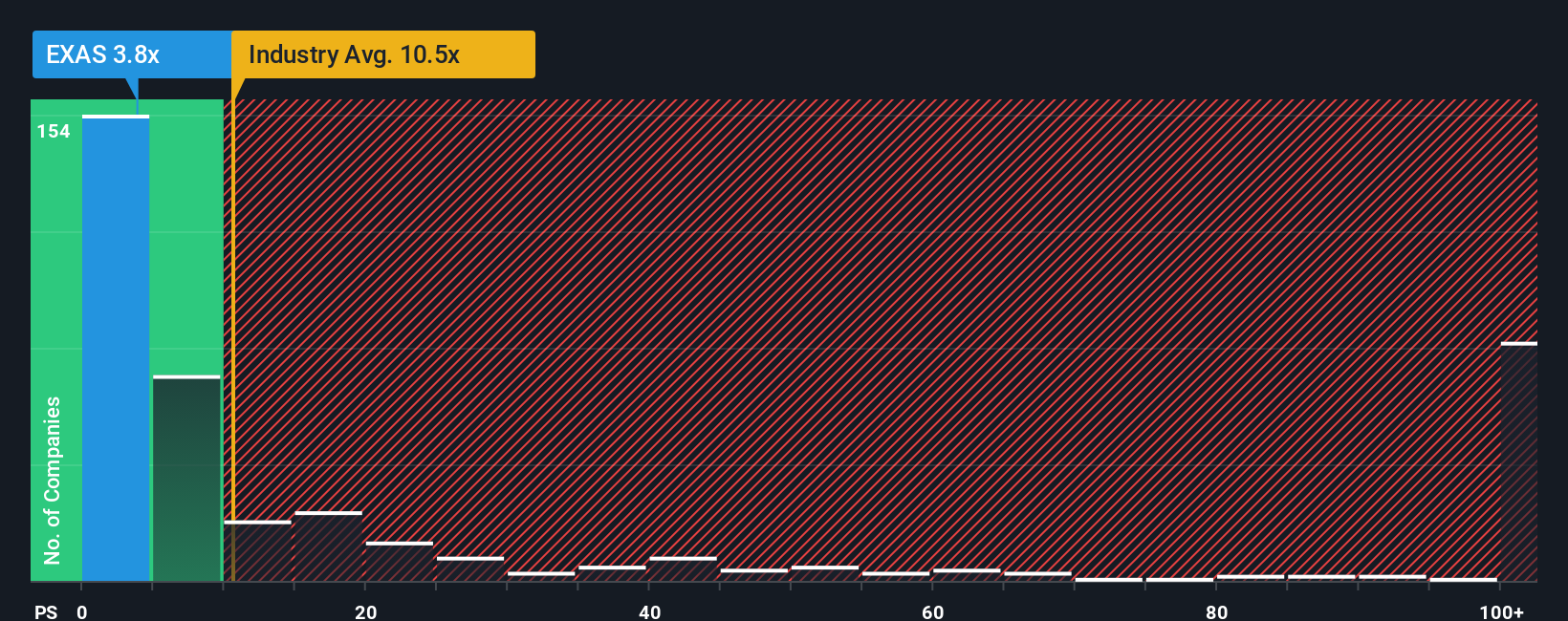

The Price-to-Sales (P/S) ratio is a widely used valuation tool for companies that are not yet consistently profitable, like Exact Sciences. This metric helps investors gauge how much they are paying for each dollar of the company's revenue, making it especially suitable for growth-focused businesses in the biotech sector where future profitability is the main attraction.

Growth expectations and risk profile play key roles in determining what a “normal” or fair P/S ratio should be. Companies expected to post higher revenues in the future, or those with lower risk, can justify higher P/S multiples compared to riskier or slower-growing peers.

Exact Sciences currently trades at a P/S ratio of 4.20x, which is well below the biotech industry average of 11.15x and lower than its peer group average of 6.55x. In addition to these benchmarks, Simply Wall St calculates a proprietary “Fair Ratio” for the stock, a comprehensive multiple (here: 6.45x) that factors in Exact Sciences' revenue growth, margins, unique industry traits, and overall risk, instead of relying solely on broad industry or peer comparisons.

The Fair Ratio method is more insightful because it blends industry-specific characteristics with company-level fundamentals, offering a nuanced view that is better suited for forward-looking, growth-driven stocks.

With Exact Sciences’ actual P/S multiple at 4.20x, well below its Fair Ratio of 6.45x, the stock appears clearly undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exact Sciences Narrative

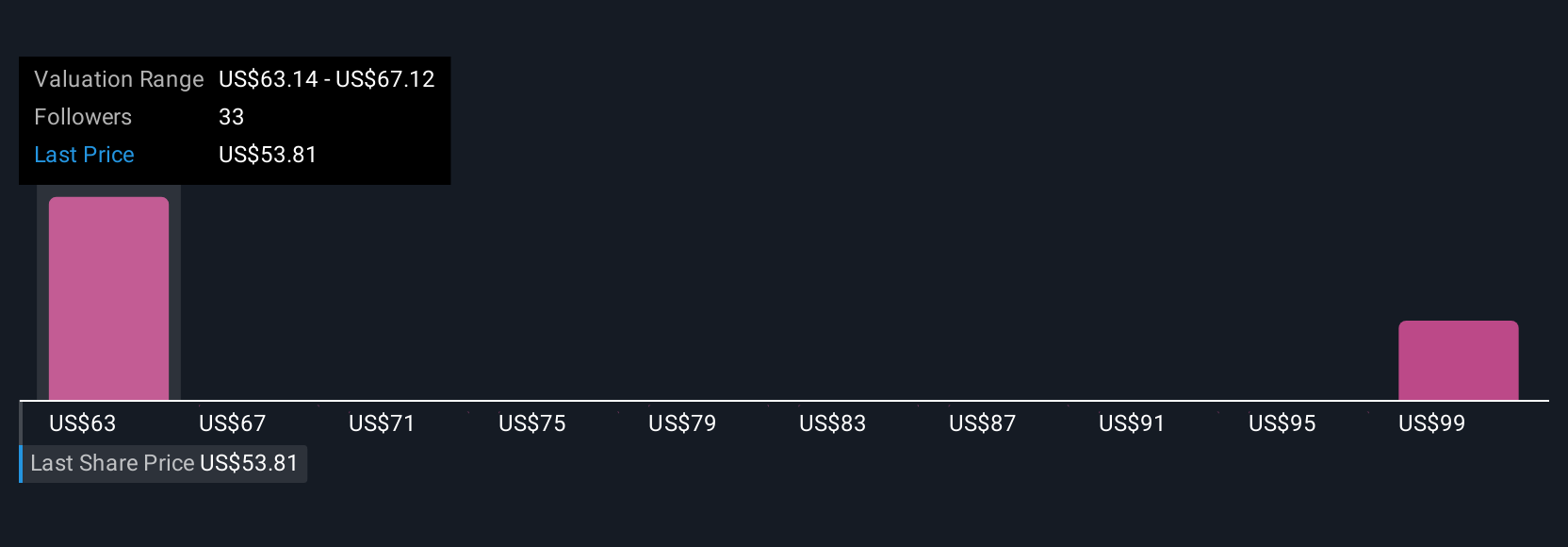

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story for how you think Exact Sciences will perform, connecting your expectations for key numbers like revenue, profit margins, and future fair value to the company’s bigger picture. Instead of relying only on standard metrics or analyst opinions, Narratives let any investor break down their own assumptions and see how those beliefs stack up financially.

Narratives are designed to be accessible to everyone, and millions of investors on Simply Wall St’s platform use them on the Community page to bring their perspectives to life. By building a Narrative, you directly link what you believe about Exact Sciences’ business (for example, more rapid market adoption or margin challenges) with forecast numbers, then see a fair value compared to the current price. This makes it easier to decide whether to buy, hold, or sell, based on your own outlook.

Best of all, Narratives update dynamically as new events such as earnings, news, or updated guidance come in, so your fair value always reflects the latest information. For example, some investors see Exact Sciences growing swiftly and assign a fair value as high as $80 per share, while others are more cautious and see only $50. This illustrates how the Narrative tool helps capture different perspectives and informs smarter, more dynamic investment decisions.

Do you think there's more to the story for Exact Sciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives