- United States

- /

- Pharma

- /

- NasdaqGS:EWTX

Will Edgewise Therapeutics' (EWTX) New CFO Shape Its Commercialization Ambitions?

Reviewed by Sasha Jovanovic

- Edgewise Therapeutics announced the appointment of Michael Nofi as Chief Financial Officer on November 10, 2025, following the retirement of R. Michael Carruthers.

- Nofi brings more than 30 years of finance leadership in the life sciences sector, including recent roles supporting organizations transitioning from research to commercialization.

- We'll explore how Nofi's extensive experience in growing finance operations may influence Edgewise's investment outlook during its commercialization push.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Edgewise Therapeutics' Investment Narrative?

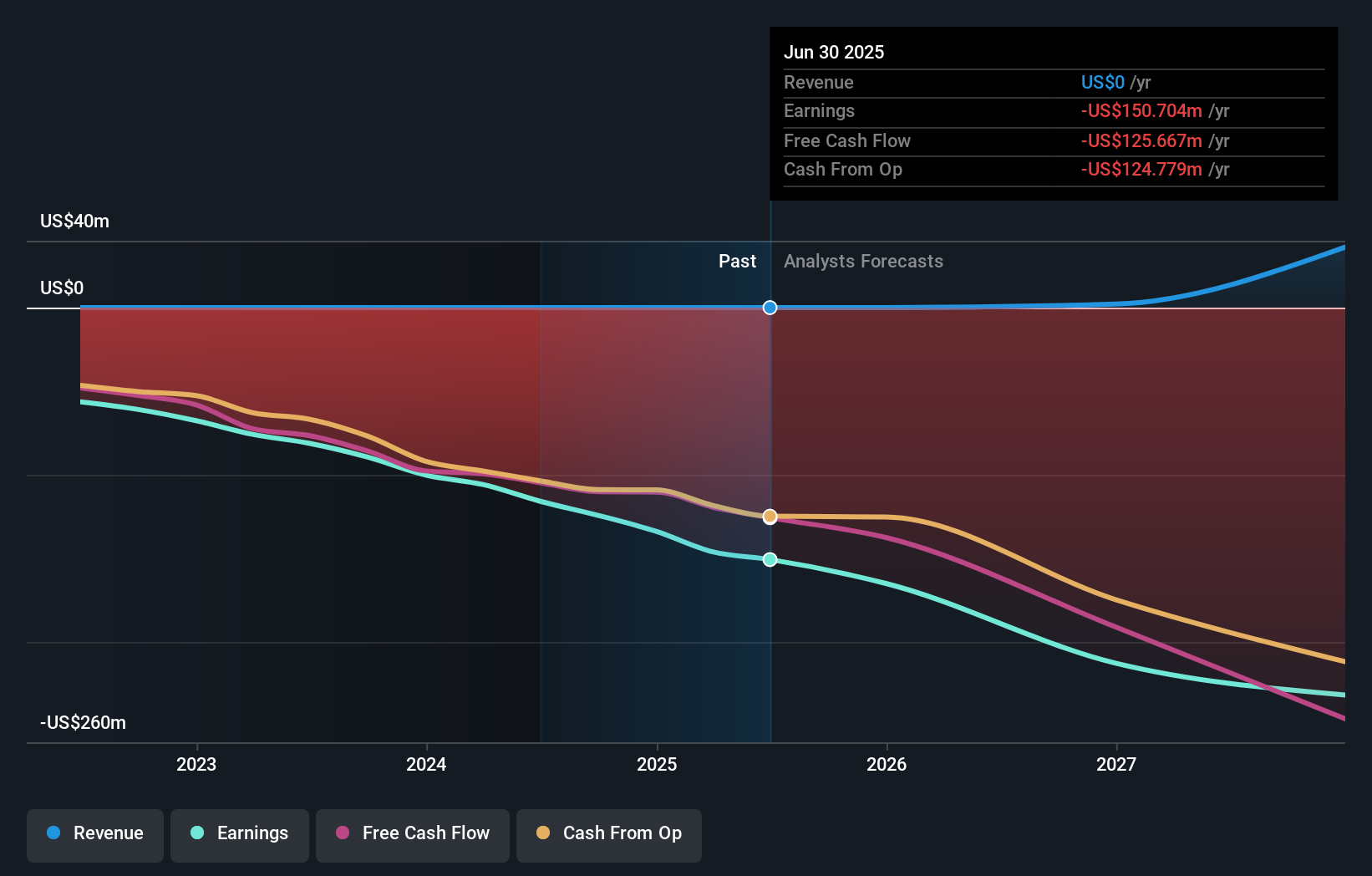

For shareholders in Edgewise Therapeutics, the big picture centers on belief in the company’s ability to bring its lead therapies, like sevasemten, through late-stage trials to approval and commercial launch. While the recent Chief Financial Officer transition is significant for operational continuity, it is unlikely to dramatically shift short-term catalysts, which still revolve around clinical trial outcomes and regulatory milestones. Michael Nofi’s arrival brings relevant experience in guiding companies through commercialization, but with no short-term revenue expected and losses widening, the company remains in a high-risk, high-reward phase. The CFO change may help strengthen finance operations as Edgewise approaches critical moments, but it does not fundamentally alter the immediate risks, chiefly, Edgewise’s dependence on future clinical success and the need to manage cash burn amid ongoing development. Investors should watch closely for any changes in execution or guidance accompanying this transition.

However, with no revenue expected this year, liquidity and burn rate remain critical for investors to follow.

Exploring Other Perspectives

Explore another fair value estimate on Edgewise Therapeutics - why the stock might be worth just $36.23!

Build Your Own Edgewise Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edgewise Therapeutics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Edgewise Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edgewise Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edgewise Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EWTX

Edgewise Therapeutics

A biopharmaceutical company, discovers, develops, and commercializes therapies for the treatment of muscle disorders.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives