- United States

- /

- Pharma

- /

- NasdaqGM:ESPR

Many Still Looking Away From Esperion Therapeutics, Inc. (NASDAQ:ESPR)

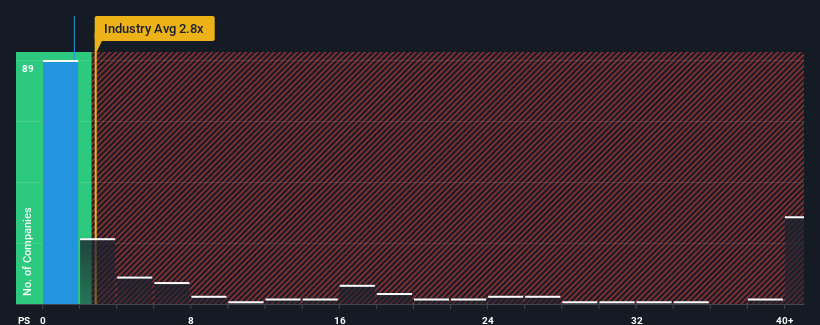

Esperion Therapeutics, Inc.'s (NASDAQ:ESPR) price-to-sales (or "P/S") ratio of 1.7x might make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Esperion Therapeutics

What Does Esperion Therapeutics' P/S Mean For Shareholders?

Esperion Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Esperion Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Esperion Therapeutics' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.3%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next three years should generate growth of 82% per year as estimated by the nine analysts watching the company. That's shaping up to be materially higher than the 41% each year growth forecast for the broader industry.

With this information, we find it odd that Esperion Therapeutics is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Esperion Therapeutics' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Esperion Therapeutics currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 4 warning signs for Esperion Therapeutics (2 are a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Esperion Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Esperion Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ESPR

Esperion Therapeutics

A pharmaceutical company, develops and commercializes medicines for the treatment of patients with elevated low density lipoprotein cholesterol (LDL-C) in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives