- United States

- /

- Biotech

- /

- NasdaqCM:EQ

Equillium (NASDAQ:EQ) adds US$25m to market cap in the past 7 days, though investors from three years ago are still down 85%

It is a pleasure to report that the Equillium, Inc. (NASDAQ:EQ) is up 207% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. In that time the share price has melted like a snowball in the desert, down 85%. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 85% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Equillium

Equillium isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Equillium grew revenue at 140% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 23% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

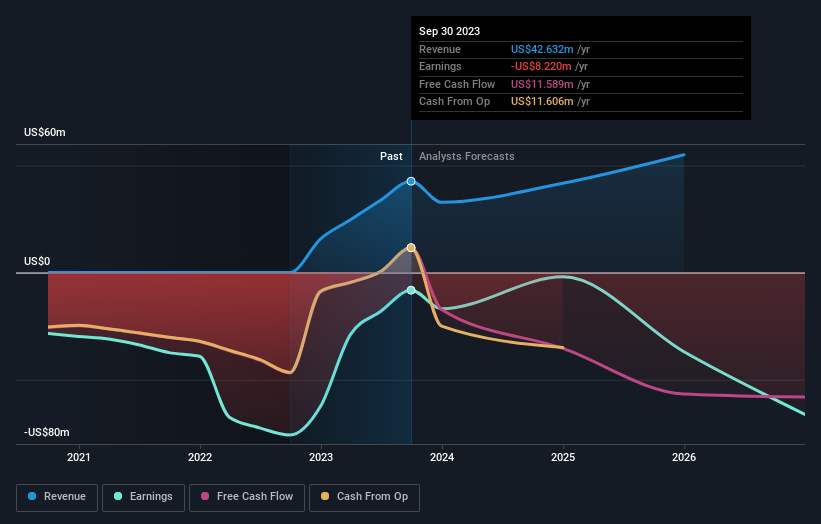

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Equillium's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Equillium has rewarded shareholders with a total shareholder return of 37% in the last twelve months. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Equillium (including 2 which don't sit too well with us) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Equillium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EQ

Equillium

A clinical-stage biotechnology company, develops and sells products to treat severe autoimmune and inflammatory, or immuno-inflammatory disorders with unmet medical need.

Excellent balance sheet moderate.