- United States

- /

- Biotech

- /

- NasdaqGS:EPZM

Can You Imagine How Epizyme's (NASDAQ:EPZM) Shareholders Feel About The 72% Share Price Increase?

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Epizyme, Inc. (NASDAQ:EPZM) share price is up 72% in the last three years, clearly besting than the market return of around 32% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 14%.

See our latest analysis for Epizyme

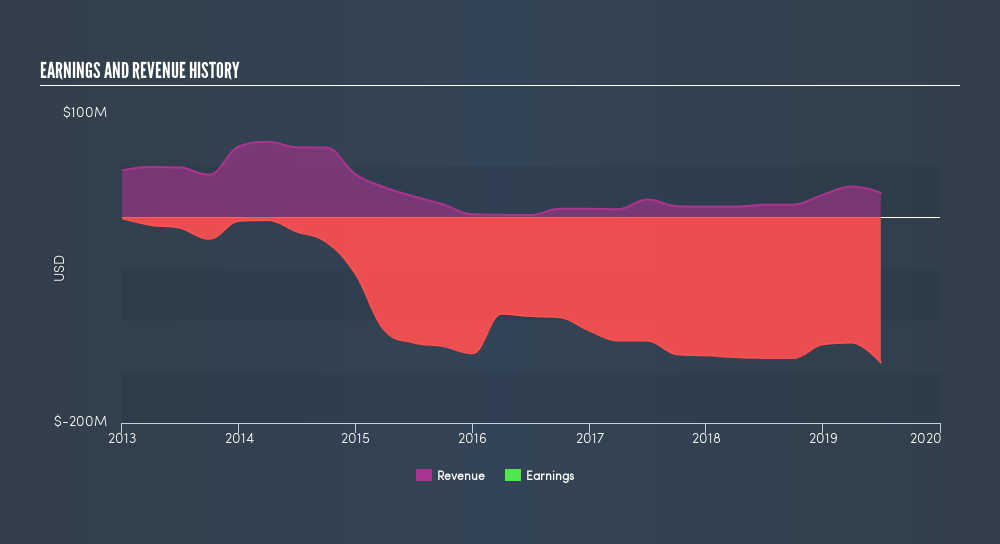

Because Epizyme is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Epizyme's revenue trended up 49% each year over three years. That's much better than most loss-making companies. The share price rise of 20% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at Epizyme. A window of opportunity may reveal itself with time, if the business can trend to profitability.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Epizyme shareholders have received a total shareholder return of 14% over one year. Notably the five-year annualised TSR loss of 17% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before spending more time on Epizyme it might be wise to click here to see if insiders have been buying or selling shares.

We will like Epizyme better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EPZM

Epizyme

Epizyme, Inc., a commercial-stage biopharmaceutical company, discovers, develops, and commercializes novel epigenetic medicines for patients with cancer and other diseases in the United States.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives