- United States

- /

- Biotech

- /

- OTCPK:EIGR.Q

The Market Doesn't Like What It Sees From Eiger BioPharmaceuticals, Inc.'s (NASDAQ:EIGR) Revenues Yet As Shares Tumble 26%

Eiger BioPharmaceuticals, Inc. (NASDAQ:EIGR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

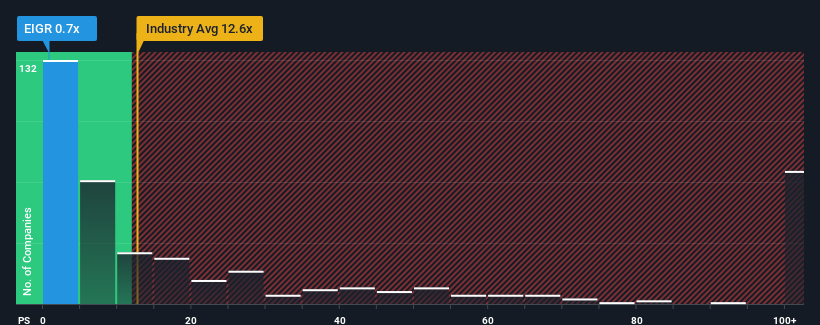

Since its price has dipped substantially, Eiger BioPharmaceuticals' price-to-sales (or "P/S") ratio of 0.7x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.6x and even P/S above 53x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Eiger BioPharmaceuticals

How Eiger BioPharmaceuticals Has Been Performing

Eiger BioPharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Eiger BioPharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Eiger BioPharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.7% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 32% per annum as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 240% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Eiger BioPharmaceuticals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Eiger BioPharmaceuticals have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Eiger BioPharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Eiger BioPharmaceuticals (3 are potentially serious) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eiger BioPharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:EIGR.Q

Eiger BioPharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development of therapies for hepatitis delta virus (HDV) and other serious diseases.

Slight and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.