- United States

- /

- Biotech

- /

- NasdaqGS:EDIT

The Market Doesn't Like What It Sees From Editas Medicine, Inc.'s (NASDAQ:EDIT) Revenues Yet As Shares Tumble 25%

To the annoyance of some shareholders, Editas Medicine, Inc. (NASDAQ:EDIT) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

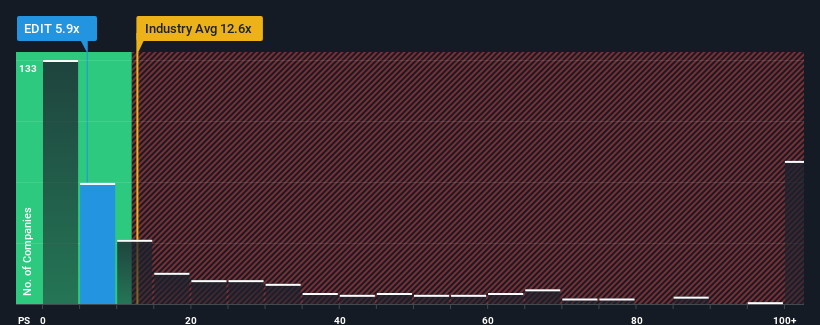

Following the heavy fall in price, Editas Medicine may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 5.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.6x and even P/S higher than 63x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Editas Medicine

What Does Editas Medicine's P/S Mean For Shareholders?

Recent times have been advantageous for Editas Medicine as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Editas Medicine's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Editas Medicine?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Editas Medicine's to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 14% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 6.0% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 162% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Editas Medicine's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, Editas Medicine's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Editas Medicine's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Editas Medicine's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Editas Medicine that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Editas Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EDIT

Editas Medicine

A clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives