- United States

- /

- Biotech

- /

- NasdaqGS:DVAX

Dynavax Technologies (DVAX): Exploring Current Valuation After Recent Modest Share Price Rebound

Reviewed by Simply Wall St

Dynavax Technologies (DVAX) has seen its stock price move modestly over the past week, drawing interest from investors who are looking for signals of where shares could be headed next. The company continues to focus on vaccine development and commercialization, which remains central to its long-term strategy.

See our latest analysis for Dynavax Technologies.

The share price has rebounded lately, climbing 10.97% over the past month and 12.94% for the last 90 days. This may hint that investor sentiment around Dynavax’s vaccine pipeline is stabilizing after a challenging start to the year. Even when recent gains are considered, the one-year total shareholder return is -11.12%. However, long-term investors have seen a 121.51% total return over five years, illustrating how momentum can shift for biotech companies like Dynavax.

If Dynavax’s turnaround has you curious about what else is on the move, this is an ideal moment to broaden your search and discover See the full list for free.

With its recent gains and a share price still well below many analysts' targets, investors are left wondering whether Dynavax is an undervalued opportunity or if the market has already accounted for its future potential.

Most Popular Narrative: 47.6% Undervalued

With Dynavax Technologies closing at $11.43 and the current narrative setting fair value at $21.80, conviction is high that shares have major catch-up potential. Investors are turning their attention to the business as its fundamentals, product mix, and future profit expectations take center stage.

Ongoing investment in the development pipeline (notably the shingles, pandemic influenza, and Lyme disease vaccine programs) positions Dynavax to benefit from heightened global government or public health focus on pandemic preparedness and preventative care, creating new long-term revenue streams and diversifying future earnings.

Curious how this price target is built? The real story hinges on bold assumptions for future revenue growth and profit margins. These are numbers you will not believe until you see them. Want to know which financial forecasts justify such a sharp upside? Dig into the full narrative for all the details behind this high-conviction valuation.

Result: Fair Value of $21.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative faces real tests. Setbacks in Dynavax’s clinical pipeline or unexpected shifts in vaccine demand could derail the upside case.

Find out about the key risks to this Dynavax Technologies narrative.

Another View: Testing the Numbers with Multiples

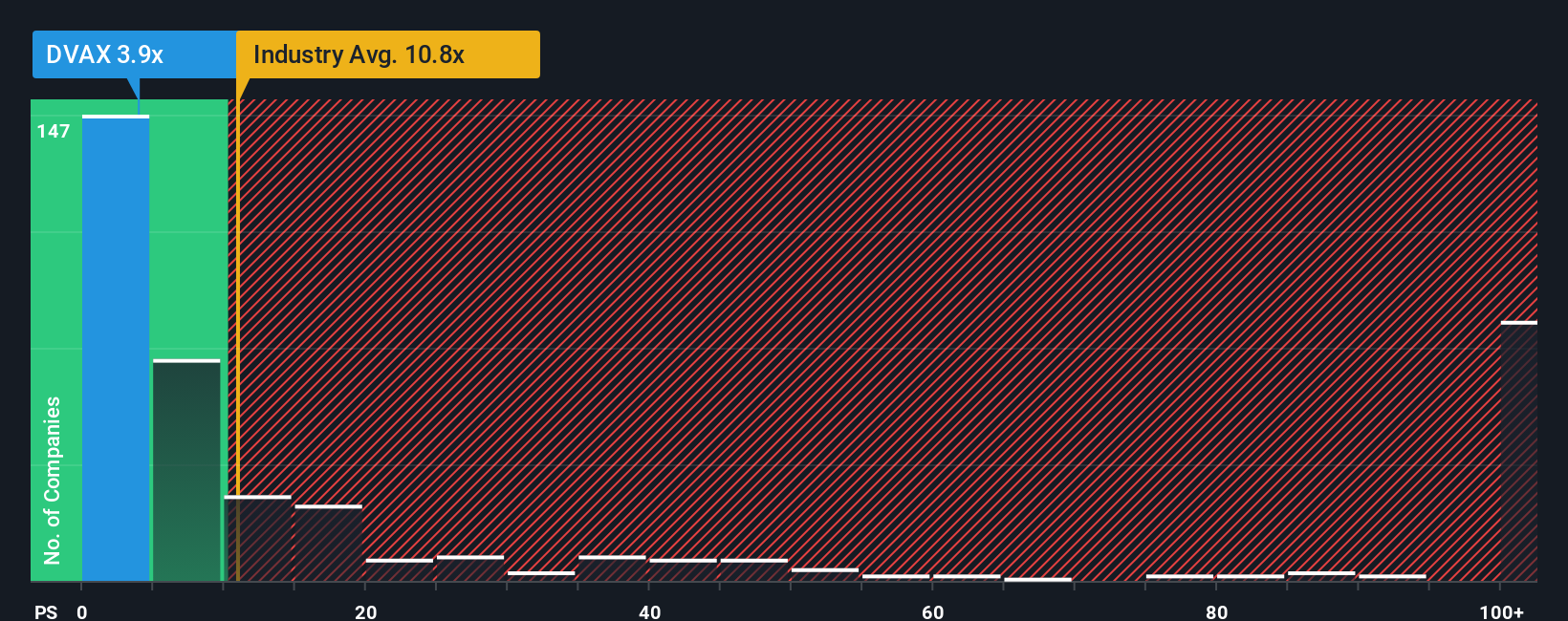

While the high-conviction narrative suggests Dynavax is significantly undervalued, a look at its sales ratio tells a more complicated story. Shares trade at 4.1x sales, which is much lower than both the industry average of 13.1x and the peer average of 20.7x. However, this is just above the fair ratio of 3.9x, indicating valuation risk if the business does not deliver future growth. Can these fundamentals really support the optimistic price target, or does the gap warn of possible downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dynavax Technologies Narrative

If you see the story differently, or want to base your decisions on your own analysis, it’s quick and easy to build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dynavax Technologies.

Looking for More Smart Investment Opportunities?

Do not limit your portfolio to just one narrative. The market is filled with hidden gems and significant trends you could be missing right now. Put your curiosity to work and explore new opportunities before others catch on.

- Spot high-potential opportunities by backing these 3579 penny stocks with strong financials that combine growth with stability and strong fundamentals.

- Capitalize on rapid innovation by tracking these 25 AI penny stocks leveraging artificial intelligence to disrupt industries and drive future advancements.

- Secure steady returns and peace of mind by selecting these 15 dividend stocks with yields > 3% that reward investors with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DVAX

Dynavax Technologies

A commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.