- United States

- /

- Biotech

- /

- NasdaqCM:DNTH

Will the Leads Biolabs Partnership and DNTH212 Advance Transform Dianthus Therapeutics' (DNTH) Innovation Narrative?

Reviewed by Sasha Jovanovic

- Dianthus Therapeutics recently announced an exclusive worldwide license agreement with Leads Biolabs for DNTH212, a novel bifunctional BDCA2 and BAFF/APRIL inhibitor targeting severe autoimmune diseases, following FDA clearance of its investigational new drug application.

- This transaction involves a US$30 million upfront payment and potential milestones approaching US$962 million, underlining both companies’ commitment to advancing new therapies for autoimmune conditions.

- We’ll examine how DNTH212’s accelerated clinical development plan could influence Dianthus Therapeutics’ longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Dianthus Therapeutics' Investment Narrative?

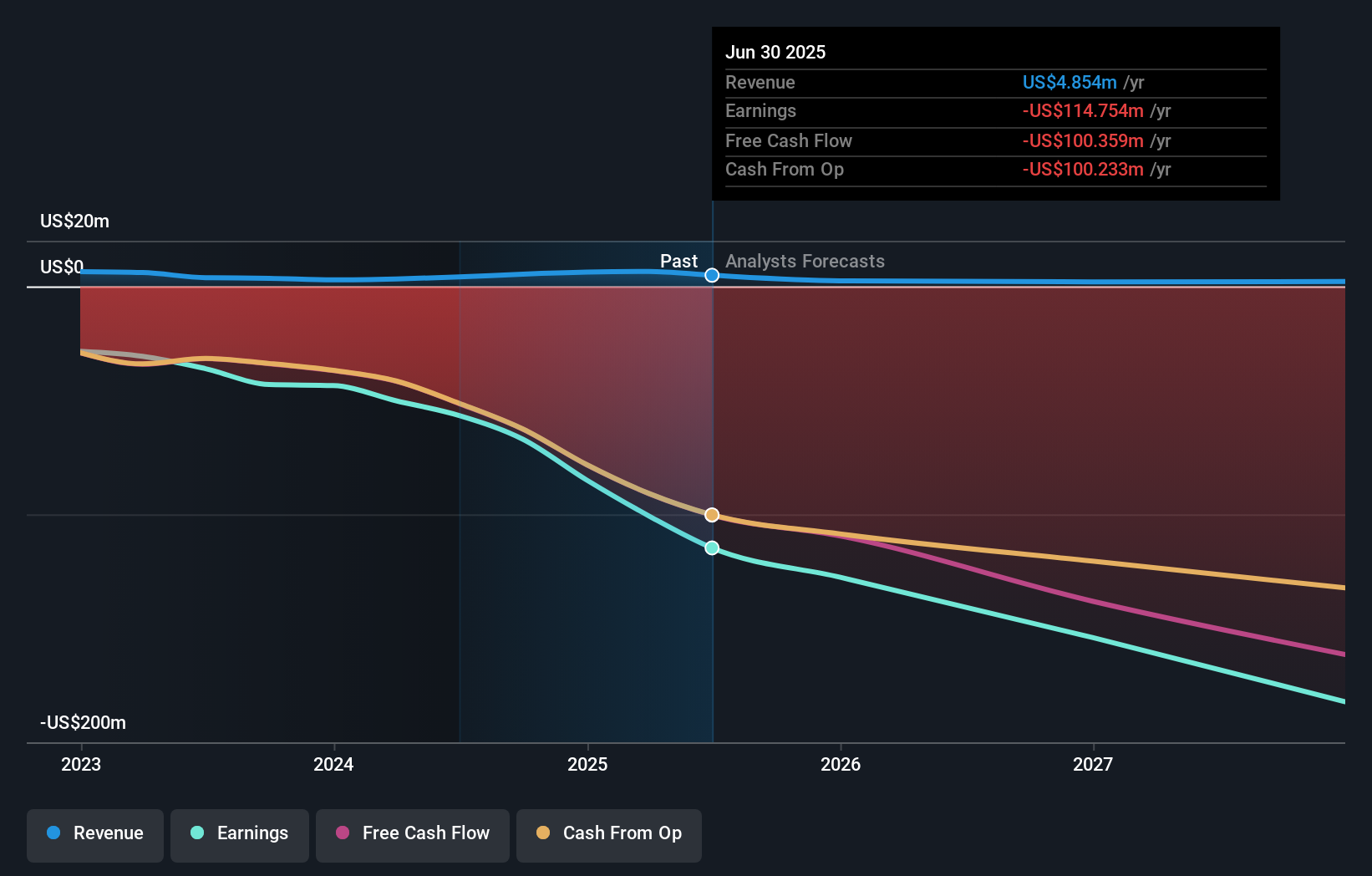

Dianthus Therapeutics sits at a classic crossroads where belief in biotech innovation meets unprofitable business realities. The recent licensing deal for DNTH212 could be a turning point, bringing a promising asset into the pipeline, adding new milestones, and reaffirming Dianthus’ cash runway into 2028 following its recent equity raise. Short-term, this agreement tilts the spotlight toward the launch and progress of Phase 1 trials for DNTH212, placing clinical data and regulatory milestones at the core of near-term catalysts. However, the company’s ongoing losses, lack of meaningful revenue, and history of shareholder dilution remain front-of-mind risks, especially as management balances aggressive clinical spending against uncertain future revenue. DNTH212’s progress could meaningfully alter risk perceptions, but with shares already rebounding after the announcement, expectations for clinical success are likely building into the stock.

By contrast, future shareholder dilution remains an important risk to be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Dianthus Therapeutics - why the stock might be worth just $62.13!

Build Your Own Dianthus Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dianthus Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Dianthus Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dianthus Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DNTH

Dianthus Therapeutics

A clinical-stage biotechnology company, develops complement therapeutics for patients with severe autoimmune and inflammatory diseases.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives