- United States

- /

- Pharma

- /

- NasdaqCM:DERM

Market Cool On Journey Medical Corporation's (NASDAQ:DERM) Revenues Pushing Shares 26% Lower

Unfortunately for some shareholders, the Journey Medical Corporation (NASDAQ:DERM) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

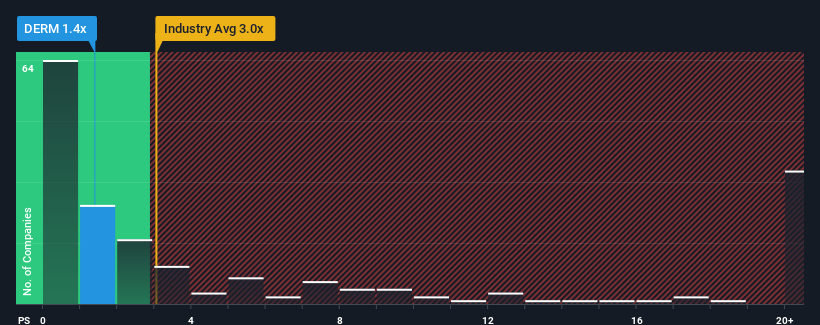

Following the heavy fall in price, Journey Medical may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3x and even P/S higher than 13x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Journey Medical

What Does Journey Medical's P/S Mean For Shareholders?

Journey Medical could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Journey Medical's future stacks up against the industry? In that case, our free report is a great place to start.How Is Journey Medical's Revenue Growth Trending?

Journey Medical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. This means it has also seen a slide in revenue over the longer-term as revenue is down 2.6% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 22% each year growth forecast for the broader industry.

With this information, we find it odd that Journey Medical is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Journey Medical's P/S?

Journey Medical's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Journey Medical's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Journey Medical (1 can't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DERM

Journey Medical

Focuses on the development and commercialization of pharmaceutical products for the treatment of dermatological conditions in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives