- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics (CYTK): Evaluating Valuation After Major Fundraise and Positive FDA Update for Aficamten

Reviewed by Kshitija Bhandaru

Cytokinetics (CYTK) just had a busy week that’s hard to ignore if you’re considering your next move with the stock. The company wrapped up not one, but two convertible note offerings totaling $1.2 billion and, almost in the same breath, provided detailed updates on the regulatory process for its lead heart drug candidate, aficamten. Between steady progress with the FDA—highlighted by positive signals from a late-cycle meeting on risk management plans—and a sizable cash infusion that shores up the balance sheet, it is no wonder investors are paying extra attention right now.

This combination of financial flexibility and regulatory transparency appears to have caught the market’s eye. Cytokinetics shares climbed over 30% in the past month and notched an impressive 52% gain over the past 3 months, signaling renewed momentum and shifting sentiment after a slower start to the year. The mix of clinical developments, regulatory milestones, and capital raising efforts has positioned the company differently than it was just a quarter ago.

So with Cytokinetics posting fresh gains and setting up for a potential product launch, is the market giving investors a limited-time window to buy, or is all that future optimism already priced in?

Most Popular Narrative: 32.3% Undervalued

The prevailing narrative among analysts is that Cytokinetics is trading well below its estimated fair value, driven by expectations for both robust pipeline execution and commercial scaling.

"Commercial launch readiness for aficamten is progressing with a newly hired, experienced cardiovascular salesforce in the U.S. and tailored strategies for Europe and China, enabling efficient product roll-out, rapid sales ramp, and improved earnings visibility upon regulatory approval."

How do bullish analysts justify such a premium on future growth? There is one detail about Cytokinetics’ projections that will make you rethink what is priced in right now. This narrative is not just about clinical wins; it is built on aggressive financial forecasts and a profit outlook that breaks with biotech convention. Are you ready to discover the jaw-dropping revenue and earnings estimates that underpin this price target?

Result: Fair Value of $74.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in regulatory approvals or slower than anticipated adoption of aficamten could quickly shift sentiment and challenge the bullish narrative around Cytokinetics.

Find out about the key risks to this Cytokinetics narrative.Another View: SWS DCF Model Tells a Different Story

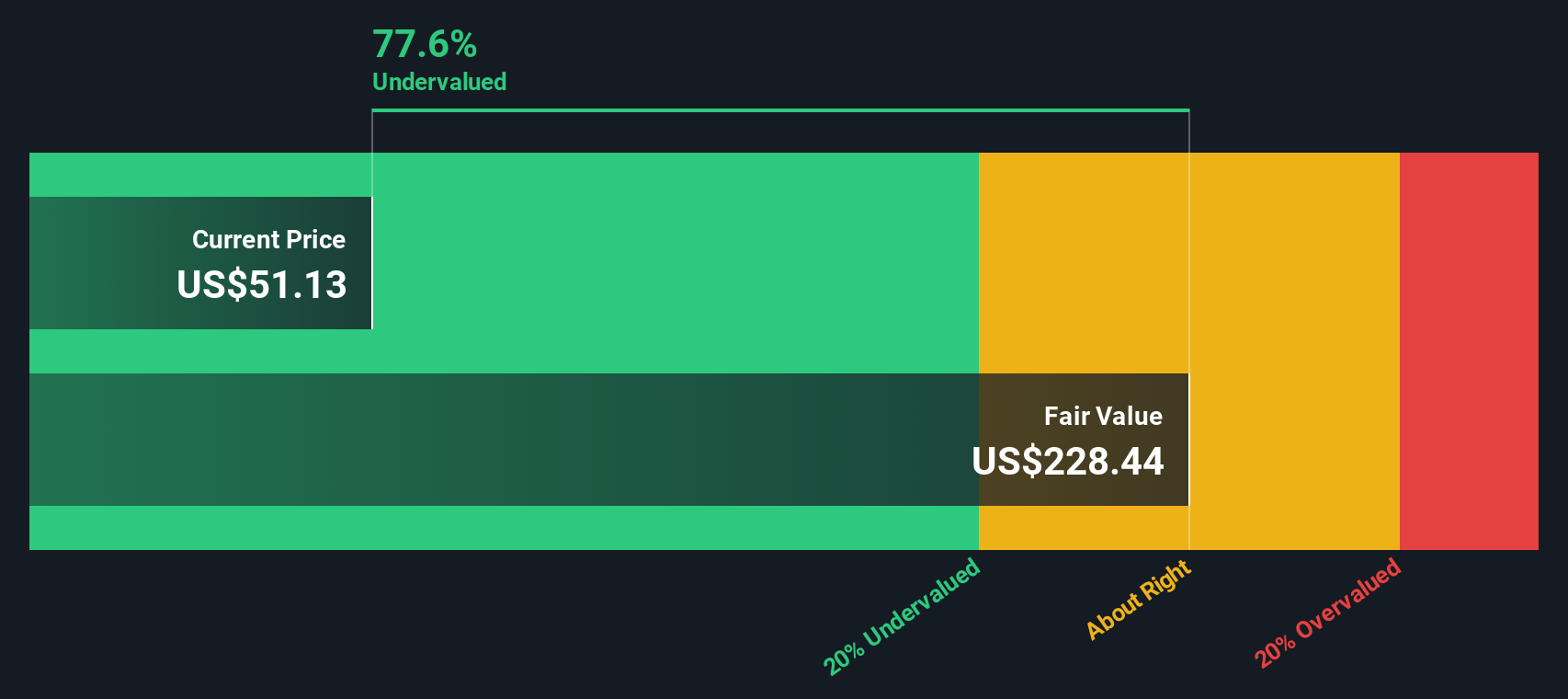

While analysts think the stock is undervalued based on future earnings projections, our SWS DCF model also shows Cytokinetics is trading well below its estimated fair worth. But is this rare agreement? Or could something be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cytokinetics Narrative

If this outlook does not fully match your perspective, or you want to dig into the numbers yourself, crafting your own view takes less than three minutes. Do it your way.

A great starting point for your Cytokinetics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Give yourself an edge and see what other game-changing stocks are catching attention with these curated picks. Your next breakthrough investment could be in plain sight, but only if you take action now.

- Find high-potential bargains that may be flying under the radar by using our undervalued stocks based on cash flows.

- Discover opportunities in medicine and diagnostics by checking out companies transforming healthcare with healthcare AI stocks.

- Add steady income to your portfolio with well-established names offering reliable dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives