- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics (CYTK): Assessing Valuation After Fresh Legal Scrutiny and New Risks to FDA Timeline

Reviewed by Simply Wall St

Several law firms have recently filed securities class action lawsuits and launched investigations into Cytokinetics (CYTK), claiming that the company misled investors about regulatory timelines and risks associated with FDA approval of its drug aficamten.

This wave of legal scrutiny follows earlier positive clinical data releases, which has sharpened investor focus on the company’s future disclosures and the broader regulatory process.

See our latest analysis for Cytokinetics.

Even as Cytokinetics faces fresh legal scrutiny and regulatory questions, the company has remained active, unveiling strong clinical results for aficamten and making a high-profile executive hire in November. Notably, despite recent headlines and a one-day share price dip of 2.1%, momentum has been exceptional with a 70% share price return over the past three months and nearly 30% total shareholder return in the past year. This may signal that long-term investors still see potential beyond these short-term risks.

If this level of activity has you thinking about what else is breaking out in biotech, it might be a great time to explore the healthcare innovators found in our See the full list for free.

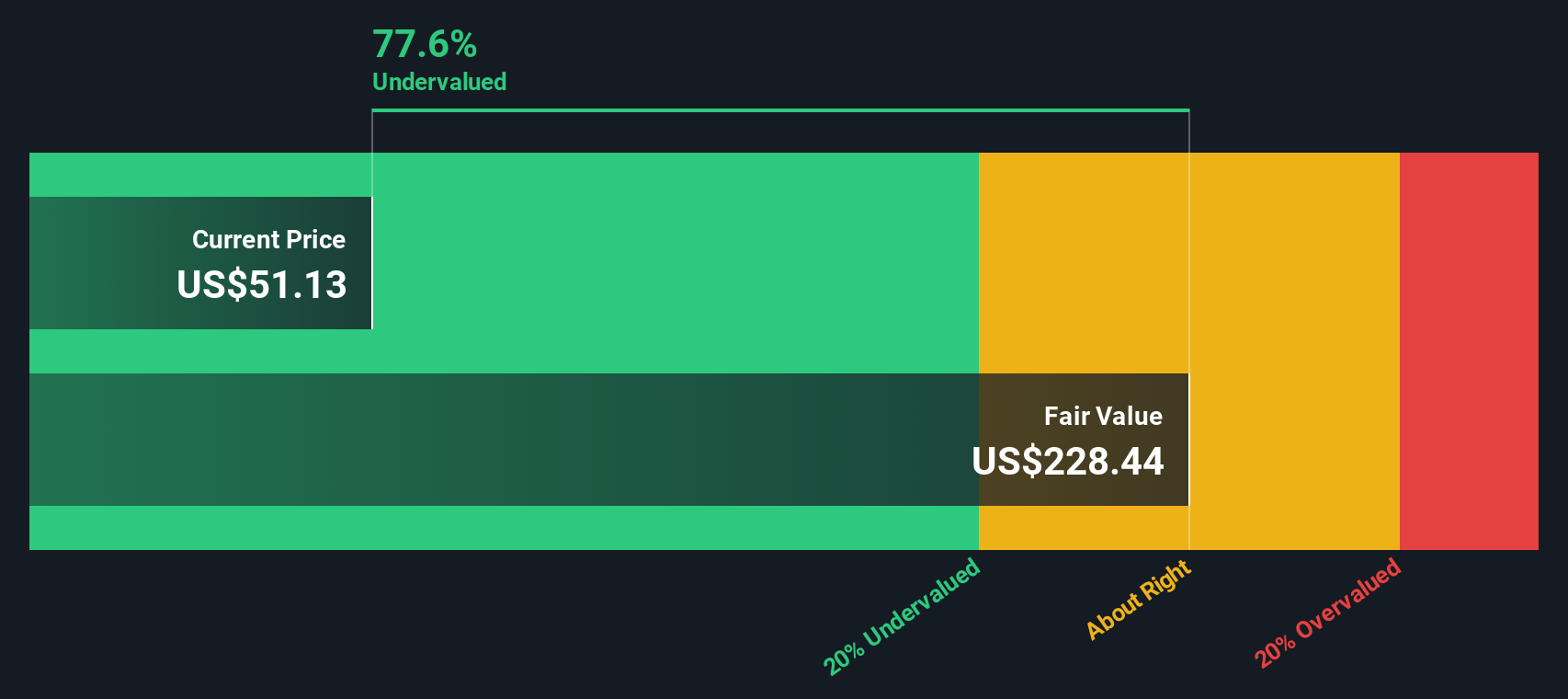

With the stock still trading about 21% below analyst price targets and recent gains following strong clinical results, the question for investors is clear: is Cytokinetics undervalued or has the market already priced in upcoming growth?

Most Popular Narrative: 17.4% Undervalued

With the most followed narrative setting Cytokinetics' fair value at $78.44, there is still a notable gap from the last close price of $64.79. This spread puts fresh focus on the company’s clinical momentum and bold expectations for future growth.

Ongoing investments in late-stage pipeline assets and a proprietary muscle biology platform expand the franchise's potential beyond a single product. This approach lays the groundwork for future portfolio growth, improved long-term net margins, and decreased business risk from single-product reliance.

Curious what the narrative is really betting on? There is a big swing in forecast revenues, profit margins and growth multiples. Hint: these numbers would surprise even sector veterans. Does the fair value hinge on blockbuster launches or something more? Find out exactly what animates this ambitious valuation in the full analysis.

Result: Fair Value of $78.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in regulatory approval or slower than expected commercial uptake could quickly challenge the current optimism and reshape future expectations for Cytokinetics.

Find out about the key risks to this Cytokinetics narrative.

Another View: Discounted Cash Flow Tells a Different Story

Looking at Cytokinetics through the lens of our SWS DCF model, the numbers suggest a much less optimistic picture. The model estimates fair value at just $2.20 per share, which is far below the current market price. Could the market be mispricing future risks, or is consensus too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cytokinetics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cytokinetics Narrative

If you see the story differently or want to dig deeper using your own research, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Cytokinetics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Can’t-Miss Investment Ideas?

Smart investors always have an eye on the next opportunity. You could be missing out on emerging leaders and hidden gems if you stop here. Use the Simply Wall Street Screener to supercharge your portfolio strategy.

- Tap into high-growth potential by checking out these 26 AI penny stocks, where artificial intelligence is transforming tomorrow’s winners in unexpected sectors.

- Unlock reliable, inflation-beating income streams by browsing these 15 dividend stocks with yields > 3%, featuring companies prioritizing strong and sustainable dividends above all else.

- Supercharge your search for undervalued opportunities with these 908 undervalued stocks based on cash flows, where robust fundamentals and attractive valuations converge for investors who want more than just the obvious choices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives