- United States

- /

- Life Sciences

- /

- NasdaqCM:CSBR

Champions Oncology (NASDAQ:CSBR investor three-year losses grow to 58% as the stock sheds US$8.0m this past week

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Champions Oncology, Inc. (NASDAQ:CSBR) have had an unfortunate run in the last three years. So they might be feeling emotional about the 58% share price collapse, in that time. The more recent news is of little comfort, with the share price down 37% in a year. Even worse, it's down 13% in about a month, which isn't fun at all.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Champions Oncology

Champions Oncology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Champions Oncology grew revenue at 6.2% per year. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 17% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

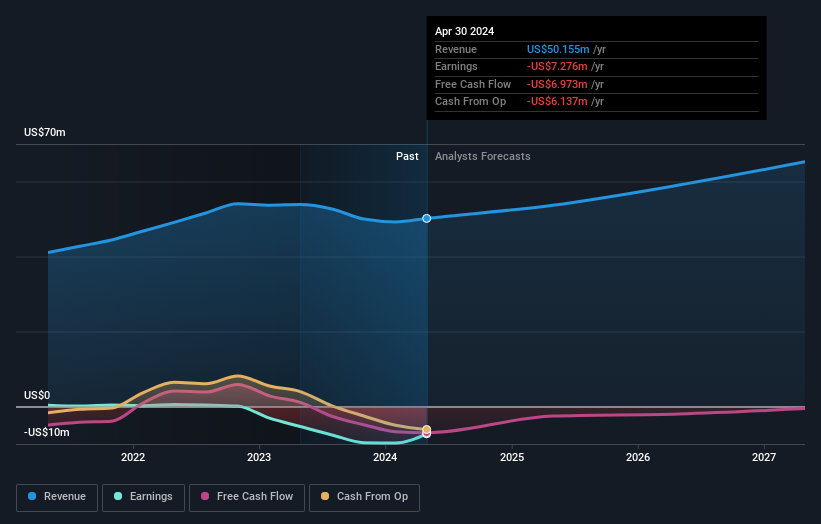

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Champions Oncology

A Different Perspective

Champions Oncology shareholders are down 37% for the year, but the market itself is up 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Champions Oncology (including 2 which don't sit too well with us) .

Champions Oncology is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CSBR

Champions Oncology

A technology-enabled research company, provides transformative technology solutions for drug discovery and development in the United States.

Good value with reasonable growth potential.