- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Shareholders Are Thrilled That The CRISPR Therapeutics (NASDAQ:CRSP) Share Price Increased 170%

CRISPR Therapeutics AG (NASDAQ:CRSP) shareholders might be concerned after seeing the share price drop 11% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In three years the stock price has launched 170% higher: a great result. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

View our latest analysis for CRISPR Therapeutics

Because CRISPR Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years CRISPR Therapeutics saw its revenue grow at 87% per year. That's much better than most loss-making companies. Along the way, the share price gained 39% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

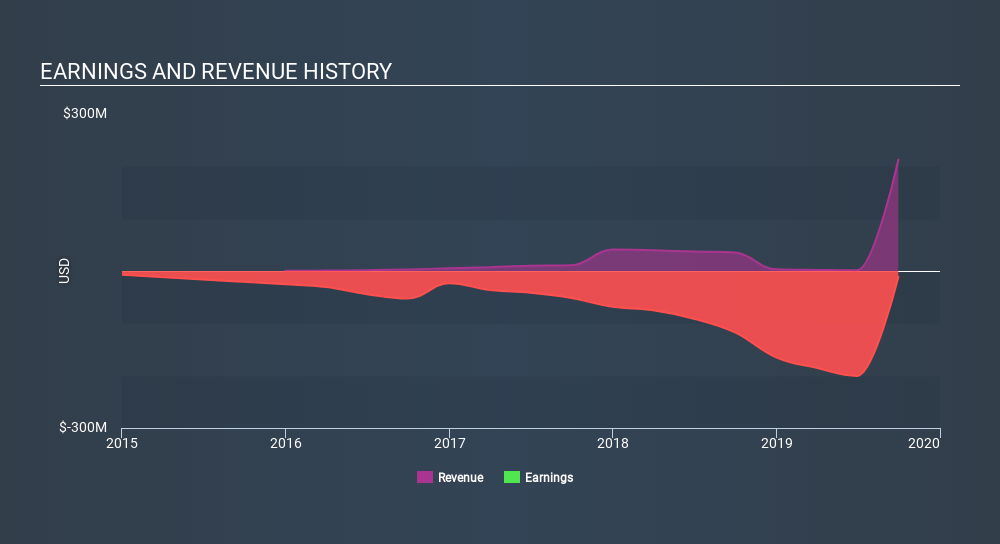

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 4 warning signs for CRISPR Therapeutics (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

We're pleased to report that CRISPR Therapeutics rewarded shareholders with a total shareholder return of 64% over the last year. That gain actually surpasses the 39% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026