- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Is Now the Right Time for CRISPR Therapeutics After a 26.9% Pullback?

Reviewed by Bailey Pemberton

- Wondering if CRISPR Therapeutics is a bargain or just a biotech buzzword? You are not alone. Many investors are asking the same question about whether now is the right time to get involved.

- After an impressive 26.8% gain year-to-date and a respectable 11.2% return over the past year, the stock has pulled back sharply by 26.9% in the last 30 days. This shows how quickly sentiment can shift.

- Much of this recent volatility has been driven by news around regulatory developments and fresh breakthroughs in gene editing, which have put CRISPR Therapeutics back in the spotlight. These headlines have sparked debate around the company's long-term prospects and risk profile.

- On our simple 6-point valuation framework, CRISPR Therapeutics currently scores 3 out of 6 for being undervalued, according to the latest checks. We will break down these valuation approaches in detail, but be sure to stick around for a perspective that goes beyond the spreadsheets by the end of this article.

Find out why CRISPR Therapeutics's 11.2% return over the last year is lagging behind its peers.

Approach 1: CRISPR Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future free cash flows and then discounting those back to their present value. This method is particularly useful for companies like CRISPR Therapeutics, where long-term growth and future earnings are the main drivers of value.

According to the latest data, CRISPR Therapeutics reported a Free Cash Flow (FCF) of -$306.7 million last year. Analyst estimates suggest that the company will remain cash flow negative over the next several years. However, future projections become more optimistic, with FCF reaching $136.9 million by 2029. Beyond the analyst-provided estimates, Simply Wall St extrapolates growth and projects continued improvement in FCF well into the 2030s.

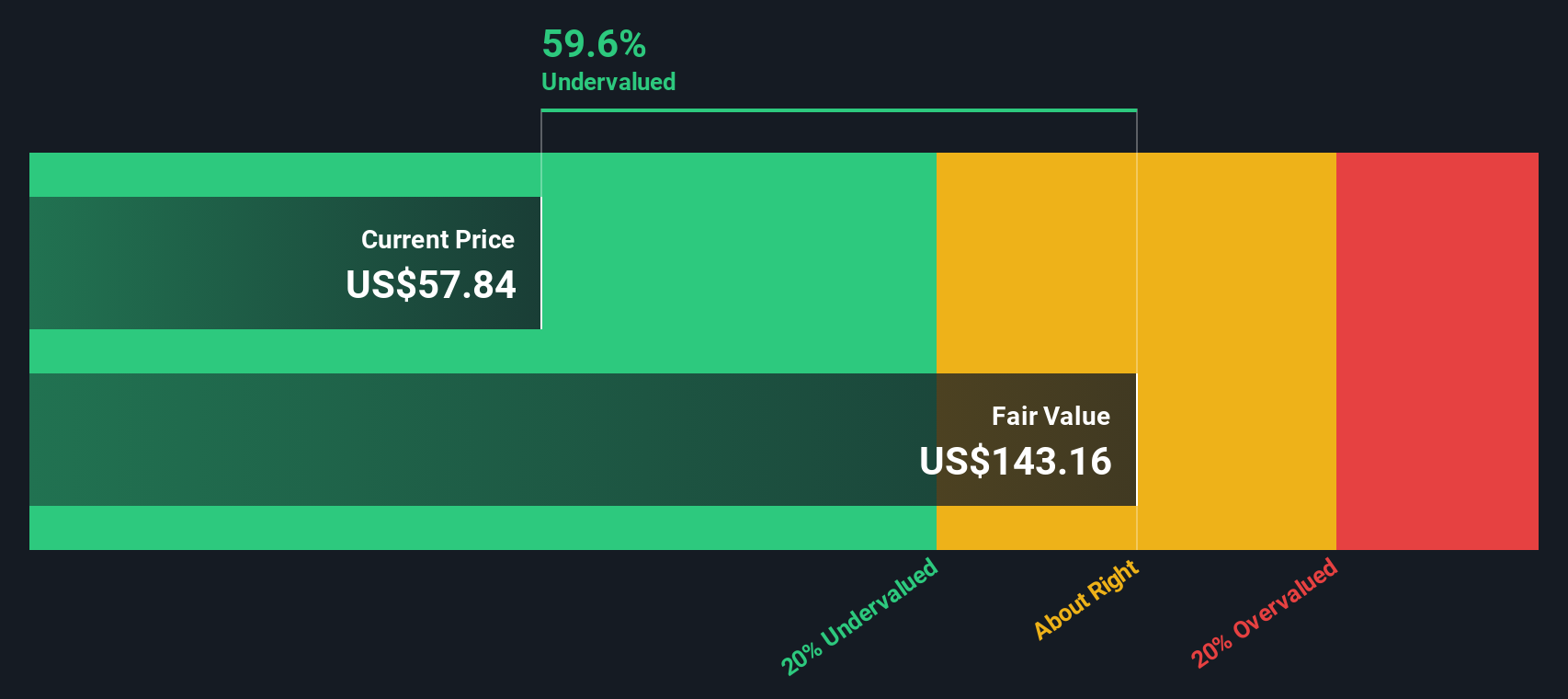

Based on these projections and using a two-stage Free Cash Flow to Equity model, the intrinsic value of CRISPR Therapeutics is estimated at $129.25 per share. This implies that the stock is trading at a 59.4% discount to its fair value, indicating significant undervaluation at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CRISPR Therapeutics is undervalued by 59.4%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: CRISPR Therapeutics Price vs Book

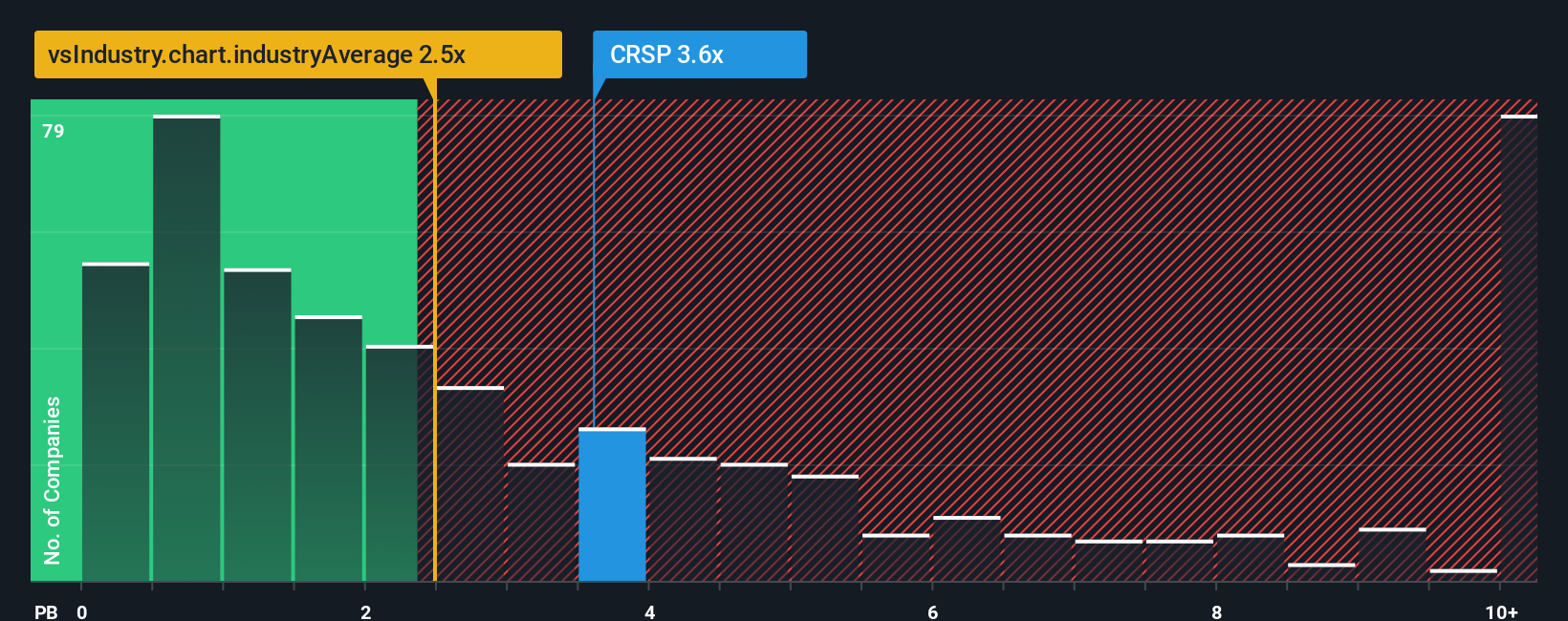

For biotech companies like CRISPR Therapeutics that are yet to reach sustained profitability, the Price-to-Book (P/B) ratio is often the preferred valuation metric. This is because, in the absence of positive earnings, the P/B ratio focuses on the value of a company’s net assets. This makes it especially relevant for asset-rich and research-driven firms that may not be profitable yet.

A company’s growth expectations and risk profile can meaningfully shift what investors consider a “normal” or “fair” P/B ratio. High growth prospects or lower risk might warrant a higher P/B multiple. In contrast, slower growth or more uncertainty typically leads to a discount versus peers.

Currently, CRISPR Therapeutics is trading at a P/B ratio of 2.6x. This is in line with the biotech industry average of 2.5x, but well below the peer average of 5.2x. This comparison provides helpful context, but it does not factor in the company’s specific growth trajectory, unique risks, or future profitability potential.

That is where Simply Wall St’s proprietary “Fair Ratio” comes into play. Unlike simple peer or industry averages, the Fair Ratio is calculated by considering factors such as projected earnings growth, profit margins, the company’s industry, market capitalization, and risk profile. This comprehensive approach delivers a more nuanced and accurate indicator of what a truly fair valuation multiple should be.

Comparing CRISPR Therapeutics’ actual P/B of 2.6x to its Fair Ratio suggests the stock is valued appropriately for its current position and outlook.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CRISPR Therapeutics Narrative

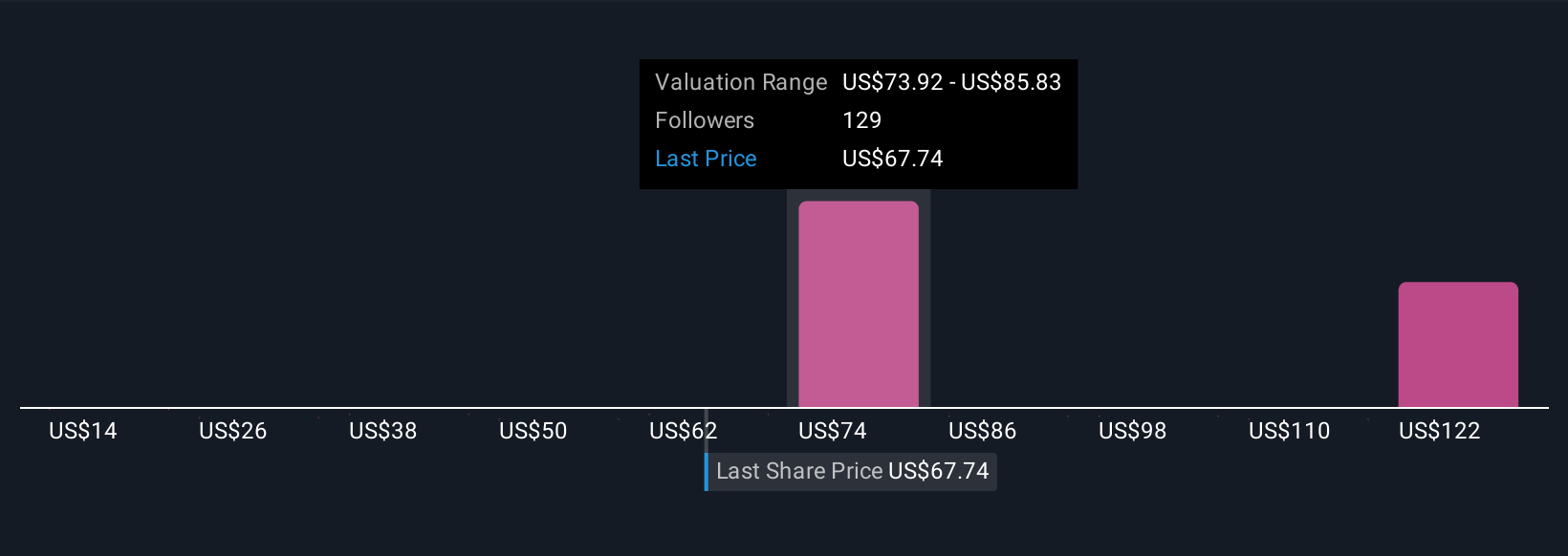

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple, powerful tools that let you tell a company's story by connecting your perspective on its future with real financial forecasts and a calculated fair value. Rather than just looking at numbers on their own, Narratives help you tie CRISPR Therapeutics’ scientific breakthroughs, regulatory updates, and market opportunities to expectations about future revenue, earnings, and margins.

Available on Simply Wall St’s Community page and used by millions of investors, Narratives make it easy to compare your own investment story to others. By laying out your reasons for estimating fair value, you get insights into whether the current share price aligns with your expectations, helping you spot opportunities to buy low or consider selling high.

Best of all, Narratives update dynamically as new news and earnings are released, keeping your investment perspective current. For example, some CRISPR Therapeutics Narratives reflect high optimism, with fair values far above today’s price, while others take a more cautious view and see limited upside. This illustrates how different investors can view the same company through their own lens.

Do you think there's more to the story for CRISPR Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives