- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Will the CAREFNDR Phase 3 Launch Broaden Crinetics Pharmaceuticals' (CRNX) Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Crinetics Pharmaceuticals recently announced that the first patient has been randomized in its pivotal Phase 3 CAREFNDR trial, a global study evaluating once-daily, oral paltusotine for carcinoid syndrome due to well-differentiated neuroendocrine tumors.

- This marks a significant step as paltusotine, already approved in the U.S. for acromegaly, could see its clinical application broadened to another rare disease area if successful.

- We'll explore what the launch of this Phase 3 trial could mean for Crinetics' pipeline focus and long-term growth story.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Crinetics Pharmaceuticals' Investment Narrative?

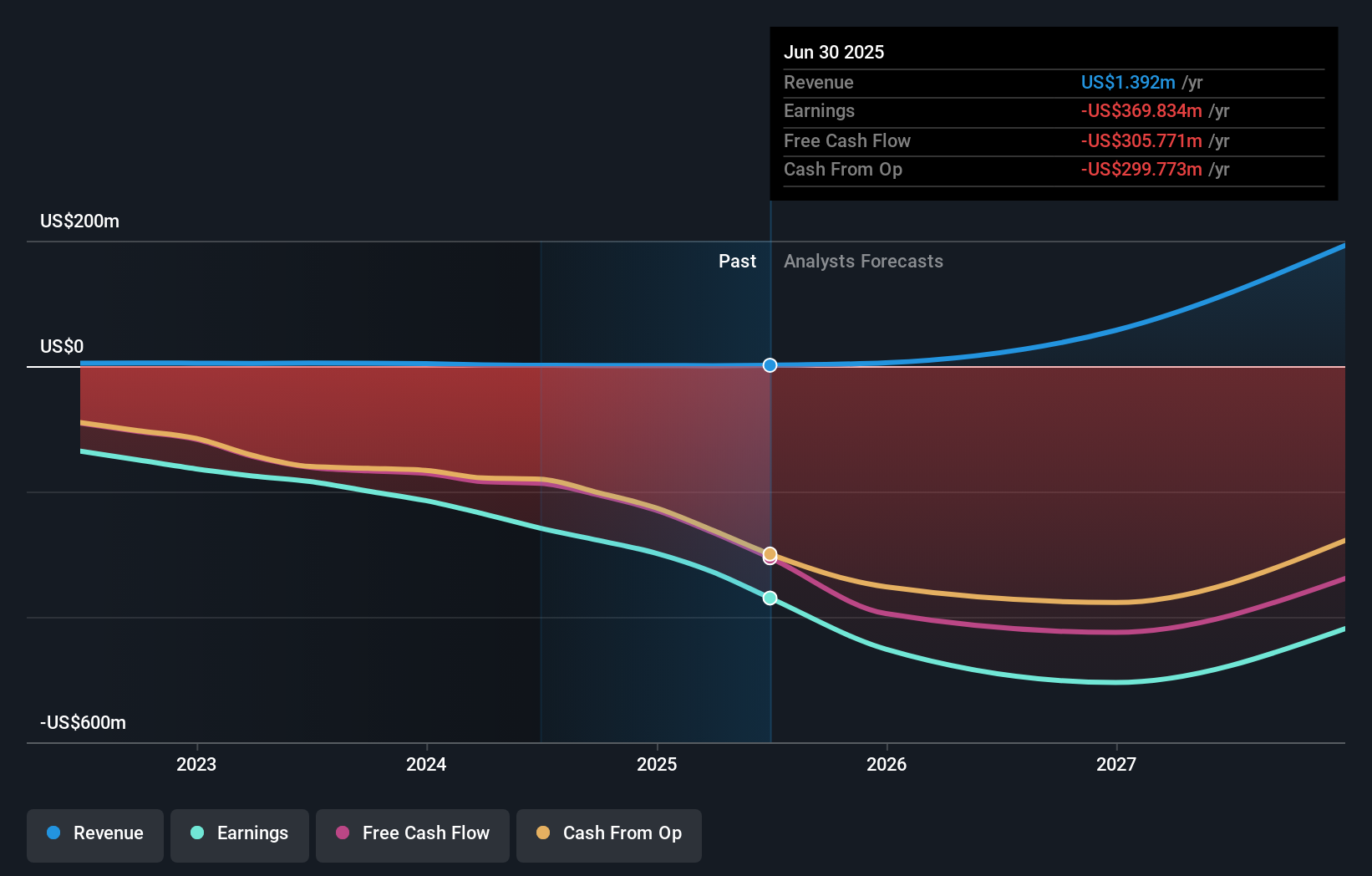

For anyone watching Crinetics Pharmaceuticals, the just-launched Phase 3 CAREFNDR trial for paltusotine in carcinoid syndrome reshapes both the excitement and the risks tied to the stock. This trial taps directly into Crinetics’ strategy of expanding paltusotine’s use beyond acromegaly, and the successful randomization of the first patient marks a clear milestone. Previously, short-term catalysts mostly hinged on acromegaly sales ramp-up and regulatory activity, but now investors may be recalibrating expectations: another late-stage clinical readout could materially affect sentiment and valuation. That said, the company remains unprofitable with mounting losses, limited revenue, and ongoing dilution risk from equity offerings, while the ambitious revenue growth projections are still largely dependent on future clinical success and market adoption. The trial launch adds potential reward, but it also amplifies execution pressure and clinical risk for the business.

But with clinical milestones come higher stakes, and the path to profitability remains a tough question for shareholders. Crinetics Pharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Crinetics Pharmaceuticals - why the stock might be a potential multi-bagger!

Build Your Own Crinetics Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crinetics Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crinetics Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives